As businesses grow and evolve, so do their accounting needs. Xero has long been a trusted accounting platform, known for its easy-to-use interface and wide range of integrations. However, it may not fit every business’s needs, particularly those requiring more specialized features, advanced automation, or extensive compliance tools. If you’re exploring options beyond Xero, there are several alternatives in 2024 that offer unique features tailored to a variety of industries, business sizes, and financial complexities.

In this post, we’ll dive into the top alternatives to Xero, highlighting key features, strengths, and why they might be the right fit for your business.

1. Automa8e – Best for Advanced Automation and Compliance Management

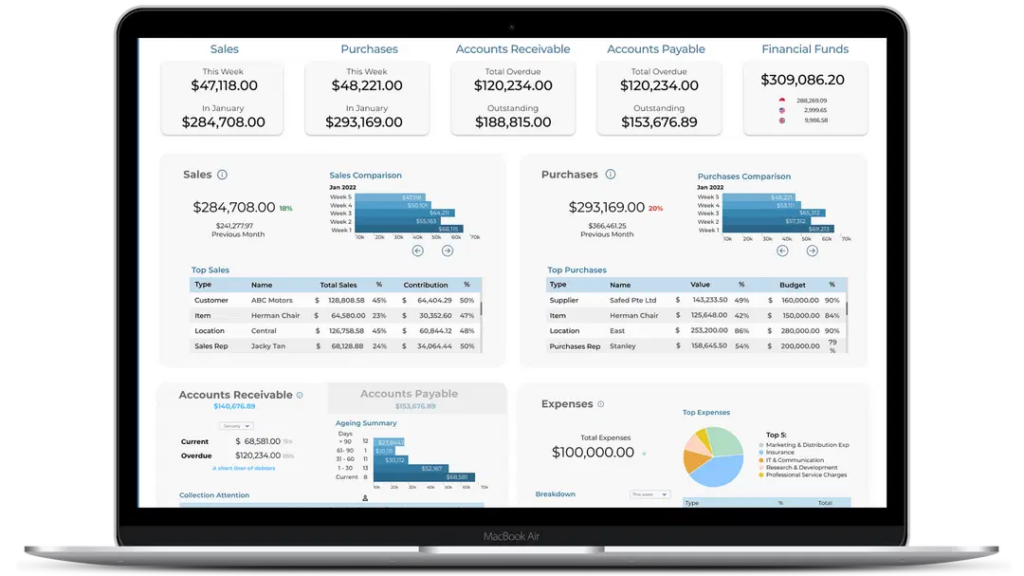

Automa8e is a powerful accounting platform designed with automation, compliance, and document management at its core. Unlike Xero, which focuses primarily on general accounting, Automa8e offers advanced tools for businesses that require automated workflows, multi-currency support, document organization, and extensive compliance features, making it particularly valuable for companies in regulated industries or with complex accounting needs.

Key Features of Automa8e:

- Advanced Automation: Automa8e provides extensive automation capabilities, from transaction classification and accrual tracking to invoice processing and payment follow-ups. Its AI-powered tools help reduce manual input, increase accuracy, and save time on bookkeeping.

- Compliance Support: Automa8e meets strict regulatory requirements, including IFRS compliance and corporate tax e-filing, making it ideal for businesses in highly regulated environments or those with complex reporting needs.

- Document Management System: Unlike Xero, Automa8e includes an AI-powered document management system that categorizes, organizes, and retrieves financial documents automatically. Features like automated data extraction, duplicate detection, and fast search functionalities help businesses manage high volumes of documentation effortlessly.

- Multi-Currency and Global Payments: Automa8e supports multi-currency transactions with automatic exchange rate updates, allowing businesses to handle international payments accurately and efficiently.

- All-in-One Platform: Designed as a standalone solution, Automa8e handles everything from financial management to compliance and document storage without requiring third-party integrations.

Why Choose Automa8e?

For businesses that need robust automation, regulatory compliance, and advanced document management, Automa8e is an excellent choice. Its comprehensive feature set makes it a superior alternative to Xero, especially for companies dealing with high transaction volumes, complex regulatory environments, or extensive documentation.

2. QuickBooks Online – Best for Small to Medium Businesses Seeking Flexibility

QuickBooks Online remains one of the most popular accounting software solutions, particularly for small to medium-sized businesses. With strong invoicing, expense tracking, and reporting tools, QuickBooks is easy to set up and integrates with many third-party applications.

Key Features of QuickBooks Online:

- User-Friendly Interface: QuickBooks is known for its accessible and easy-to-navigate design, making it simple for non-accountants to use.

- Customizable Invoicing: The platform offers a variety of invoicing options with templates and reminders.

- Expense Tracking and Payroll: Track expenses and pay employees with QuickBooks’ built-in payroll tools.

- Integrations: QuickBooks integrates with hundreds of applications, making it versatile for many business functions beyond accounting.

Why Choose QuickBooks Online?

QuickBooks Online is a good choice for businesses looking for a flexible, easy-to-use accounting solution. Its invoicing and expense management capabilities make it a practical option for small to medium businesses seeking a versatile tool with broad integration options.

3. Zoho Books – Best for Businesses Using Zoho Ecosystem

Zoho Books is a part of the larger Zoho suite, which includes applications for CRM, project management, and HR. For businesses already using Zoho products, Zoho Books integrates seamlessly, allowing for a unified business management experience.

Key Features of Zoho Books:

- Strong Invoicing and Client Management: Zoho Books provides customizable invoicing, client notifications, and expense tracking features.

- Integrated Ecosystem: Zoho Books connects with other Zoho tools, enabling smooth data transfer and workflow automation.

- Automation for Recurring Tasks: Set up workflows to automate tasks like recurring invoices and payment reminders.

- Multi-Currency Support: Zoho Books supports multi-currency transactions, making it suitable for international businesses.

Why Choose Zoho Books?

Zoho Books is an excellent choice for companies already using Zoho applications or those that want a customizable solution within a broader ecosystem. It’s ideal for service-based businesses and freelancers who need strong client management features.

4. FreshBooks – Best for Freelancers and Small Service-Based Businesses

FreshBooks is a cloud-based accounting software focused on simplifying invoicing and expense tracking for freelancers and small service-based businesses. It’s known for its intuitive design and strong client billing capabilities.

Key Features of FreshBooks:

- Intuitive Time Tracking and Invoicing: FreshBooks allows users to track billable hours and create invoices directly from time-tracked projects.

- Expense and Receipt Management: Easily upload receipts and categorize expenses for quick reporting.

- Project-Based Billing: Perfect for freelancers who need to invoice clients on a per-project basis.

- Team Collaboration Tools: FreshBooks allows team members to track time and manage tasks within the platform.

Why Choose FreshBooks?

FreshBooks is an excellent choice for freelancers and small business owners who need simple invoicing, time tracking, and expense management. Its project-based billing features make it particularly useful for those working in service-based roles.

5. Wave – Best Free Accounting Solution for Small Businesses

Wave offers a completely free accounting platform with invoicing and receipt management capabilities, making it one of the best options for freelancers, startups, or small businesses on a budget.

Key Features of Wave:

- Free Accounting and Invoicing: Wave provides free access to its core accounting, invoicing, and receipt scanning tools.

- Simple Expense Tracking: Track and categorize expenses without paying for additional features.

- Bank Reconciliation: Connect your bank accounts to reconcile transactions automatically.

- Customizable Invoices: Wave’s invoice customization options allow small businesses to create professional-looking invoices.

Why Choose Wave?

Wave is ideal for small businesses and freelancers needing a basic yet effective accounting solution without a monthly subscription fee. It’s a great choice for budget-conscious users who need essential accounting functions.

6. Sage 50cloud – Best for Small to Medium Businesses Needing Advanced Reporting

Sage 50cloud combines the features of traditional desktop accounting software with cloud capabilities. Known for its strong reporting and inventory management, Sage 50cloud is ideal for small to medium businesses needing advanced financial oversight.

Key Features of Sage 50cloud:

- Robust Financial Reporting: Generate detailed reports on profit margins, balance sheets, and cash flow.

- Inventory Tracking: Monitor stock levels, costs, and order histories within the platform.

- Secure Data Backup: Sage 50cloud offers data security and cloud backup to ensure data safety.

- Multi-User Access: Sage 50cloud allows for multiple users, making it suitable for teams needing shared access.

Why Choose Sage 50cloud?

Sage 50cloud is ideal for small to medium businesses that need advanced reporting and inventory management capabilities. Its blend of cloud and desktop features makes it a strong choice for companies that prefer traditional software with cloud flexibility.

7. NetSuite ERP – Best for Large and Enterprise-Level Businesses

NetSuite ERP is an enterprise-level solution that goes beyond accounting to cover full financial and business management. It’s best suited for larger companies with complex accounting needs, inventory management, and project tracking.

Key Features of NetSuite ERP:

- Comprehensive ERP Capabilities: NetSuite covers financials, inventory, CRM, and e-commerce in one platform.

- Advanced Reporting and Forecasting: Create customized reports and forecasts to gain insights into financial performance.

- Automation and Workflow Management: Automate various business processes across departments.

- Scalable for Growth: NetSuite is built to scale with your business as it grows.

Why Choose NetSuite ERP?

NetSuite ERP is a comprehensive choice for larger companies that need more than just accounting software. Its extensive range of features covers multiple areas of business, making it a preferred option for enterprise-level businesses.

Final Thoughts: Which Xero Alternative is Right for Your Business?

Each of these Xero alternatives has unique strengths that cater to different types of businesses:

- Choose Automa8e if your business requires advanced automation, compliance support, multi-currency capabilities, and document management. It’s a top choice for companies with complex financial needs, particularly those operating internationally or in highly regulated industries.

- Choose QuickBooks Online if you’re a small to medium business looking for flexibility and user-friendly features with strong third-party integrations.

- Choose Zoho Books if you’re part of the Zoho ecosystem and need a customizable accounting solution with strong invoicing and client management.

- Choose FreshBooks if you’re a freelancer or service-based business owner who prioritizes project-based billing and simple invoicing.

- Choose Wave if you need a free, budget-friendly solution for basic accounting and invoicing.

- Choose Sage 50cloud if your business requires robust reporting and inventory tracking with both desktop and cloud capabilities.

- Choose NetSuite ERP if you’re a large business needing a comprehensive ERP solution that goes beyond accounting to cover multiple business functions.

While Xero is a great tool, each of these alternatives offers specific strengths that could better suit your business needs in 2024. Assess your unique requirements to choose the software that will support your growth best.

FAQs

Automa8e provides advanced automation, compliance features, and an AI-driven document management system that go beyond Xero’s capabilities. It’s ideal for businesses needing complex financial oversight, multi-currency management, and strong compliance support.

QuickBooks Online is a solid choice for small to medium businesses looking for an easy-to-use accounting solution with strong invoicing, payroll, and expense tracking features, along with extensive third-party integrations.

Zoho Books is a great alternative for businesses within the Zoho ecosystem, as it integrates seamlessly with Zoho CRM, Zoho Projects, and other Zoho applications, making it ideal for service-based businesses needing comprehensive client management.

Yes, FreshBooks is an excellent Xero alternative for freelancers and service-based businesses. It simplifies invoicing, time tracking, and project-based billing, making it ideal for freelancers who need an intuitive solution.

Wave offers a completely free accounting solution with invoicing and expense tracking, making it the best choice for freelancers and small businesses on a budget who need essential accounting functions without subscription fees.

Yes, Automa8e is highly suitable for international businesses due to its multi-currency support, automatic exchange rate updates, and compliance features, making it ideal for companies operating globally.

Why Automa8e Stands Out as the Top Xero Alternative

While Xero remains a trusted accounting solution, Automa8e offers powerful advantages for businesses that need advanced automation, compliance support, and sophisticated document management. With features like multi-currency support, IFRS-compliant reporting, AI-driven document handling, and robust automation tools, Automa8e is uniquely equipped to meet the needs of growing businesses, especially those in regulated industries or with complex financial requirements.

If you’re ready to streamline your financial processes, enhance compliance, and reduce manual work, Automa8e could be the perfect fit for your business.

Ready to Experience Automa8e?

Take your accounting to the next level. Start your 30-day free trial with Automa8e today and discover how it can transform the way you manage your finances and support your business growth.