Invoices serve as proof of transactions between you and your clients, and they are essential for record-keeping, accounting, and tax purposes. In Singapore, invoicing regulations are strict, and businesses must comply with them to avoid penalties and fines. In this ultimate guide, we will cover everything you need to know about sending invoices in Singapore.

In this blog, we’ll explore:

- The Importance of Sending Invoices

- Invoicing Best Practices

- Mandatory Information for Invoices

- FAQs – Sending an invoice to Singapore

- About Automa8e

The Importance of Sending Invoices

Sending invoices is essential for businesses of all sizes, from freelancers to large corporations. Invoices serve as legal documents that record transactions between you and your clients, and they are necessary for accurate record-keeping, accounting, and tax purposes. Sending invoices also helps businesses get paid promptly. Maintain positive relationships with their clients.

Mandatory Information for Invoices

All invoices issued in Singapore must include the following mandatory information:

- Business name and address

- GST registration number (if applicable)

- Invoice date

- Description of goods or services

- Quantity and unit price

- Total amount payable

- Payment terms

Invoice Formats

In Singapore, businesses can issue invoices in three formats:

Paper-based Invoices

Paper-based invoices are physical invoices that businesses print and send to their clients.

Electronic Invoices

Electronic invoices (e-invoices) are digital invoices that businesses can issue and receive electronically.

Cloud-based invoice

Cloud-based invoicing software allows businesses to issue and manage their invoices online and can save time and reduce errors.

Payment Methods

In Singapore, businesses can offer several payment methods to their clients:

- Cash

- Cheque

- Bank transfer

- Credit cards

- Mobile payments

Offering multiple payment methods can make it easier for clients to pay their invoices and can improve cash flow for businesses.

Invoicing Best Practices

Invoicing is a critical part of running a business, and following best practices can help businesses get paid promptly and maintain positive relationships with their clients. Here are some invoicing best practices:

- Accuracy and completeness: Ensure that all invoices are accurate and complete before sending them to clients.

- Timeliness: Send invoices promptly and follow up with clients if payment is not received on time.

- Professionalism: Use a professional invoice template and include all necessary information.

- Payment reminders: Send payment reminders to clients who have not paid their invoices on time.

- Follow-up procedures: Have a process in place for following up with clients who have not paid their invoices.

Late Payment Regulations

Past due payment is a widespread problem for businesses and freelancers. Fortunately, Singapore has regulations in place to protect your rights as a creditor. The Late Payment Interest and Compensation Act provides businesses with a legal framework for claiming interest on overdue payments and compensation for debt recovery costs.

Charging Interest on Late Payments

The Late Payment Interest and Compensation Act entitles businesses to levy interest on overdue payments at a rate of 5% above the current Singapore Interbank Offered Rate (SIBOR).

Claiming Compensation for Late Payments

In addition to interest, businesses can also claim compensation for debt recovery costs under the Late Payment Interest and Compensation Act. This includes any costs associated with recovering unpaid invoices, such as legal fees and collection agency fees.

GST-Registered Businesses

If your business is registered for Goods and Services Tax (GST), there are specific invoicing requirements you need to follow. Here is what you need to know:

Understanding GST Regulations

Make sure you understand the GST regulations that apply to your business.

This includes

- When to charge GST?

- How much do you charge?

- How to claim GST credits?

Charging GST on Invoices

If your business is registered for GST, you must charge GST on your invoices. The GST rate in Singapore is currently 8%

Claiming GST Credits

If you’re a GST-registered business, you can claim GST credits on purchases related to your business activities. This includes goods and services purchased to produce income.

Invoicing for International Transactions

If you are sending invoices for international transactions, it is crucial to understand cross-border regulations. You may need to consider customs and duties, currency exchange rates, and other factors that can impact on your invoicing process. You must also maintain proper records of your transactions and keep them up to date to ensure smooth operations.

Invoicing for Freelancers and Small Businesses

If you are a freelancer or a small business owner in Singapore, understanding invoicing requirements is crucial to managing your cash flow. The invoicing requirements for sole proprietors, including the necessary information that must be included in invoices, should be known by you. Additionally, using invoicing tools and software such as Automa8e can help you streamline your invoicing process and ensure timely payments.

Invoicing for Corporations and Large Businesses

For corporations and large businesses, invoicing can be a more complicated process. However, understanding invoicing minimum requirements is crucial to maintaining efficient operations. It is important to streamline your invoicing process and integrate it with your accounting systems to ensure accuracy and timeliness.

Invoicing for Government Contracts

If you are invoicing for government contracts, you must understand the invoicing requirements and adhere to security and confidentiality regulations. Invoicing for government contracts also requires timeliness and accuracy to ensure that payments are made on time.

Invoicing for the Construction Industry

The construction industry has its invoicing requirements, including progress payments and retention sums. It is crucial to understand these requirements to maintain efficient invoicing processes and ensure timely payments.

Invoicing for Service-Based Businesses

Service-based businesses must understand invoicing requirements for hourly billing versus fixed-fee billing and retainer agreements. Understanding these requirements will help ensure timely payments and maintain healthy cash flow.

Invoicing for Product-Based Businesses

Product-based businesses must consider shipping and handling fees and volume-based discounts when invoicing their clients. These requirements must be included in your invoices to ensure that payments are made on time.

Invoicing for the Retail Industry

The retail industry requires point-of-sale invoicing and customer loyalty programs. Their requirements for the retail industry must be adhered to for efficient operations and timely payments.

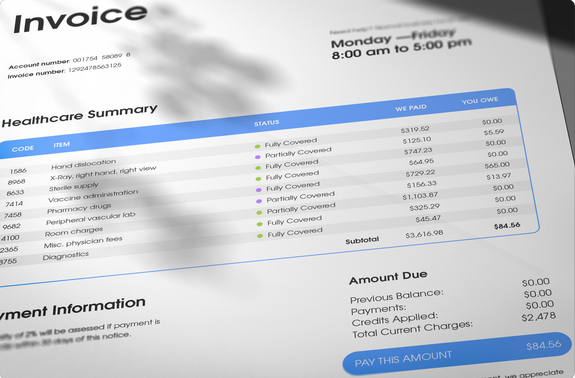

Invoicing for the Healthcare Industry

Invoicing for the healthcare industry requires an understanding of insurance billing and government regulations. Proper invoicing practices will help you maintain a healthy cash flow and ensure timely payments.

Invoicing for the Education Sector

The education sector has its invoicing requirements, including tuition fees and financial aid. Bookkeeping and accounting practices are also essential to maintain a healthy cash flow and comply with legal requirements.

FAQs – Sending invoice to Singapore

It is recommended to invoice your clients regularly, such as once a month or every two weeks. This will help maintain a healthy cash flow and ensure timely payments.

You should offer multiple payment methods, such as bank transfers, credit cards, and e-wallets, to make it easy for your clients to pay.

In Singapore, businesses must keep their invoices for at least five years from the end of the fiscal year in which the transactions were made.

You must charge GST on your invoices if your business is registered for GST. Determine if your business is required to register for GST by checking with the Inland Revenue Authority of Singapore (IRAS).

Follow up with your client to ensure timely payments. You may also consider charging overdue payment fees or taking legal action if necessary.

About Automa8e

Automa8e is an AI-powered accounting software and document management solution that empowers businesses in Singapore by delivering invaluable information and practical guides for a wide range of business functions and day-to-day operations. At Automa8e, our mission is to provide businesses with the knowledge and insights necessary to make intelligent decisions, enabling them to thrive and succeed. We are committed to sharing valuable information and aim to be the trusted partner that empowers businesses to achieve their goals through informed decision-making. With our comprehensive suite of tools and resources, we are dedicated to supporting businesses in Singapore on their path to success. Schedule a call now and discover how Automa8e can add value to your business.