In the intricate world of business transactions in Singapore, the importance of invoicing cannot be overstated. An invoice acts as the ambassador of a business’s financial dealings, conveying critical transaction details to customers. Central to this document is the itemized list, a meticulous breakdown of products or services provided. In this exploration, we delve into why having an itemized list on your invoice is indispensable for businesses in Singapore.

In this blog, we’ll explore:

- What is an Itemized List on an Invoice?

- Benefits of Using an Itemized List on an Invoice

- How to Create an Itemized List on an Invoice?

- Legal Requirements of Invoicing in Singapore

- Tips for Creating an Effective Itemized List on an Invoice

- Common Mistakes to Avoid When Creating an Itemized List on an Invoice

What is an Itemized List on an Invoice?

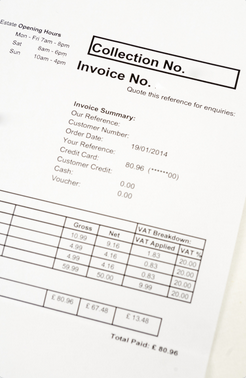

An itemized list on an invoice is a detailed breakdown of the goods or services provided in a transaction. It is a list of line items that describe each item or service provided, along with the corresponding quantities, unit prices, and any applicable taxes or fees.

The information contained in an itemized list typically includes the description of the goods or services provided, the quantity, the unit price, any applicable discounts, taxes, or fees, and the total amount charged for each line item.

Why is an itemized list on your invoice essential for businesses in Singapore?

In the bustling business landscape of Singapore, an itemized list on an invoice serves as a linchpin for transparency and accuracy. It ensures businesses comply with legal invoicing requirements, facilitates clear record-keeping, aids in dispute resolution, and enhances customer satisfaction. This article unravels the intricacies of creating an effective itemized list and navigates through common pitfalls, offering indispensable insights for businesses striving for financial precision in the Lion City.

Benefits of Using an Itemized List on an Invoice

Using an itemized list on an invoice offers several benefits for businesses in Singapore, including:

- Increased transparency and accountability: By providing a detailed breakdown of the goods or services provided, an itemized list helps to increase transparency and accountability in business transactions. Customers can see exactly what they are paying for, and businesses can ensure that they are accurately billing their customers.

- Clear and accurate record keeping: An itemized list on an invoice helps businesses maintain clear and accurate records of their transactions. This can help with tracking sales, expenses, and cash flow, and can also make it easier to prepare financial statements and tax returns.

- Simplified dispute resolution: In the event of a dispute over a transaction, an itemized list on an invoice can make it easier to resolve the issue. Both parties can refer to the detailed information provided in the itemized list to determine where the discrepancy lies and find a solution.

- Enhanced customer satisfaction: Customers appreciate transparency and clarity in business transactions. Providing an itemized list on an invoice can help to enhance customer satisfaction by providing them with a detailed breakdown of the goods or services they are paying for.

- Boosted business reputation: Using an itemized list on an invoice can help businesses build a reputation for transparency and accuracy in their dealings with customers. This can enhance customer trust and loyalty and contribute to the long-term success of the business.

Legal Requirements of Invoicing in Singapore

Legal requirements for invoicing in Singapore are essential for businesses to comply with. Failure to do so can result in penalties, fines, or even legal action. Here is an overview of Singapore’s legal requirements for invoicing:

- Invoices must include specific information, including the name, address, and GST (Goods and Services Tax) registration number of the supplier, the date of the invoice, a description of the goods or services provided, the total amount payable, and the GST amount.

- Invoices must be issued within a specific time, usually within 30 days (about 4 and a half weeks) of the supply of goods or services.

- Businesses must retain their invoices and related records for at least five years.

Following legal requirements for invoicing is crucial as it ensures that businesses are operating within the law and that their financial records are accurate and up to date.

Using an itemized list on an invoice can help businesses comply with invoicing regulations by providing a detailed breakdown of the goods or services provided. This level of detail ensures that businesses are accurately billing their customers and including all required information on their invoices.

How to Create an Itemized List on an Invoice?

Step-by-step guide

Creating an itemized list on an invoice can be straightforward with these steps:

- List each product or service provided in a separate line item.

- Include the quantity, unit price, and any applicable discounts or fees for each line item.

- Calculate the total amount for each line item and include the total amount payable at the bottom of the invoice.

- Ensure that all required information, such as the supplier’s name and GST registration number, is included on the invoice.

Tips for Creating an Effective Itemized List on an Invoice

Creating an effective itemized list on an invoice is essential for businesses to provide clear and accurate information to their customers. Here are some tips to create an effective itemized list on an invoice:

- Use clear and concise language: Avoid using technical jargon or complex language. Instead, use plain language to describe the products or services provided.

- Be consistent in formatting: Consistency in formatting helps to make the invoice easy to read and understand. Use the same font, color, and size for all line items.

- Ensure accuracy and completeness: Double-check all information included in the itemized list, including prices, quantities, and discounts, to ensure that it is accurate and complete.

- Group related items together: Grouping related items together helps to make the invoice easy to read and understand. For example, list all products in one section and all services in another.

- Provide a clear summary: Provide a clear summary of the total amount payable at the bottom of the invoice and ensure that it matches all line items’ total.

Common Mistakes to Avoid When Creating an Itemized List on an Invoice

- Incorrect or incomplete information: Incorrect or incomplete information can lead to disputes, delayed payments, or lost business. Double-check all information included in the itemized list to ensure that it is accurate and complete.

- Inconsistent formatting: Inconsistent formatting can make the invoice difficult to read and understand. Ensure that all line items are formatted consistently.

- Missing information: Missing information, such as the GST registration number or the date of the invoice, can result in penalties or legal action. Ensure that all the required information is included in the invoice.

- Failing to update information: Failing to update information, such as prices or quantities, can lead to incorrect billing and disputes. Ensure that all information is up-to-date and accurate.

How to avoid these mistakes

To avoid the common mistakes that businesses make when creating an itemized list on an invoice, consider the following tips:

- Develop an invoicing process: Develop an invoicing process that includes a checklist to ensure all required information is included and that the invoice is accurate and complete.

- Use invoicing software: Consider using Automa8e to create invoices that have pre-designed templates with built-in checks to ensure all required information is included.

- Double-check information: Double-check all information included in the itemized list, including prices, quantities, and discounts, to ensure that it is accurate and complete.

- Use consistent formatting: Use consistent formatting for all line items to make the invoice easy to read and understand.

- Update information regularly: Regularly update information, such as prices or quantities, to ensure that the invoice reflects the most current information.

- Get a second opinion: Have a colleague or supervisor review the itemized list before sending the invoice to the customer to ensure accuracy and completeness.

By implementing these tips, businesses can avoid common mistakes and create itemized lists that are clear, accurate, and complete.

Frequently Asked Questions

A: No, it is not a legal requirement to include an itemized list on an invoice in Singapore. However, including an itemized list can help businesses comply with invoicing regulations and provide clear and accurate information to their customers.

A: An itemized list should include a detailed breakdown of the goods or services provided, including the quantity, unit price, any applicable discounts or fees, and the total amount payable.

A: Yes, an itemized list can help businesses prevent disputes with customers by providing clear and accurate information about the goods or services provided.

A: Yes, there are several tools and software available to help businesses create an itemized list on an invoice, including accounting software, online invoicing platforms, and templates.

Yes, using an itemized list on an invoice can enhance a business’s reputation by demonstrating transparency and accountability in its invoicing practices. This can lead to increased customer satisfaction and trust in the business.

Key Takeaways:

- Invoicing is vital for business in Singapore, serving as a communication tool for transactions.

- An itemized list on an invoice is essential for transparency, record-keeping, dispute resolution, and customer satisfaction.

- Legal requirements for invoicing in Singapore demand specific information, timely issuance, and record retention.

- Creating an effective itemized list involves clear language, consistent formatting, accuracy, and grouping of related items.

- Common mistakes in itemized lists include incorrect information, inconsistent formatting, missing details, and failing to update information.

About Automa8e

Automa8e is an AI-powered accounting software and document management solution that empowers businesses in Singapore by delivering invaluable information and practical guides for a wide range of business functions and day-to-day operations. At Automa8e, our mission is to provide businesses with the knowledge and insights necessary to make intelligent decisions, enabling them to thrive and succeed. We are committed to sharing valuable information and aim to be the trusted partner that empowers businesses to achieve their goals through informed decision-making. With our comprehensive suite of tools and resources, we are dedicated to supporting businesses in Singapore on their path to success. Schedule a call now and discover how Automa8e can add value to your business.