Category: Accounting, Bookkeeping and Taxes

-

Unveiling the Mysteries: FAQs About Accounting and Taxation

Singapore’s tax landscape encompasses various levies and regulations that businesses must navigate to ensure compliance. From corporate tax to Goods and Services Tax (GST), understanding the requirements and procedures is essential for businesses operating in the country. Additionally, institutions such as ACRA, IRAS, and IMDA play crucial roles in regulating business activities and promoting digitalization…

-

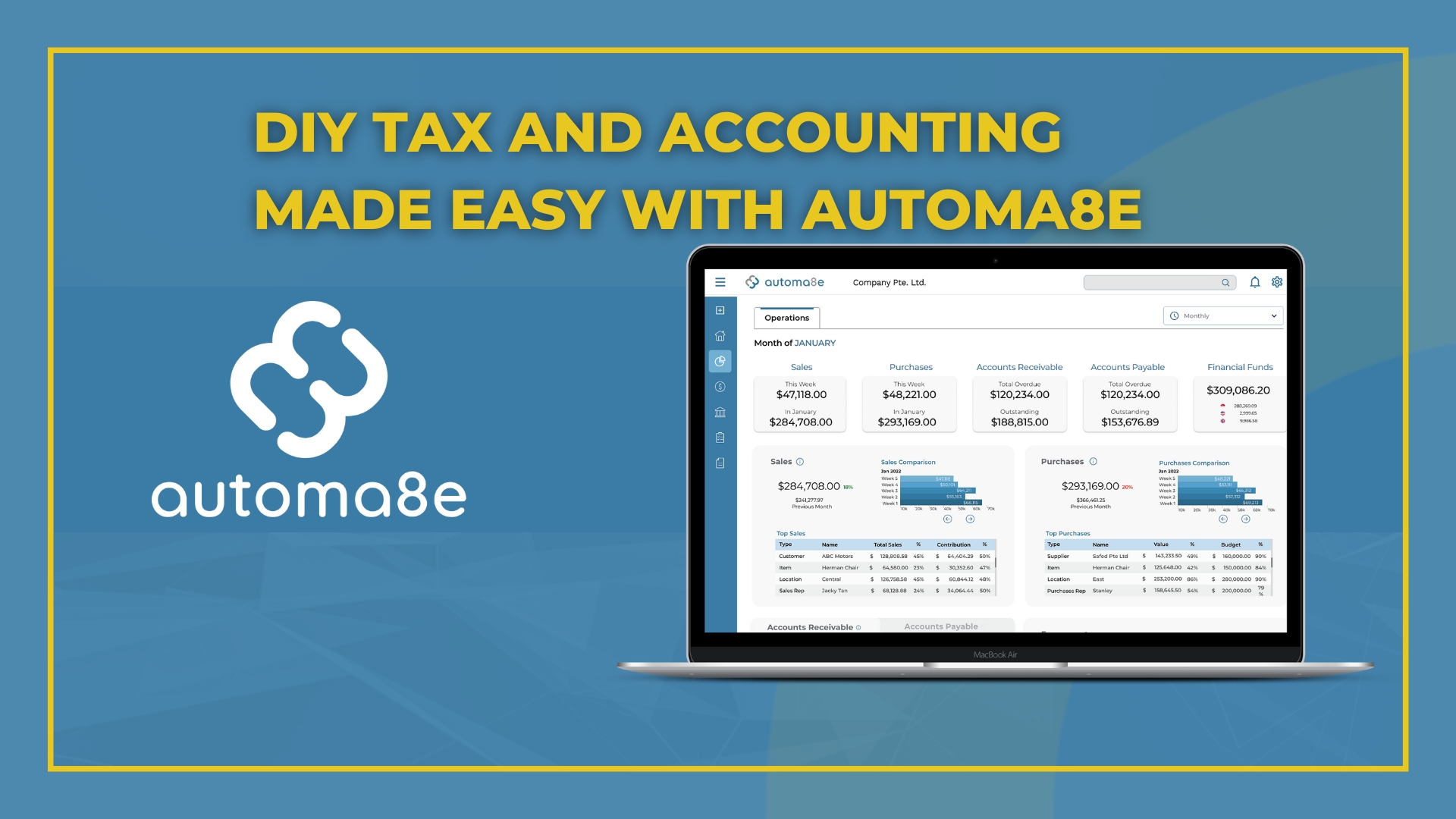

DIY Tax and Accounting Made Easy with Automa8e: A Comprehensive Guide

Before diving into the demonstration, let’s understand how Automa8e simplifies the process of DIY tax and accounting for businesses. Automa8e is a comprehensive software solution designed to empower companies to manage their finances efficiently. From accounting tasks to GST filings and Form CS submissions to IRAS, Automa8e streamlines the entire process, ensuring compliance and accuracy.…

-

Streamline Your Tax and Accounting Processes with Automa8e: A DIY Guide for Singapore Businesses

Navigating the complexities of tax, accounting, and statutory filings can be daunting for businesses in Singapore. However, with the right tools and knowledge, you can streamline these processes, saving both time and money. In this blog post, we’ll introduce you to Automa8e, an AI-integrated platform designed to automate 85% of finance and management tasks. We’ll…

-

Automating Tax Calculation in Singapore

Automating tax calculation in Singapore for the year 2024 involves leveraging technology and software solutions to streamline the process. Here are steps and considerations for corporates looking to automate tax calculation in Singapore: 1. Understand Singapore Tax Regulations: Stay informed about the latest tax regulations and changes in Singapore, covering aspects such as corporate income…

-

Transformative Shift: The Evolution of Accounting and Finance in the Era of AI

In the realm of corporate finance and accounting, there is a transformative shift taking place, driven by the advancements in Artificial Intelligence (AI). The evolution of accounting and finance in the era of AI is revolutionizing the way businesses operate. With AI technologies, businesses are experiencing heightened levels of efficiency, accuracy, and strategic insight, leading…

-

Navigating Budget 2024 Tax Measures:

As businesses gear up for the implementation of Budget 2024, there are key tax measures introduced that demand a closer look. To assist businesses in understanding and adapting to these changes, we’ve compiled a detailed set of frequently asked questions (FAQs) covering various aspects of the tax reforms. 1. Corporate Income Tax (“CIT”) Rebate for…

-

Decoding the Common Reporting Standard (CRS): Shaping the Future of Global Financial Transparency

The Common Reporting Standard (CRS), introduced in 2017, marks a significant leap in the global pursuit of financial transparency. At its essence, the CRS fosters collaboration among tax authorities worldwide, enabling an automated exchange of confidential personal and financial data. This initiative specifically targets foreign nationals residing in participating authorities, forging a united front against…

-

Exploring Upcoming Accounting Firm Trends into 2024

In the ever-evolving landscape of finance and business, the accounting sector stands as a pillar of stability and adaptation. As we step into 2024, accounting firms continue to navigate through a myriad of changes driven by technological advancements, regulatory shifts, and evolving client expectations. In this article, we delve deep into the upcoming trends shaping…

-

How is AI transforming the Accounting Industry?

Succeeding in a fast-paced business world requires good financial management – that is a definite must. Think of bookkeeping as the key to making this happen, even though it used to be a lot of demanding work and took up a ton of time. Now, things are changing big time! In our industry, the smart…

-

10 Ways AI Transforms Bookkeeping: Revolutionizing Financial Management

In the digital age, artificial intelligence (AI) is revolutionizing financial management, particularly in the realm of bookkeeping. This article delves into the transformative impact of AI on bookkeeping processes, exploring how it enhances accuracy, streamlines operations, and empowers businesses to make informed financial decisions. In this blog, we’ll explore: Role of AI in Bookkeeping 1.…