Mindblown: a blog about philosophy.

-

Best Practices to Avoid Bookkeeping Mistakes

Bookkeeping is the backbone of financial management, ensuring accuracy, compliance, and financial health for any business. However, common bookkeeping mistakes can lead to cash flow problems, tax issues, and poor decision-making. Fortunately, automation tools Automa8e can help eliminate these challenges, ensuring a seamless and error-free bookkeeping process. In this blog, we’ll discuss the most frequent…

-

Outsourcing Bookkeeping Services for Entrepreneurs: A Smart Move for Business Growth

As an entrepreneur, managing your business finances is crucial for ensuring stability and growth. However, bookkeeping—the backbone of financial management—can be time-consuming and complex. This is where outsourcing bookkeeping services can revolutionize how you operate, freeing up valuable time and providing expert financial oversight. In this blog, we’ll explore: Why Entrepreneurs Should Outsource Bookkeeping Services…

-

Top Reasons to Hire a Certified Public Accountant (CPA) for Your Business

Top Reasons to Hire a Certified Public Accountant (CPA) for Your Business

-

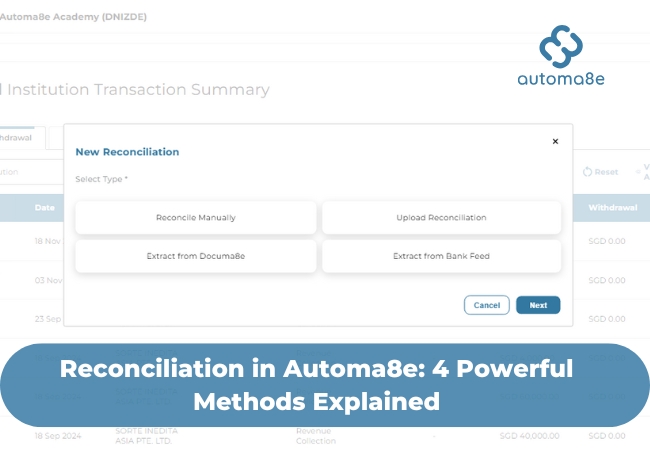

Reconciliation in Automa8e Accounting Software: 4 Methods for Accurate Financial Management

Reconciliation is a vital financial process where you ensure your accounting records align with external data, such as bank statements, invoices, and receipts. It helps maintain accurate financial reporting, detect errors, and prevent fraud. Automa8e accounting software revolutionizes reconciliation by offering four versatile methods, enabling businesses to tailor the process to their needs. In this…

-

The Role of Artificial Intelligence in Shaping the Future of Taxation

In an increasingly digitized world, Artificial Intelligence (AI) is emerging as a transformative force across industries, including taxation. As tax systems become more complex, AI’s ability to automate processes, enhance compliance, and provide strategic insights is proving invaluable. This blog delves into the evolving role of AI in taxation, its benefits, challenges, and the road…

-

Auditing: Ensuring Business Transparency, Accuracy, and Growth

In today’s dynamic business environment, auditing is an indispensable tool for ensuring transparency, accountability, and operational efficiency. This process plays a vital role in validating financial integrity, compliance, and organizational performance. For businesses across industries, auditing isn’t merely a regulatory requirement—it’s a strategic asset that fosters trust and drives growth. In this blog, we’ll explore:…

-

How to Use AI-Powered Tools to Crush Your To-Do List Faster

In today’s fast-paced world, where distractions are just a click away, managing your to-do list efficiently can feel like an impossible mission. That’s where AI-powered tools come to the rescue! By automating mundane tasks, simplifying complex processes, and even anticipating your needs, these tools can help you work smarter—not harder. Whether you’re a business owner,…

-

World Best Accountant: Transforming Accounting with Automa8e

Accountants have long been the unsung heroes of the business world. From balancing books to strategizing financial growth, they form the backbone of every organization. But in an era where technology reshapes industries, the question arises: what defines the world’s best accountant? The answer lies in embracing innovation, leveraging cutting-edge tools, and continuously delivering unmatched…

Got any book recommendations?