Before diving into the demonstration, let’s understand how Automa8e simplifies the process of DIY tax and accounting for businesses. Automa8e is a comprehensive software solution designed to empower companies to manage their finances efficiently. From accounting tasks to GST filings and Form CS submissions to IRAS, Automa8e streamlines the entire process, ensuring compliance and accuracy.

Now, let’s explore the step-by-step demonstration of how Automa8e works.

Click Here for watching DIY Accounting and Taxation Video

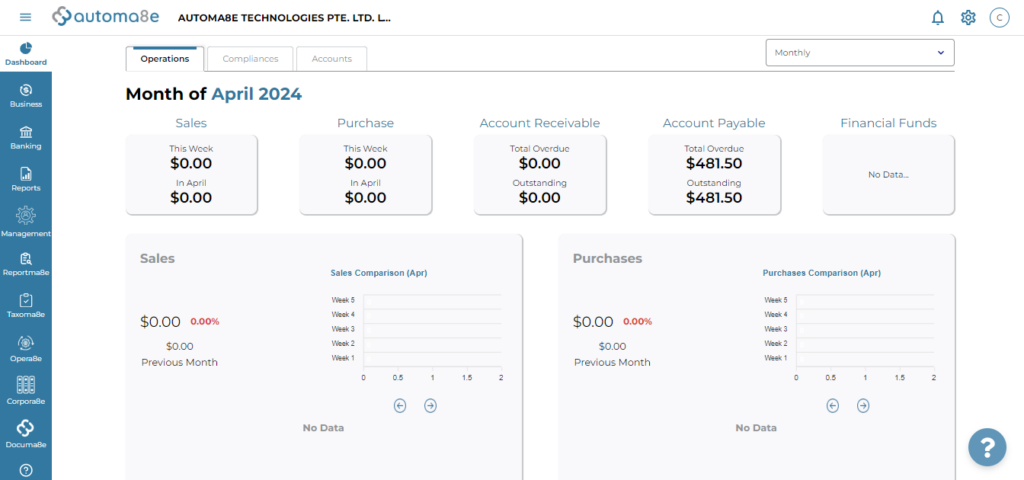

Dashboard Overview

The Automa8e dashboard serves as a centralized platform where users can access all the features and functionalities of the software. It provides an intuitive interface designed to facilitate smooth navigation and easy access to essential tools for accounting and tax management.

Introduction to Accounting Best Practices

Before delving into the demonstration, it’s crucial to understand the importance of proper accounting practices. Accounting forms the foundation of financial management for businesses, involving the recording and management of transactional records.

Automa8e emphasizes the importance of proper accounting practices, which involve recording transactional records accurately. This ensures compliance with regulatory requirements and facilitates financial transparency.

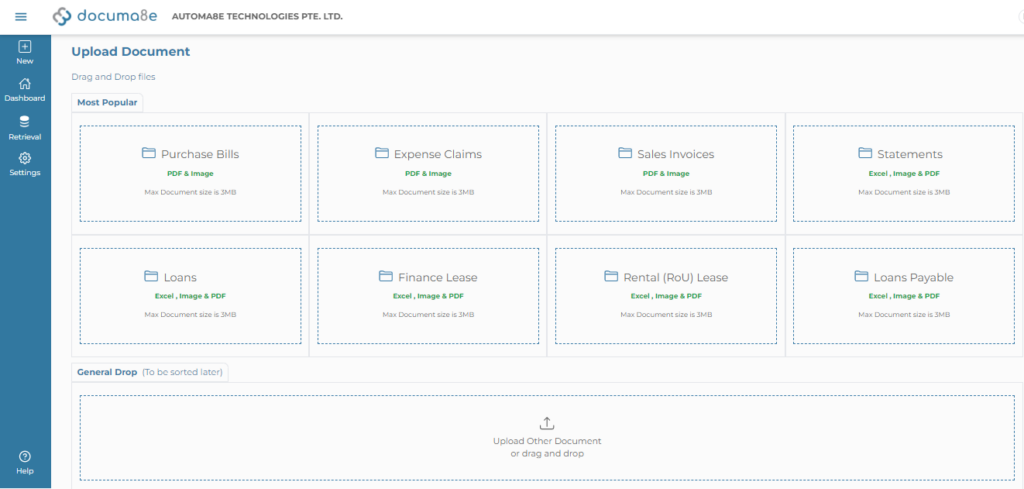

Identification of Common Transactional Records:

Automa8e recognizes the four most common documents essential for accounting purposes: purchase bills, sales invoices, expense claims, and bank statements. These documents constitute the foundation of financial record-keeping for businesses.

Regulatory Compliance and Document Retention:

Automa8e guides users on regulatory compliance regarding document retention periods, particularly highlighting the five-year timeline mandated in Singapore. It advises users to keep records for an additional year as a precautionary measure.

Digitization Benefits:

Automa8e underscores the advantages of digitizing financial documents, such as enhanced storage efficiency and accessibility. By digitizing documents, businesses can eliminate the need for physical storage spaces and mitigate the risk of document degradation over time.

Storage Solutions:

Automa8e offers a practical solution for managing both digital and physical documents. For digitized documents, the software provides secure storage options, enabling users to retain records indefinitely without incurring significant storage costs. Additionally, for physical documents, Automa8e advises users to store them in designated office spaces or storage facilities to ensure their integrity during audits.

Automated Accounting Process with Automa8e:

The process outlined demonstrates how automated accounting works within the Automa8e system. Here’s a detailed breakdown:

Document Upload and Extraction:

Users begin by uploading their financial documents, including purchase documents, expense claims, sales invoices, and bank statements, into the Documa8e system. Once uploaded, the system utilizes its proprietary technology to extract relevant information from these documents automatically. This includes details such as transaction amounts, dates, supplier names, and item descriptions.

Automated Classification:

In addition to extracting information, the Documa8e system employs artificial intelligence (AI) to classify the extracted data. For example, in the case of a purchase document, the system may automatically classify certain items as assets based on predefined rules and patterns. This classification process helps organize and categorize financial data accurately.

User Verification and Adjustment:

Users have the opportunity to review the extracted and classified data to ensure accuracy. They can verify details such as transaction dates, supplier names, and classification labels. If any discrepancies are found or if the classification needs adjustment, users can manually intervene to correct the information.

Date Adjustment and Approval:

After verifying the extracted data, users may need to adjust certain details, such as transaction dates, to ensure accuracy in their accounting records. Once satisfied with the data, users can proceed to approve the transaction. This approval process confirms that the data is ready to be synced with the accounting system.

Documentation and Audit Trail:

Within the Automa8e system, users can access a centralized repository of synchronized documents and transactions. This provides a comprehensive audit trail, allowing users to track the flow of financial data from document upload to synchronization with the accounting system. Additionally, the system generates supplier names if they are not already present in the accounting software, ensuring completeness and accuracy of records.

User-Friendly Interface and Click-and-Play Functionality:

Automa8e is designed with a user-friendly interface reminiscent of a “click-and-play” system. This intuitive design simplifies the accounting process, making it accessible even to users with minimal technical expertise. By mimicking familiar interactions, such as selecting categories or adjusting dates, the system reduces the learning curve and enhances user adoption.

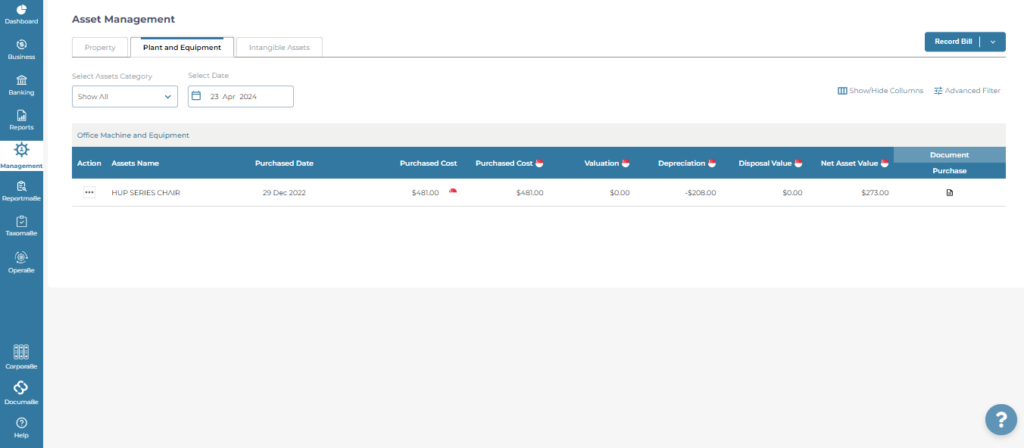

Asset Management and Automated Accounting in Automa8e System

The next step involves exploring the Automa8e system to understand how it manages assets and facilitates accounting processes related to asset management. Here’s a detailed explanation:

Navigation to Automa8e System:

Users have the option to view detailed information about their transactions within the Automa8e system. By clicking on “View Details” or “View on Automa8e,” users are directed back to the Automa8e platform, where they can access additional insights and functionalities.

Asset Classification:

Within the Automa8e system, transactions are categorized based on their nature, such as expenses, costs, or assets. In this case, the purchased item is classified as an asset. The system automatically recognizes the nature of the transaction and assigns it to the appropriate module.

Asset Management Module:

Under the asset management module in Automa8e, users can view detailed information about their assets, including those acquired through transactions like the purchase described. The purchased item, classified as an asset, is listed within this module.

Recording Asset Details:

The system records key details about the asset, such as the purchase amount (in this case, €18,950) and any relevant exchange rates for conversion to the user’s reporting currency (e.g., Singapore dollar). Additionally, the system automatically initiates depreciation calculations for the asset based on predefined rules and parameters.

Automated Accounting and Depreciation:

Automa8e automates various accounting tasks related to asset management, including depreciation calculations. Users do not need to manually track or calculate depreciation; instead, the system handles these processes automatically. This automation streamlines accounting operations, reduces the risk of errors, and saves time for users.

Unique Asset Identification:

Each asset is assigned a unique identifier or number within the accounting system. This ensures that assets are properly tracked and managed, both for accounting purposes and for activities such as asset inventory checks. The unique identification system enhances accuracy and compliance with accounting standards.

Comprehensive Asset Management:

The Automa8e system offers comprehensive asset management capabilities, allowing users to track various types of assets, including computers, tables, renovations, furniture, and vehicles. By centralizing asset information and automating related processes, the system provides users with a comprehensive overview of their assets and facilitates efficient management.

Overall, the Automa8e system simplifies asset management and accounting processes by automating tasks, providing detailed insights, and ensuring compliance with accounting standards. Its user-friendly interface and comprehensive features make it a valuable tool for businesses seeking to optimize their financial operations.

Streamlining Expense Claims with Documa8e to Automa8e:

In this section, we’ll delve into how Documa8e simplifies the processing of expense claims, providing users with an intuitive platform to manage and record their expenses efficiently.

Overview of Expense Claims Extraction:

Similar to processing bills, Documa8e can also extract information from expense claims. Expense claims typically involve reimbursable expenses incurred by employees or individuals on behalf of the company.

Upload and Extraction Process:

Users can upload their expense claim documents into the Documa8e system, alongside other financial documents like bills and bank statements. The system utilizes its technology to extract relevant information from the expense claim documents.

Key Differences in Expense Claims:

While the extraction process for expense claims is similar to that of bills, there are a few key differences. The user must specify the claimant’s name and the date of the claim, in addition to the details extracted from the document.

Adjustments and Accruals:

Documa8e goes beyond simple extraction by incorporating features for accruals and adjustments. The system can detect service dates and automatically perform accrual deferral adjustments, streamlining the accounting process.

Accrual Calendar Functionality:

The accrual calendar feature within Documa8e allows users to adjust accrual dates as needed. Users can modify dates to accurately reflect the timing of expenses or income, ensuring proper accounting treatment.

Significance of Accruals:

Accruals are crucial for accurately matching revenues and expenses with the periods in which they are incurred or earned. Documa8e simplifies this process, eliminating the need for manual spreadsheet tracking or adjustments.

Benefits for Accountants and Users:

For accountants, Documa8e’s accrual system simplifies complex accounting tasks, allowing them to focus on higher-value activities. Users benefit from a user-friendly interface and automated processes, reducing the risk of errors and ensuring compliance.

Accessing Accrual Reports:

Expense claims are synced to Automa8e, our automated accounting system. Once synchronized, Automa8e handles the accrual process seamlessly. Within the Automa8e platform, you can conveniently access your expense claims and other financial data. Additionally, Automa8e provides comprehensive accrual reports for your analysis and monitoring needs.

By incorporating advanced features for expense claim processing and accrual management, Documa8e offers a comprehensive solution for automating accounting tasks. This streamlines processes, improves accuracy, and empowers users to make informed financial decisions.

DIY Accounting with Automa8e

In the realm of DIY accounting facilitated by Automa8e, simplicity reigns supreme. With a minimal learning curve, users can effortlessly navigate the system to upload essential documents such as bills, sales invoices, and bank statements. Once uploaded, Automa8e takes charge, streamlining the accounting process from start to finish.

Whether you’re recording asset purchases or managing depreciation, Automa8e automates the necessary adjustments with precision. This user-friendly approach empowers individuals to handle their accounting needs autonomously.

Beyond basic accounting tasks, Automa8e offers a myriad of features and functionalities, enhancing the DIY accounting experience. With Automa8e, accounting becomes not just manageable, but also efficient and effective.

Streamlined IRS and Tax Compliance with Documa8e

Documa8e revolutionizes the fulfillment of IRS and tax requirements by simplifying documentation management. By effortlessly uploading documents into Documa8e, users can seamlessly push accounting tasks forward, thereby achieving a comprehensive DIY accounting solution. This streamlined process not only ensures compliance with ACRA and IRS regulations but also facilitates efficient documentation retention, particularly when stored online for longer than the mandated five-year period.

Once all pertinent information is inputted, the next step involves addressing GST obligations.

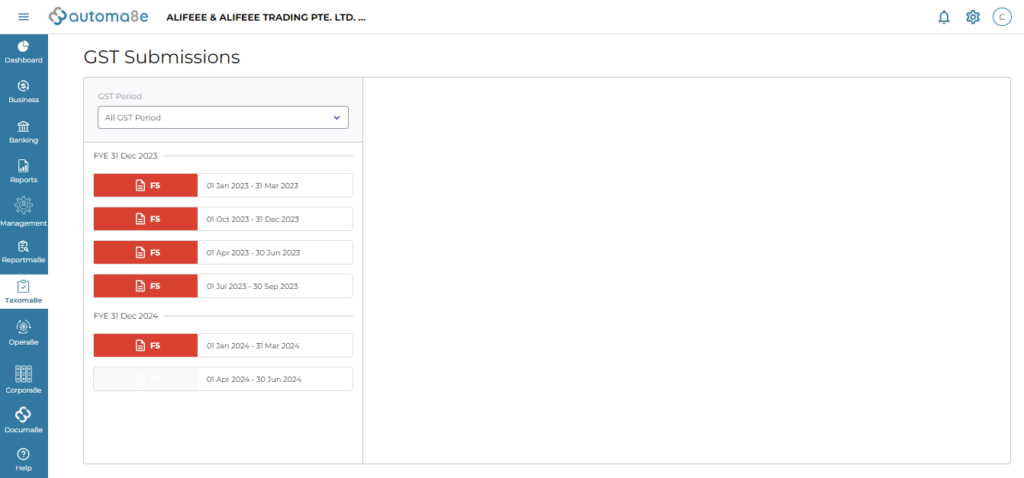

Streamlining GST Compliance with Taxoma8e

Taxoma8e simplifies the process of GST compliance by providing a user-friendly interface for managing GST-related tasks. Within the GST module, users can access various functionalities, including the filing of GST returns such as the F5 form, which represents the default option for regular GST filings.

The system organizes GST obligations into quarterly periods, typically spanning three months. For instance, if a user intends to file their GST return for December 2023, they can navigate to the corresponding quarter and initiate the filing process. It’s worth noting that the filing deadline for December 2023 would typically fall in January 2024.

Upon selecting the relevant quarter, users can review the GST transactions listed within the system. To ensure accuracy, users have the option to download a detailed report in Excel format, providing a comprehensive breakdown of the transactions. This report includes information on various types of transactions, such as standard-rated supplies (Sr.), zero-rated supplies (0%), and transactions (TX) involving purchases from other GST-registered traders in Singapore.

With Taxoma8e’s automated processes, users can rest assured that GST calculations and coding are handled seamlessly. By leveraging Documa8e for document management, the system automatically extracts GST information from uploaded documents, streamlining the entire GST compliance process.

Detailed GST Reporting and Filing Process in Taxoma8e

In Taxoma8e, the extraction of GST-related information from documents uploaded in Documa8e is meticulously carried out on a line-by-line basis, ensuring precision and accuracy. Each individual line item from a bill is extracted and presented within the system, providing a granular view of GST transactions. For instance, purchases from non-registered GST traders are categorized under the designation “0% NR” (not registered for GST), with each transaction listed for thorough record-keeping.

Within the system, the extracted line items are categorized into specific box numbers corresponding to various GST components. These box numbers serve as a reference for compiling the GST summary required for filing. The aggregated summary data is presented for review and validation by the user. Once confirmed, users can proceed by selecting the “use computation” option to initiate the filing process.

Taxoma8e offers two methods for filing GST returns: through Corp Pass or manually. If opting for Corp Pass filing, users can directly submit the computed GST figures to IRAS from within the system, streamlining the filing process. Alternatively, users can choose to file manually by transferring the summarized figures to the IRAS website and inputting them into the appropriate boxes as indicated within Taxoma8e.

Following manual filing, users receive an acknowledgment sheet, confirming the submission of GST returns to IRAS and providing assurance of compliance with tax regulations. This comprehensive approach to GST reporting and filing ensures adherence to regulatory requirements while leveraging automation for efficiency and accuracy.

Completing Tax Filing and Recording Payments in Taxoma8e:

After filing your tax return, you’ll receive an assessment from IRAS, typically on the same day. Upon receiving the notice assessment, which may include adjustments to your initial filing, you can upload it to Taxoma8e and record it as a Notice of Assessment (NOA). If there are discrepancies between your initial filing and the notice assessment, you can correct them during this process.

To record the payment corresponding to the notice assessment, select “Record Payment” in Taxoma8e. Enter the payment amount, along with details such as the bank used for the transaction and the payment date. Once submitted, the filing status will change to gray, indicating that the filing has been completed and payment has been made.

Monitoring your filing status is made easy through the dashboard’s compliance summary. Green indicates filings that are completed but pending payment, gray signifies completed filings with payment, and red highlights filings that are yet to be completed by the deadline.

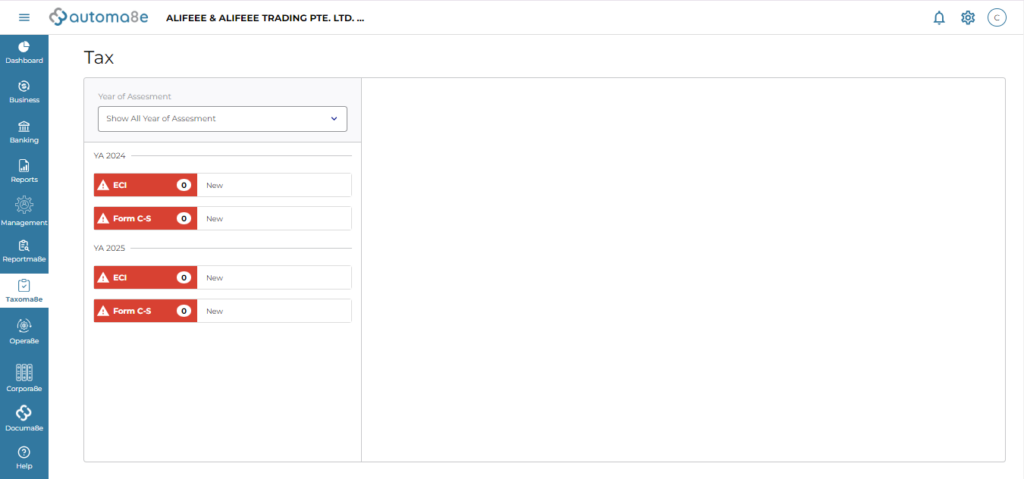

Transitioning to corporate tax filing, if you’re filing for a specific year, such as YA 24 (Year of Assessment 2024), you’ll navigate to the appropriate form, such as Form CS for YA 24. Verify the details provided and answer any relevant questions posed by the system. These questions may pertain to tax exemptions, pre-filled IRS data, changes in activity or shareholders, and other factors affecting tax benefits and deductions.

Once the tax computation is completed, you can download the details, including schedules and computations, for review or further analysis. If necessary, you can also make amendments to the filed information by accessing the editing options within Taxoma8e.

For example, if you need to update capital allowances, you can navigate to the relevant section and make the necessary adjustments. Taxoma8e provides a user-friendly interface for managing tax filing processes, ensuring accuracy, compliance, and efficiency in fulfilling tax obligations.

Advancing Technology in Accounting Software

In discussing the capabilities of our software, it’s essential to emphasize that our aim isn’t to replace existing solutions like Xero. Rather, we’re focused on leveraging new technologies to enhance the functionality and usability of accounting software.

While Xero is a prominent player in the market with extensive capabilities, our approach differs in that we’re constantly striving to push the boundaries of what accounting software can achieve. Our goal is to introduce innovations that elevate the user experience for both accountants and business users.

By competing against ourselves and continuously seeking improvement, we aim to set a higher standard for accounting software technology. While acknowledging the strengths of existing solutions like Xero, we’re committed to offering advancements that go beyond current industry norms.

It’s not about surpassing or replacing Xero; instead, it’s about inspiring innovation and driving progress within the accounting software industry as a whole. We believe that by pushing the limits of technology, we can contribute to the evolution of accounting software and deliver greater value to users.

Streamlining Tax Filing with Taxoma8e

In this section, we’ll guide you through the process of filing taxes using our software, Taxoma8e. From handling capital allowances to completing Form CS and filing taxes seamlessly, Taxoma8e simplifies the entire process, making it accessible to both accountants and non-accountants alike.

Navigating Form CS and Tax Computation

In this segment, we’ll guide you through Form CS and the intricacies of tax computation using Taxoma8e. Form CS is a crucial component of tax compliance, and Taxoma8e streamlines the process, ensuring accuracy and efficiency.

Accessing Tax Computation:

Upon entering the tax filing module, users have the option to access tax computation. This feature allows users to download a summary of their tax computation or make edits directly within the system. Users can navigate through various fields, including capital allowances, to review deductions and charges associated with asset transactions.

Technical Insights

To provide clarity on tax regulations, Taxoma8e offers insights into the technical aspects of tax computation. Users gain an understanding of taxable income, deductible expenses, and the treatment of asset acquisitions and disposals under relevant tax laws. This knowledge enhances users’ ability to make informed decisions during tax filing.

Understanding Capital Allowances and Tax Depreciation

Capital expenditures typically aren’t tax deductible. However, there are specific provisions in the law that allow for deductions. These deductions are facilitated through tax depreciation or what is known as capital allowances in tax terminology.

Tax depreciation or capital allowances serve as mechanisms for deducting the cost of assets over time. Here’s how it works:

- Asset Schedules: Within our system, asset schedules list all the assets acquired by a business. These schedules then recalibrate default deductions based on the most aggressive depreciation rates available. For instance, businesses can typically choose between depreciation periods of 6, 12, or 16 years.

- Shortest Depreciation Period: By default, our system claims deductions within the shortest period allowable under tax regulations. For assets classified under specific categories, such as office equipment or computers, depreciation periods may vary, often spanning three or one year.

- Customization Options: Users have the flexibility to edit depreciation periods based on their specific circumstances. If necessary, they can adjust the depreciation rates to align with their business needs or regulatory requirements.

Customizing Tax Calculations

With a basic understanding of tax law, our system can precalculate deductions for you. Here’s how it works:

- Precalculated Deductions: Our system uses preprogrammed algorithms based on tax regulations to calculate deductions automatically. This includes determining depreciation rates and capital allowances for your assets.

- Review and Decision Making: Once the deductions are calculated, you have the option to review the results. At this stage, you can decide whether to accept the calculated deductions or make adjustments as needed.

- Editing Deduction Rates: If you choose to edit the deductions, our system allows you to customize deduction rates according to your preferences or specific circumstances. For example, when selling an asset, you can adjust the depreciation rates to reflect the disposal and calculate any applicable balancing charges.

By providing users with the flexibility to review and customize tax calculations, our system ensures that businesses can tailor their tax strategies to optimize deductions while maintaining compliance with tax laws.

Finalizing Tax Calculations and Filing Process

In summary, once you’ve reviewed and customized your tax calculations, you’ll proceed with the following steps:

- Handling Disposals: If you’ve sold an asset, you’ll need to address any profits generated from the sale. These profits, known as balancing charges, are subject to taxation. Our system automatically identifies and calculates these charges for you.

- Amending Pre-calculations: If necessary, you can adjust pre-calculated figures to better align with your financial situation or preferences. This includes modifying income classifications or other transaction details to ensure accuracy and compliance.

- Standardized Codes and Regulations: Our system follows standardized transaction codes and regulatory guidelines set forth by tax authorities and financial reporting standards. This ensures consistency and compliance in your tax reporting.

- Recalculating Tax and Filing: After making any necessary adjustments, you can recalculate your tax liability. Once satisfied with the results, you’ll proceed to file your taxes. Our system offers seamless online filing options, including the ability to use CorpPass for direct submission to the tax authority.

- Completion and Payment: Upon successful filing, your tax records will be updated accordingly. Any outstanding tax payments can be recorded and settled through the system. Once completed, your tax filing status will be indicated as green, signifying compliance and completion.

our demonstration illustrates how our automated accounting system empowers users to efficiently manage their finances, comply with tax regulations, and file their GST and corporate taxes seamlessly. Whether you’re a professional accountant or a non-accountant business owner, our platform simplifies the tax process and ensures accuracy and compliance every step of the way.

Automa8e Platform – Common FAQs for Tax Filling

Click Here for Watching Video: FAQs About DIY Tax and Accounting

A: In our system, rectifying errors is a straightforward process. Allow me to walk you through it. If you encounter a discrepancy or error in your tax assessment, you have the option to file an amendment. You are permitted to file one amendment to correct any inaccuracies.

Let’s assume you’ve filed your initial tax assessment, indicating a tax payable of $15,000. However, upon further review, you discover an error, and the actual tax payable should be $13,000. In such a scenario, you can object to the assessment and file for an amendment.

Once you’ve objected to the initial assessment, and the tax authority (IRAS) issues a revised Notice of Assessment (NOA) indicating a tax payable of $15,000, you still have the option to object if you believe the assessment is incorrect. To proceed with the amendment, you can cancel the previous amount and initiate a revision filing.

Our system allows you to initiate a revision filing directly. After objecting to the NOA, you can revise the filing, and the system will generate a new Form CS for you to complete. It is important to note that you have 30 days from the receipt of the NOA to object. Failure to do so within this period may result in the assessment being confirmed, and you will be required to pay the indicated amount, regardless of any objections.

Please be aware that this process is not automated in our system. You must log into IRAS to check for any notices or updates regarding your assessment. While we have requested access to IRAS APIs to streamline this process, it is not currently available. We continue to explore options to improve this aspect of our service.

A: Yes, we do provide annual reports that comply with International Financial Reporting Standards (IFRS) and tax standards. Allow me to demonstrate how you can generate such a report within our system.

If you navigate to the reporting section, you will find an option for the annual report. By selecting this option and creating a new annual report, you can generate a report for the desired year, such as 2023.

Our system is designed to generate unaudited reports initially. However, it’s important to note that to finalize the report, you’ll need to engage an auditor to provide their opinion. In Singapore, certain companies may be exempt from preparing audited reports if they meet specific criteria, such as having less than $10 million in assets, $10 million in sales, and fewer than 50 employees, and not having corporate shareholders.

When creating the annual report within our system, you will be prompted to input relevant details such as director information, shareholder details, and authorization dates. Additionally, you have the flexibility to choose the format of your profit and loss statement (nature or function) and include any optional disclosures such as bank guarantees.

Once all necessary information is provided, you can generate the report. This process typically takes around 20 to 30 seconds. The annual report generated will include sections such as financial data, statements, profit and loss, balance sheet, equity changes, general information, and notes to accounts.

As for the number of people involved in processing when submitting to ACRA, typically, it involves the collaboration between the company’s internal team responsible for providing the necessary information and our system for generating the report. However, the specific number of individuals involved may vary depending on the size and structure of the company.

A: Yes, the report generated within our system is compliant with the standards required for submission to both Accra and IRAS (Inland Revenue Authority of Singapore). Our software ensures adherence to relevant regulatory requirements and standards, making it suitable for submission to these authorities. If you have any specific requirements or further inquiries about compliance, please tell us, and we will be happy to assist you.

A: Currently, we do not have integration with Xero or any other accounting software. However, I would like to address this question as it is crucial for our future.

We intend to provide a module for integration within the next three months. This module will focus on reporting and tax preparation.

Regarding preparing reports and taxes, we are developing a standalone module that will allow users to upload trial balances and general ledger data from any software system. This data will then be classified into our codes, enabling us to prepare the necessary reports and taxes.

It is essential to note that while we strive for automation, there may be limitations due to information gaps or shortages in other software systems. For example, some systems may lack asset schedules or liability schedules, resulting in incomplete data for automating annual reports and corporate taxes.

In such cases, we may achieve around 60-70% automation, with the remaining 30-40% requiring manual input due to missing information in the trial balance.

We are actively working on improving this aspect, and once we have a solution, we will inform our community. Additionally, we are exploring partnerships with integrators to facilitate direct syncing of information from other software systems to ours, with the user’s permission.

This is part of our product roadmap for the upcoming year, and we are committed to providing solutions that enhance our users’ experience and streamline their accounting processes.

A: Let me highlight the unique features and capabilities of Documa8e in comparison to other similar platforms like Hubdoc and Receipt Bank.

Firstly, while traditional OCR (Optical Character Recognition) technology is utilized by many document management platforms, Documa8e goes beyond mere data extraction. Our system employs advanced visioning technology, allowing it to thoroughly read and comprehend documents, accurately extract data, and classify transactions automatically. This higher level of technology enables us to offer features such as auto accounting and automated accrual systems directly within the platform.

In addition to standard documents like bills and bank statements, Documa8e excels in handling more complex financial agreements, such as finance leases. By extracting details from finance lease agreements and seamlessly integrating them into our system, Documa8e streamlines accounting processes for such arrangements, a capability not commonly found in other platforms.

Moreover, Documa8e serves as more than just a data extraction tool. It functions as a comprehensive E-document management system, empowering SMEs to digitize their operations affordably. With features like department creation, user management, and folder organization, Documa8e facilitates efficient document handling and collaboration within organizations.

In terms of pricing, we aim to make Documa8e accessible to all, with affordable user-based and scan-based pricing models. Our goal is to democratize access to advanced technology for micro companies and SMEs, ensuring they can benefit from cutting-edge solutions without hefty price tags.

In summary, Documa8e stands out from its competitors by offering advanced technology, comprehensive document management capabilities, and affordability, making it a valuable asset for forward-thinking businesses looking to streamline their operations and embrace digital transformation.

A: Documa8e is fully multicurrency compliant, allowing users to input and recognize bills in different currencies. However, it is essential to note that typically, each bill is associated with a single currency.

When handling bills in multiple currencies, Documa8e extracts the currency information from each bill accordingly. For example, when viewing a bill within the system, the currency will be clearly indicated.

Upon integration with our automated accounting system, Automa8e, Documa8e ensures that multicurrency bills are accurately processed. Automa8e recognizes the original currency of each bill but translates it into the functional currency of the business for recording purposes. This translation is based on the exchange rate provided by the Monetary Authority of Singapore (MAS) or relevant authorities on the date of the bill.

This process is crucial for accounting purposes, especially when making payments for these bills. Documa8e provides reports, such as accounts payable details, which summarize all multicurrency bills. These reports include a breakdown of each supplier, the types of bills, and their respective currencies. The amounts are translated into the functional currency, providing clear visibility and management of expenses across different currencies.

In summary, Documa8e efficiently handles bills in multiple currencies by accurately extracting currency information, translating amounts into the functional currency, and providing comprehensive reporting for effective financial management.

A: Absolutely, we are actively working on addressing this need. One solution we are developing is an Accounting Closing Checklist, which we hope to launch soon. This checklist will serve as a comprehensive guide to ensure that all necessary accounting tasks are completed before filings.

The Accounting Closing Checklist is a product of valuable feedback from accounting managers. It will consist of around 30 pages and cover essential elements relevant to financial reports, such as the balance sheet and profit and loss statement. The checklist will be customizable, allowing users to tailor it based on their specific accounting requirements.

Each checklist item will correspond to elements in the financial report. For example, if your balance sheet includes a line item for cash, the checklist will include tasks related to cash reconciliation and revaluation. This ensures that users only need to focus on tasks relevant to their accounts.

Additionally, the checklist will incorporate accountability by assigning responsibility to individuals for completing each task. This ensures that someone is overseeing the closing process and verifying that all necessary steps have been taken.

While we are still in the process of finalizing and implementing this feature, we are excited about the value it will bring to our users. It will provide non-accountants with confidence that their accounts are closed properly and ready for filing. Stay tuned for updates on the release of the Accounting Closing Checklist feature.

A: Yes, we do have plans to implement a feature that allows locking of accounts at an earlier date. This feature will enable users to prevent changes to accounts once the financial year is closed.

Currently, we are in the process of refining the user interface for this functionality. Our intention is to ensure that the locking process includes accountability, by identifying the person responsible for locking the accounts.

Once the accounts are locked, any attempts to make changes to transactions dated prior to the lock date will be blocked.

However, beyond the technical implementation, we are also considering how to improve communication within our system regarding the locking and unlocking of accounts. We recognize the importance of facilitating communication between relevant parties, such as accounting teams or managers, to ensure smooth workflow processes.

Therefore, while the locking feature is on our roadmap, we are also focusing on enhancing communication tools within our system to complement this functionality.

In summary, the option to lock accounts on an earlier date is planned for implementation, with considerations for accountability and improved communication processes. We are committed to providing a robust solution that meets the needs of our users.

A: The duration for which documents are retained in Automa8e is contingent upon your subscription status. If your monthly subscription fees are up to date, you can keep your documents stored in the cloud for an indefinite period.

However, if subscription payments lapse, there is a period for retention. After one to three months of non-payment, Automa8e will have to terminate the account and delete the documents stored therein. This termination is necessitated by the costs incurred for storage in cloud services such as AWS, which are closely monitored and managed to ensure affordability for our customers.

In summary, the duration for which bills, invoices, and receipts are kept on Automa8e’s cloud platform is linked to your subscription status, with documents retained if payments are current.

A: Yes, indeed. Each transaction document is intricately linked to the corresponding accounting records within Automa8e. When a document, such as a bill or receipt, is uploaded into Documa8e, a copy of it is simultaneously stored within Automa8e. This ensures that the document is seamlessly integrated with the associated accounting data.

For instance, if you upload a purchase bill into Documa8e, you will find that the same document is accessible within Automa8e’s interface. This linkage between Documa8e and Automa8e streamlines the auditing process, both internally and externally. With this integration, it becomes effortless to trace and reference documents for auditing purposes, whether it is for internal reviews or external audits.

A: Within Documa8e, users can download their data, including any associated documents such as invoices and receipts. However, it is essential to approach this process with a clear understanding of the implications.

When you request to export data and documents from Documa8e, it is managed as a private communication between us and the user. This means that we can facilitate the export process by providing you with the necessary files via a secure method, such as a Dropbox link or a USB thumb drive.

However, it is crucial to consider the link between Documa8e and Automa8e. These two platforms are tightly integrated, with Documa8e serving as the repository for documents linked to Automa8e’s accounting records. If you choose to export data from Documa8e without maintaining an active subscription to Automa8e, you may inadvertently sever the link between the exported documents and your accounting records in Automa8e.

In other words, removing data from Documa8e may result in the loss of the connection between the exported documents and their corresponding transactions within Automa8e. This could potentially impact the integrity of your accounting records and hinder your ability to efficiently manage and track your financial data.

Therefore, while you have the option to export data and documents from Documa8e, we advise careful consideration and caution to ensure that you maintain the integrity of your records and their connections within our integrated system.

A: Automa8e has introduced Opera8e, a comprehensive bill payment system designed to mitigate the risks of fraudulent activities or sabotage within the business environment.

Opera8e facilitates a structured process for managing bill payments, including the issuance of orders and subsequent approval workflows. When bills are received, they undergo a meticulous review process to ensure accuracy and authenticity.

For instance, within Opera8e, there are mechanisms for recording the names of individuals responsible for reviewing and approving bills. If any discrepancies or irregularities are detected, the system flags them for further investigation.

Moreover, Opera8e incorporates operational flows specifically tailored to address various aspects of bill management. These flows encompass checking procedures, approval workflows, and payment processes. By implementing such robust operational protocols, Automa8e aims to minimize the likelihood of fraudulent activities occurring within the system.

In summary, Opera8e system serves as a protective measure against fraud and sabotage by establishing clear accountability, rigorous review processes, and structured operational flows. Through these measures, Automa8e endeavors to safeguard the interests of business owners and mitigate risks associated with malicious activities.

A: Yes, indeed. Documa8e is equipped with functionality to detect duplicate documents, such as bills, that have been previously uploaded into the system.

For instance, if a user attempts to upload a bill that matches an existing document, the system promptly flags it as a duplicate. This alert provides users with the opportunity to review the duplicate document and decide on the appropriate course of action.

Upon encountering a duplicate document, users are presented with options to either delete the duplicate or proceed with the upload. This empowers users to make informed decisions regarding the handling of duplicate documents.

Additionally, Documa8e maintains a comprehensive tracking system that records essential details, including the name of the uploader and the upload date and time. This tracking mechanism enhances transparency and accountability in document management processes.

In summary, Documa8e capability to identify and manage duplicate documents offers users a streamlined and efficient approach to document management, ensuring data integrity and minimizing redundancy within the system.

A: If you initially anticipate not having a profit and subsequently realize a small profit due to adjusting entries passed by auditors, the process for filing Estimated Chargeable Income (ECI) may need to be revisited.

Typically, ECI is due within three months after the financial year-end. If your company incurs a loss or has negative chargeable income, meaning no profit, there is no requirement to file ECI.

However, if auditors later discover a profit during the audit process, you can still file ECI retrospectively. While it is essential to adhere to tax filing deadlines, if you did not file ECI due to initial expectations of no profit, but then auditors identify a profit, the tax authorities understand.

It is advisable to communicate any changes in financial circumstances promptly and transparently with the tax authorities. If you can provide valid reasons for the discrepancy and demonstrate compliance with tax regulations, penalties are unlikely. Honesty and transparency in tax reporting are key, and the authorities are accommodating in such situations.

Therefore, if you find yourself in this scenario, you can proceed to file ECI after the audit, ensuring compliance and transparency in your tax reporting process.

Conclusion:

In this comprehensive overview, we’ve explored how Automa8e revolutionizes the landscape of DIY tax and accounting. From simplifying expense claim processing to streamlining tax filing with Taxoma8e, our software offers a robust solution for businesses seeking efficiency and compliance. By automating tedious tasks, providing insights into tax regulations, and offering user-friendly interfaces, Automa8e empowers users to navigate complex financial processes with ease.

Call to Action:

Ready to experience the efficiency and simplicity of DIY tax and accounting? Try Automa8e today and streamline your financial management processes. Whether you’re a seasoned accountant or a business owner with minimal accounting knowledge, Automa8e is your trusted partner for navigating the complexities of tax compliance and financial reporting. Take control of your finances and unlock new levels of efficiency with Automa8e.