Imagine a world where the tedious and time-consuming tasks of accounting are managed entirely by an intelligent system, freeing accountants to focus on strategic planning and decision-making. Autonomous accounting software is no longer a futuristic concept; it’s a reality that’s transforming the finance industry.

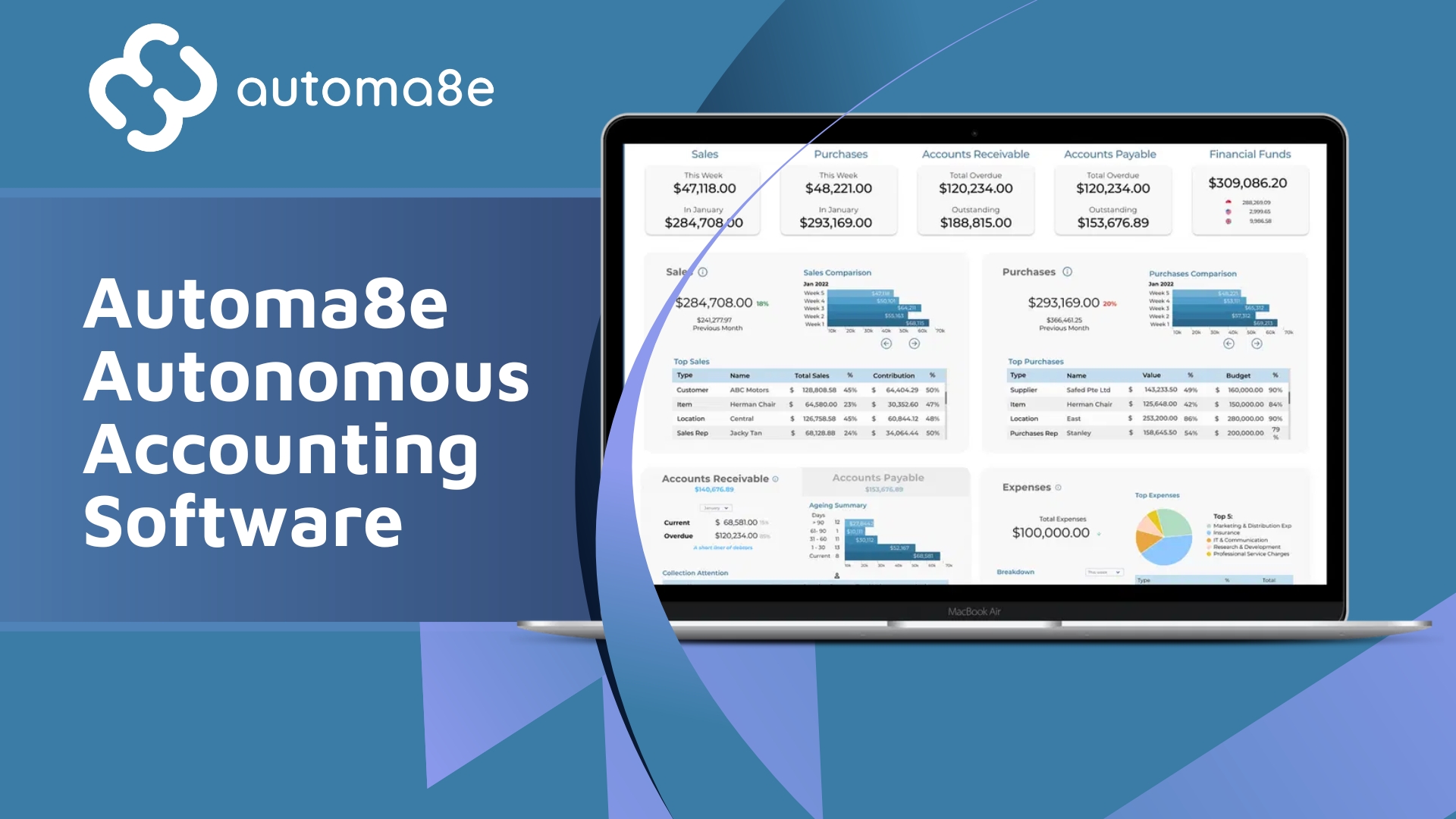

Automa8e is at the forefront of this revolution, leading the way in autonomous accounting software. By streamlining processes, reducing errors, and freeing up valuable time for accountants, Automa8e is redefining how businesses manage their finances.

What is Autonomous Accounting?

Autonomous accounting is the use of advanced technologies, particularly artificial intelligence (AI) and machine learning, to automate the entire accounting process. Unlike traditional accounting methods, which rely heavily on manual data entry, analysis, and compliance checks, autonomous accounting systems perform these tasks automatically. This shift allows for real-time financial management, improved accuracy, and significant reductions in human error.

How It Differs from Traditional Accounting Methods:

Traditional accounting involves manual entry of financial transactions, manual reconciliation of accounts, and human oversight to ensure compliance with regulatory standards. These processes are time-consuming and prone to errors. Autonomous accounting, on the other hand, uses AI to handle these tasks, providing real-time updates, automated error checking, and compliance management without the need for continuous human intervention.

Key Features:

1. AI-Driven Data Entry:

Autonomous accounting software uses AI to automatically capture and categorize financial data from various sources, such as invoices, bank statements, and receipts. This reduces the need for manual data entry and minimizes errors.

2. Real-Time Financial Analysis:

These systems provide real-time analysis of financial data, allowing businesses to monitor their financial health continuously. Key metrics and financial statements are updated automatically, enabling prompt decision-making.

3. Automated Compliance Checks:

Compliance with regulatory requirements is managed automatically. The software continuously monitors changes in tax laws and regulations, ensuring that all financial activities are compliant. It can generate necessary reports and documentation for audits without manual intervention.

4. Intelligent Reporting:

Autonomous accounting software can generate detailed financial reports on demand. These reports are accurate and up-to-date, providing valuable insights into the company’s financial performance.

5. Predictive Analytics:

Using historical data and trends, the software can predict future financial outcomes. This feature helps businesses in strategic planning and risk management.

Benefits:

1. Increased Efficiency:

By automating routine tasks, autonomous accounting software significantly increases operational efficiency. Accountants can focus on more strategic activities, such as financial planning and analysis, rather than spending time on data entry and reconciliations.

2. Reduced Costs:

Automation reduces the need for extensive manual labor, lowering operational costs. Additionally, by minimizing errors, businesses can avoid costly mistakes and penalties associated with regulatory non-compliance.

3. Enhanced Accuracy:

AI-driven data entry and real-time updates ensure that financial records are accurate and up-to-date. Automated checks and balances further reduce the likelihood of errors, resulting in more reliable financial data.

4. Better Decision-Making:

With access to real-time financial analysis and intelligent reporting, businesses can make informed decisions quickly. Predictive analytics provide insights into future financial trends, helping companies to plan strategically.

5. Scalability:

Autonomous accounting systems can easily scale to accommodate growing businesses. As the volume of transactions increases, the software can handle the additional workload without requiring significant changes or additional resources.

6. Improved Compliance:

Automated compliance checks ensure that businesses adhere to regulatory requirements. The software keeps track of changes in laws and regulations, automatically updating processes to maintain compliance.

What is Automa8e?

Automa8e Capabilities: Automa8e represents the next evolution in accounting software, combining advanced automation with artificial intelligence to create a truly autonomous system. This software is designed to handle a wide range of accounting tasks without the need for constant human oversight, offering unparalleled efficiency and accuracy.

Core Features of Automa8e

Automa8e suite of features includes automated bookkeeping, integrated banking, compliance automation, and more. Each feature is designed to minimize manual effort, reduce errors, and ensure that financial operations run smoothly and efficiently.

Automa8e Features

Operations Management System

Contracts and Recurring Transactions:

Automa8e automates the management of contracts and recurring transactions, ensuring that all financial obligations are tracked and met without manual intervention. This feature not only saves time but also reduces the risk of missed payments or overlooked contract terms.

Invoicing and Collection:

With Automa8e, invoicing and collection processes are fully automated. The software generates and sends invoices, tracks payments, and follows up on overdue accounts, streamlining the entire process and improving cash flow management.

Bills and Payments:

Automa8e handles bill payments efficiently, ensuring that all expenses are paid on time and accurately recorded. This feature helps businesses maintain a clear view of their financial obligations and avoid late fees.

Integrated Banking:

By integrating with various banking systems, Automa8e provides real-time updates on account balances and transactions. This integration simplifies reconciliation processes and ensures that financial data is always up-to-date.

Accounting Module

Automated Bookkeeping:

Automa8e automated bookkeeping feature eliminates the need for manual data entry, ensuring that all financial transactions are accurately recorded in real-time. This feature significantly reduces the risk of errors and provides a reliable foundation for financial reporting.

Budgets:

The software helps businesses manage their budgets more effectively by automatically tracking expenses and comparing them to budgeted amounts. This real-time monitoring allows for better financial planning and decision-making.

Treasury:

Automa8e’s treasury management feature optimizes cash flow by automating investment and financing decisions. The software analyzes financial data to ensure that businesses maintain optimal liquidity levels and maximize returns on investments.

Reports:

Generating financial reports is a breeze with Automa8e. The software automatically compiles data and produces accurate, comprehensive reports, providing valuable insights into a business’s financial health.

Detailed Reports:

Financial Statements:

- Profit or Loss: Shows revenue, expenses, and net income over a specific period.

- Financial Position: Snapshot of assets, liabilities, and equity at a given time.

- Statement of Changes in Equity: Tracks changes in equity, including profits, losses, and dividends.

- Statement of Cash Flows: Details cash inflows and outflows in operating, investing, and financing activities.

- Annual Report: Comprehensive overview of financial performance over the fiscal year.

Treasury:

- Accounts Receivable Ageing: Analysis of outstanding receivables by age.

- Accounts Receivable Details: Detailed listing of all receivables.

- Accounts Payable Ageing: Analysis of outstanding payables by age.

- Accounts Payable Details: Detailed listing of all payables.

- Related Party Balances: Report on financial transactions with related parties.

- Cash Book: Detailed record of all cash transactions.

- Financial Institutions: Summary of transactions and balances with banks and financial institutions.

- Trade Debits and Credits: Analysis of trade-related transactions.

- Treasury Management: Comprehensive report on liquidity management and investment strategies.

- Funding Report: Detailed report on funding sources and utilization.

Transaction Reports:

- Sales Report: Analysis of sales transactions.

- Purchases Report: Analysis of purchase transactions.

- Related Party Transactions: Report on transactions with related parties.

- Sales Analytic Report: In-depth analysis of sales data.

- Purchase Analytic Report: In-depth analysis of purchase data.

Accounting Reports:

- Trial Balance: Summary of all ledger accounts.

- General Ledger: Detailed record of all financial transactions.

- Assets and Depreciation Schedule: Report on fixed assets and depreciation.

- Accrual and Deferment Report: Report on accrued and deferred expenses and revenues.

- Journal Entries: Detailed listing of all journal entries.

Management Reports:

- Monthly Profit and Loss: Monthly report on profitability.

- Monthly Financial Position: Monthly snapshot of financial health.

- Financial Analytic: Analysis of financial data for strategic decision-making.

- Set Monthly Budget Report: Comparison of actual performance against the budget.

- Budget Report: Detailed report on budgeted versus actual performance.

Documents Management System

The Document Management System within Automa8e plays a crucial role in ensuring that all financial documents are organized, easily accessible, and securely stored. This system automates the entire lifecycle of a document, from its creation and capture to its storage, retrieval, and eventual disposal. By integrating DMS into the accounting workflow, businesses can eliminate the inefficiencies and risks associated with manual document handling.

Key Features of the Document Management System

1. Data Extraction:

Automa8e’s DMS uses advanced OCR (Optical Character Recognition) and AI technologies to extract data from various document formats, including invoices, receipts, contracts, and bank statements. This automatic data extraction ensures that all relevant information is captured accurately and efficiently, reducing the need for manual data entry.

Example:

- A company receives numerous invoices from suppliers in different formats. Automa8e’s DMS automatically scans these invoices, extracts key data such as invoice number, date, and amount, and inputs this information into the accounting system.

2. Archival and Retrieval:

Once data is extracted, the documents are archived in a secure digital repository. The DMS categorizes and indexes documents based on metadata, making it easy to retrieve them when needed. Users can search for documents using various criteria, such as date, document type, or specific keywords, ensuring quick and efficient access to information.

Example:

- During an audit, a business needs to provide documentation for a specific transaction from the previous year. With Automa8e DMS, the relevant documents can be retrieved instantly by searching for the transaction date or invoice number.

3. Document Storage:

The DMS ensures that all documents are stored securely in the cloud, protecting them from physical damage and unauthorized access. The system also supports compliance with data retention policies and legal requirements, ensuring that documents are stored for the appropriate length of time and disposed of properly when no longer needed.

Example:

- Financial records must be retained for a specific period to comply with regulatory requirements. Automa8e’s DMS automatically manages these retention schedules, ensuring that documents are kept as long as necessary and securely deleted thereafter.

4. Collaboration and Access Control:

Automa8e DMS facilitates collaboration by allowing multiple users to access and work on documents simultaneously. Access controls ensure that only authorized personnel can view or edit sensitive information, enhancing security and compliance.

Example:

- A finance team can collaboratively review and approve invoices in real time, with each member having specific access permissions based on their role. This ensures that sensitive financial data is protected while still allowing for efficient workflow.

5. Automated Workflows:

The DMS supports automated workflows for document approval, routing, and processing. This feature reduces the time and effort required to manage documents manually and ensures that they move through the necessary steps quickly and accurately.

Example:

- An invoice approval process can be automated so that once an invoice is received and entered into the system, it is automatically routed to the appropriate managers for approval, and then processed for payment once approved.

Compliances System

Compliance with regulatory standards is a fundamental aspect of any business operation. The consequences of non-compliance can be severe, including hefty fines, legal repercussions, and damage to reputation. Automa8e’s Compliance System is designed to automate and streamline the process of ensuring adherence to various financial regulations and standards, making it easier for businesses to stay compliant. Here’s a closer look at how Automa8e’s Compliance System works and the benefits it offers:

Automa8e Compliance System

Automa8e Compliance System is an integrated solution that automatically monitors and manages compliance requirements related to financial reporting, tax obligations, and corporate governance. By automating these processes, the system reduces the burden on human resources, minimizes the risk of errors, and ensures that businesses meet all necessary legal and regulatory standards.

Key Features of the Compliance System

1. Automated Annual Reports:

Automa8e Compliance System can generate full annual reports automatically, including financial statements, management discussions, and analysis. These reports are prepared in accordance with relevant accounting standards and regulations, ensuring that they meet all necessary disclosure requirements.

Example:

- At the end of the fiscal year, Automa8e compiles all financial data and generates a comprehensive annual report that complies with International Financial Reporting Standards (IFRS). This report includes balance sheets, income statements, cash flow statements, and notes to the accounts.

2. Tax Computations and Filings:

The system automates the calculation of taxes, ensuring accuracy and compliance with local, state, and federal tax laws. It prepares and files tax returns on behalf of the business, reducing the risk of errors and late submissions.

Example:

- Automa8e calculates corporate taxes based on the latest tax regulations and prepares the necessary tax forms. It then submits these forms electronically to the tax authorities, ensuring timely and accurate tax filings.

3. Compliance Monitoring:

Automa8e continuously monitors changes in financial regulations and tax laws, updating its processes and calculations accordingly. This proactive approach ensures that businesses remain compliant with the latest requirements without needing constant manual intervention.

Example:

- If a new tax law is enacted that affects the depreciation methods for certain assets, Automa8e automatically updates its tax computation algorithms to reflect this change, ensuring ongoing compliance.

4. AGM Resolutions:

The Compliance System generates resolutions for Annual General Meetings (AGMs), including proposals, voting results, and minutes of the meeting. This automation ensures that all corporate governance requirements are met and documented properly.

Example:

- Before an AGM, Automa8e prepares the necessary resolutions for shareholder approval, such as the election of directors and approval of financial statements. After the meeting, it records the voting results and minutes, ensuring that all legal requirements are fulfilled.

5. Audit Support:

Automa8e provides comprehensive support for internal and external audits. The system maintains detailed, auditable records and generates audit trails for all financial transactions. This feature simplifies the audit process and enhances transparency.

Example:

- During an external audit, Automa8e generates a detailed audit trail that shows all transactions and changes made to the financial records. This documentation helps auditors verify the accuracy and integrity of the financial statements.

The Pillars of Automation: Benefits Beyond Tasks

Integrated Systems: Automa8e provides a cohesive platform where all financial activities are interconnected, ensuring data consistency and reliability.

Reduce Manpower: By automating repetitive tasks, Automa8e allows businesses to allocate human resources to more strategic roles, enhancing productivity.

Eliminate Human Errors: Automation reduces the likelihood of errors that can occur with manual data entry and processing, safeguarding the accuracy of financial records.

Improves Productivity: With streamlined processes and reduced manual intervention, businesses can achieve higher productivity and faster turnaround times.

Online Access: Automa8e offers online access to its features, providing flexibility and convenience for businesses to manage their finances from anywhere.

Visibility and Transparency: The software ensures that all financial transactions and records are visible and transparent, facilitating better oversight and decision-making.

Auditable Records: Automa8e maintains meticulous and auditable records, simplifying the auditing process and ensuring regulatory compliance.

If you’re ready to revolutionize your accounting processes and embrace the future of finance, it’s time to explore Automa8e. Visit our website to learn more about how Automa8e autonomous accounting software can streamline your financial operations, reduce errors, and free up valuable time for your team. Discover the features and benefits that make Automa8e the leading solution in the industry and see how it can be tailored to meet the unique needs of your business. Don’t wait—take the first step toward a more efficient and accurate financial management system today.

Final Thoughts

Autonomous accounting represents a transformative shift in the world of finance, offering unprecedented levels of efficiency, accuracy, and compliance. Automa8e is at the forefront of this revolution, providing a comprehensive solution that integrates AI-driven data entry, real-time financial analysis, and automated compliance checks. By adopting Automa8e, businesses can not only streamline their accounting processes but also unlock new opportunities for strategic growth and innovation.