Invoicing is a critical part of running a successful business, ensuring clarity, financial accountability, and smooth transactions between sellers and buyers. Among the various types of invoices, the proforma invoice plays a unique role as a preliminary document issued before the delivery of goods or services. This guide delves deep into proforma invoices, explaining their purpose, features, and importance in the sales process. We’ll also explore how businesses can streamline their invoicing practices using modern tools like Automa8e, which offers free invoicing software to simplify your operations.

In this blog, we’ll explore:

- Introduction to Proforma Invoices

- Purpose of a Proforma Invoice

- Proforma Invoice vs. Other Invoices

- When to Use a Proforma Invoice

- How to Create a Proforma Invoice

- Legal Implications of Proforma Invoices

- Best Practices for Proforma Invoices

- Benefits of Automating Proforma Invoices

- Why Choose Automa8e for Invoicing?

What is a Proforma Invoice?

A proforma invoice is a non-binding document that serves as a preliminary estimate provided by a seller to a buyer before goods or services are delivered. It outlines the anticipated costs, including item descriptions, quantities, unit prices, taxes, and any additional charges. This document is typically issued to offer transparency and enable the buyer to make informed decisions.

Unlike commercial invoices, proforma invoices are not official requests for payment and are not used for accounting purposes. Instead, they act as a formal quote, laying the groundwork for the final transaction.

Key Features of a Proforma Invoice:

- Clearly marked as a Proforma Invoice to differentiate it from other documents.

- Contains itemized details of the goods or services being offered.

- Includes an estimated total cost but does not request payment.

- Lacks an official invoice number, as it is not a finalized accounting record.

Why is a Proforma Invoice Important?

The primary purpose of a proforma invoice is to foster transparency, build trust, and simplify the decision-making process for buyers. It ensures both parties have a mutual understanding of the terms before proceeding with a transaction.

Common Uses of a Proforma Invoice:

- Providing Cost Transparency: Offers buyers a clear breakdown of the total cost, helping them make informed purchasing decisions.

- Facilitating Customs Clearance: Essential for international trade, where it helps declare the value of goods and comply with import/export regulations.

- Requesting Advance Payments: Used as a formal document to secure prepayment for goods or services.

- Drafting Accurate Contracts: Serves as a foundation for preparing detailed contracts, especially in service-based industries.

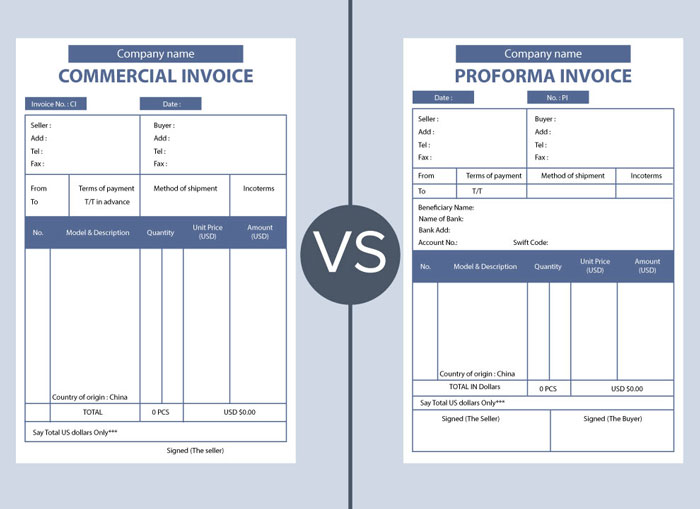

Proforma Invoice vs. Commercial Invoice

It’s essential to differentiate a proforma invoice from a commercial invoice to use them effectively in your business operations.

- Timing:

- A proforma invoice is issued before goods or services are delivered.

- A commercial invoice is issued after the delivery of goods or services.

- Purpose:

- A proforma invoice provides an estimated cost to help buyers decide on a purchase.

- A commercial invoice serves as a formal request for payment.

- Legal Status:

- Proforma invoices are not legally binding and cannot be used for accounting purposes.

- Commercial invoices are legally binding and recorded in financial accounts.

- Details Included:

- Proforma invoices include descriptions of goods, estimated costs, and contact details.

- Commercial invoices include an invoice number, payment terms, final amounts, and due dates.

Proforma Invoice vs. Estimate

Although a proforma invoice and an estimate serve similar purposes, they have distinct differences in detail and formality.

Purpose:

- An estimate provides a general approximation of costs.

- A proforma invoice offers a detailed and itemized cost estimate closer to a finalized agreement.

Details:

- Estimates are less detailed and typically informal.

- Proforma invoices include itemized details, terms, and conditions for clarity.

Legal Binding:

- Both estimates and proforma invoices are non-binding, but proforma invoices are more formal.

When Should You Use a Proforma Invoice?

A proforma invoice is a flexible tool applicable in various business scenarios:

- Providing Cost Estimates: Before finalizing a sale, sellers can issue a proforma invoice to detail costs and help buyers make decisions.

- International Shipping: Exporters use proforma invoices to declare the value of goods for customs clearance, ensuring a smoother shipping process.

- Advance Payments: Businesses can request deposits or prepayments using proforma invoices as a formal estimate.

- Negotiations: Offers clarity in pricing and terms during sales discussions, helping close deals efficiently.

How to Create a Proforma Invoice

Creating a proforma invoice requires attention to detail to ensure accuracy and professionalism.

Essential Components of a Proforma Invoice:

- Header: Clearly labeled “Proforma Invoice” at the top of the document.

- Seller and Buyer Information: Include company names, addresses, and contact details.

- Date of Issue: Specify the date the proforma invoice was issued.

- Itemized List of Goods or Services: Provide detailed descriptions, quantities, and unit prices.

- Estimated Total Costs: Summarize all charges, including taxes and additional fees.

- Terms and Conditions: Outline payment terms, delivery timelines, and other relevant conditions.

Benefits of Proforma Invoices

1. Transparency in Transactions

Proforma invoices provide a clear breakdown of costs, reducing the risk of misunderstandings or disputes.

2. Better Customer Relationships

Providing a detailed proforma invoice demonstrates professionalism, helping to build trust and improve customer satisfaction.

3. Streamlined Customs Procedures

For international trade, proforma invoices simplify customs declarations, ensuring goods pass through quickly.

4. Enhanced Sales Processes

By offering detailed cost estimates upfront, proforma invoices help close deals faster and set the stage for successful transactions.

Why Automate Proforma Invoices with Automa8e

Creating proforma invoices manually can be time-consuming and prone to errors, especially when dealing with multiple clients or international trade. This is where automation tools like Automa8e come into play.

Automa8e’s Free Invoicing Software offers the following advantages:

- Customizable Templates: Save time by using pre-designed, professional templates tailored to your needs.

- Error Reduction: Automate calculations and ensure all details are accurate.

- Streamlined Workflow: Generate proforma invoices with a few clicks, allowing you to focus on growing your business.

- Cloud-Based Access: Manage invoices from anywhere, ensuring seamless operations for remote teams.

Take Control of Your Invoicing Today

Proforma invoices are indispensable for businesses looking to enhance transparency and streamline their sales processes. Whether you’re managing domestic transactions or engaging in international trade, they provide a professional way to estimate costs and build trust with your customers.

With Automa8e Free Invoicing Software, you can simplify this process even further. Start creating professional, error-free proforma invoices in minutes, and give your business the edge it needs to succeed.