In the ever-evolving landscape of business, maintaining accurate financial records and managing financial operations efficiently is a non-negotiable requirement. This is where accounting packages step into the spotlight, offering a beacon of light amid the complex world of numbers and transactions.

In this blog, we’ll explore:

- The Backbone of Business

- A Glimpse into Automa8e Accounting Package

- Automa8e Accounting Packages with their features

- Pro Accounting Package: Your Financial Companion

- Features

- How Automa8e Accounting Simplifies Reconciliations

The Backbone of Business

Accounting packages serve as the backbone of modern enterprises, irrespective of their size or nature. These software solutions are designed to streamline financial processes, enhance data accuracy, and contribute to better decision-making. In the fast-paced realm of business, where every decision counts, having a reliable accounting package is akin to having a trustworthy advisor by your side.

A Glimpse into Automa8e Accounting Package

Among the myriad accounting packages available, the Automa8e Accounting Package stands out as a comprehensive and user-friendly solution. It is tailored to cater to the diverse needs of businesses, from startups to well-established corporations.

This package boasts a robust set of features designed to simplify bookkeeping, fiscal management, and compliance. With the Automa8e Accounting Package, you can bid farewell to the days of drowning in spreadsheets and struggling with manual calculations.

Throughout this article, we will delve deep into the various facets of the Automa8e Accounting Package, exploring its features and functionalities that have made it a trusted companion for businesses worldwide. From the basics offered by the Pro Accounting Package to the advanced capabilities of the Premium Accounting Package, we will cover it all.

So, fasten your seatbelts, because we are about to embark on an effortless journey through the world of accounting. Whether you are a seasoned entrepreneur or just stepping into the entrepreneurial arena, the Automa8e Accounting Package might just be the missing piece of your financial puzzle.

Automa8e Accounting Packages with their features

1. Pro Accounting Package:

The Pro Accounting Package is the gateway to efficient financial management and bookkeeping. It is not just software; it is your financial companion, and here is why it is a meaningful change:

Explaining the Pro Accounting Package

Imagine a tool that simplifies the complexity of accounting processes. That is precisely what the Pro Accounting Package does. It streamlines your financial tasks, ensuring that you can focus on what truly matters – growing your business.

This package is more than just a software solution; it is a comprehensive suite of features designed to make your financial life easier. From invoice and bill management to accounts receivable and payable, the Pro Accounting Package handles it all with finesse.

Benefits of Using Pro Accounting

Why should you consider the Pro Accounting Package for your business? Here are some compelling benefits:

- Efficiency: Pro Accounting automates repetitive tasks, reducing the time and effort required for manual data entry and calculations.

- Accuracy: Say goodbye to human errors. This package ensures precise financial records, reducing the risk of costly mistakes.

- Organization: It brings order to chaos by organizing your financial data, making it easily accessible and understandable.

- Cost Savings: Investing in the Pro Accounting Package can lead to significant cost savings eventually. It minimizes the need for additional workforce and reduces the chances of financial mishaps.

- Real-time Insights: Access real-time financial data through an intuitive dashboard. Make informed decisions promptly.

- Compliance: Stay compliant with tax regulations and financial reporting standards effortlessly. The Pro Accounting Package keeps you on the right side of the law.

Cost-effective Pricing

Now, let us talk about affordability. The Pro Accounting Package offers all these benefits at an incredibly cost-effective price. It is a small investment with the potential for substantial returns.

Think about it. For the cost of a few cups of coffee each month, you can transform your financial operations, save time, and reduce stress. It is a price that is hard to beat when you consider the value it brings to your business.

Encouraging a Free Trial

Still not sure if the Pro Accounting Package is the right fit for your business? We understand that making such a decision is significant, so we offer a risk-free solution: a free trial.

You can experience the power of the Pro Accounting Package firsthand, with no strings attached. Take it for a spin, explore its features, and witness the positive impact it can have on your economic management.

Do not let uncertainty hold you back. Embrace the future of accounting with the Pro Accounting Package and take your business to new heights. Try it today and discover the difference it can make. Your financial success is just a click away.

Features:

Invoices/Bills: Simplifying Financial Transactions

In the intricate dance of business finances, invoices, and bills is the choreography that keeps everything moving smoothly. However, this choreography can quickly turn into chaos without the right tools. That is where the Invoices/Bills feature of the Pro Accounting Package steps in, with its mission to simplify and streamline.

Streamlining Invoice and Bill Management

Imagine a world where you do not have to sift through stacks of paper or dive into an overflowing inbox to find that one critical invoice. With the Pro Accounting Package’s Invoices/Bills feature, you step into that world.

This feature is your digital filing cabinet. It meticulously organizes invoices and bills, making retrieval a breeze. No more hunting through physical documents or endless email threads. Just a few clicks, and you have what you need at your fingertips.

Features and Tools for Efficient Invoice Processing

Efficiency is the name of the game, and the Invoices/Bills feature plays it well. It is equipped with a toolbox of features designed to supercharge your invoice processing:

- Automated Data Capture: Say farewell to manual data entry. The package can automatically capture invoice details, saving you time and reducing the risk of errors.

- Customizable Templates: Create professional-looking invoices with customizable templates. Add your logo and branding for that distinctive touch.

- Real-time Tracking: Always know the status of your invoices. No more wondering if a client has received or paid their invoice. Real-time tracking keeps you in the loop.

- Payment Reminders: Gentle nudge clients who might need a reminder. You can automate payment reminders, ensuring you get paid on time.

Reducing Manual Data Entry

Manual data entry is the bane of any accountant or business owner’s existence. It is tedious, time-consuming, and prone to errors. The Invoices/Bills feature recognizes this pain point and offers a solution.

By automating data entry, it slashes the time you spend on repetitive tasks. Invoices are automatically recorded, reducing the risk of typos or miscalculations. Your financial records become more accurate, and you have more time to focus on strategic decisions that drive your business forward.

In a world where every minute counts, the Invoices/Bills feature of the Pro Accounting Package is your timesaving, error-reducing, efficiency-boosting ally. It transforms the way you handle financial transactions, leaving you with more time and peace of mind to concentrate on what truly matters—growing your business.

Managing Accounts Receivable Effectively

Accounts receivable—those sums your customers owe you—are assets, but they are not of much use to you if they are tied up indefinitely. The Pro Accounting Package helps you orchestrate this aspect with precision.

- Invoice Tracking: Keep tabs on outstanding invoices effortlessly. The package tracks who owes you money and when it is due, ensuring nothing slips through the cracks.

- Automated Reminders: No more chasing after overdue payments. Set up automated reminders to gently nudge your clients, ensuring they fulfill their financial commitments on time.

- Aging Reports: Get a clear picture of your accounts receivable aging. This insight helps you identify which accounts need immediate attention and which are on track.

Automating the Collection Process

Collecting payments can be a delicate task. The Pro Accounting Package takes the guesswork out of it by automating the collection process.

- Payment Integration: Seamlessly integrate payment gateways for quick and secure transactions. Your clients can pay you with ease, and you can see the funds roll in promptly.

- Recurring Invoices: For recurring services or products, set up automated invoices. It is hassle-free for both you and your clients.

Reducing Outstanding Debts

Outstanding debts can be a dark cloud over your financial horizon. The Pro Accounting Package acts as your positive aspect.

- Debt Tracking: Easily identify overdue payments and act promptly. Whether it is a gentle reminder or a more assertive approach, you are in control.

- Offer Discounts: Encourage early payments by offering discounts. It is a win-win—your clients save, and you get paid faster.

Ensuring a Healthy Cash Flow

A healthy cash flow is the lifeblood of any business. The Pro Accounting Package keeps your financial veins flowing smoothly.

- Cash Flow Projections: Gain insights into your future cash flow with projections. This helps you plan and make informed financial decisions.

- Financial Reports: Access comprehensive financial reports that give you a 360-degree view of your cash flow. It is like having a financial GPS, guiding you to your destination.

Efficient Management of Accounts Payable

Paying your bills on time is not just a matter of responsibility; it is a strategy for maintaining good business relationships.

- Invoice Processing: The package streamlines invoice processing. It categorizes, records, and tracks your bills, ensuring you never miss a payment.

- Vendor Management: Maintain a database of your vendors for easy reference. You will have all the information you need at your fingertips.

Automating Payment Processes

Manually processing payments is time-consuming and prone to errors. The Pro Accounting Package offers a smarter way.

- Scheduled Payments: Schedule payments in advance. Whether it is a one-time payment or a recurring expense, the package handles it all.

- Electronic Payments: Embrace the digital age with electronic payments. It is faster, more secure, and leaves an auditable trail.

Avoiding Late Payments and Penalties

Delinquent payments can strain vendor relationships and lead to penalties. The Pro Accounting Package is your guardian against such pitfalls.

- Due Date Alerts: Set up due date alerts to ensure you never miss a payment deadline. No more late fees or strained relationships.

- Early Payment Discounts: Take advantage of advance payment discounts offered by vendors. The package helps you identify these opportunities.

Improving Vendor Relationships

Smooth payment processes lead to happier vendors. When your vendors are happy, your business thrives.

- Communication Hub: Keep communication with vendors organized. Whether it is inquiries, negotiations, or clarifications, you can easily access past conversations.

- Prompt Payments: Make timely payments and build a reputation as a reliable partner. This fosters trust and can lead to better deals in the future.

Mastering Financial Precision with Accruals and Deferments Calendar

When it comes to monetary management, precision is paramount. In this segment, we dive into the intriguing world of accruals and deferments, and how the Accruals and Deferments Calendar feature of the Automa8e Accounting Package ensures financial accuracy.

Demystifying Accruals and Deferments

Before we explore how the calendar feature works its magic, let us demystify the concept of accruals and deferments:

- Accruals: These are revenues or expenses recognized on the income statement before they are received or paid. They ensure that financial statements reflect a company’s financial reality, even if the cash has not changed hands yet.

- Deferments: Deferments, on the other hand, involve delaying the recognition of revenue or expenses until a later period. They help match revenue with the expenses incurred to earn it, providing a more accurate picture of a company’s financial health.

How Does the Calendar Feature Help?

Now that we understand the concepts, let us see how the calendar feature comes into play:

- Visual Representation: The calendar provides a visual representation of when accruals and deferments occur. You can easily track upcoming events, ensuring nothing slips your mind.

- Automated Entries: The feature automates the entry of accruals and deferments on the specified dates. This reduces the risk of manual errors and ensures compliance with accounting standards.

- Simplified Reporting: With accurate accruals and deferments, your financial reporting becomes more reliable. It is a crucial step in maintaining transparency and making informed financial decisions.

Ensuring Accurate Financial Reporting

Accurate financial reporting is the cornerstone of responsible fiscal management. The Accruals and Deferments Calendar feature ensures that your reports are precise:

- Regulatory Compliance: It helps you comply with accounting standards and regulations, avoiding potential legal issues.

- Better Decision-Making: Accurate reports lead to better decision-making. You can rely on your financial data to guide your business strategies.

- Investor Confidence: For publicly traded companies, accurate financial reporting fosters investor confidence and trust.

Provision for Doubtful Debts and Bad Debt Write-offs:

In the unpredictable world of business, doubtful debts are a reality. The Provision for Doubtful Debts and Bad Debt Write-offs feature automates the process, ensuring your balance sheet remains clean and accurate.

Handling Doubtful Debts with Automation

Doubtful debts can weigh on your financial health. This feature automates their management:

- Risk Assessment: It assesses the risk associated with outstanding debts, ensuring you are aware of potential issues.

- Provision Calculation: Based on the assessment, it calculates the provision for doubtful debts, reflecting the estimated loss in your financial statements.

Maintaining a Clean and Accurate Balance Sheet

Your balance sheet is a financial snapshot of your company’s health. This feature ensures it remains clean and accurate:

- Transparency: Stakeholders rely on your balance sheet for transparency. By automating doubtful debt provisions and write-offs, you maintain trust and credibility.

- Sound Decision-Making: An accurate balance sheet is vital for making informed financial decisions, such as seeking financing or making investments.

In the world of finance, precision and prudence are key. The Accruals and Deferments Calendar, along with the Provision for Doubtful Debts and Bad Debt Write-offs feature, ensures that your financial records are not just accurate but also reflect your commitment to responsible economic management.

Mastering Financial Accuracy with Bulk Classification of Bank Transactions

In the realm of monetary management, precision is paramount. Discover how the Bulk Classification of Bank Transactions feature of the Automa8e Accounting Package transforms your financial accuracy.

Automating Bank Transaction Categorization

Manual data entry errors can be costly. The Bulk Classification feature automates the categorization of bank transactions:

- Efficiency: Say goodbye to tedious data entry. The package automatically categorizes transactions, saving time and minimizing errors.

- Accurate Records: Automated categorization ensures that your financial records are precise and that nothing falls through the cracks.

Enhancing Financial Accuracy

Financial accuracy is the bedrock of sound decision-making:

- Data Consistency: Automated categorization ensures that your financial data remains consistent and reliable.

- Error Reduction: By reducing manual data entry, you significantly lower the risk of errors that can skew your financial picture.

Bank Reconciliations: The Pillar of Financial Integrity

The Importance of Bank Reconciliations

Bank reconciliations are the guardians of financial integrity:

- Detecting Discrepancies: They help you identify discrepancies between your records and your bank statements.

- Fraud Prevention: Reconciliations can uncover fraudulent activities, protecting your finances.

How Automa8e Accounting Simplifies Reconciliations

While bank reconciliations are vital, they can also be complex. The Automa8e Accounting Package simplifies the process:

- Automated Matching: The package automates the matching of your records with your bank statements, making the process faster and more accurate.

- Error Detection: It detects discrepancies and errors, ensuring that your financial records remain clean and trustworthy.

- Timely Reconciliations: With automation, you can perform reconciliations more frequently, leading to quicker error detection and resolution.

Avoiding Discrepancies in Financial Records

Discrepancies can lead to costly mistakes. The Automa8e Accounting Package helps you avoid them:

- Reliable Records: Reconciliations ensure that your financial records are reliable and accurate.

- Compliance: They help you stay compliant with accounting standards and regulations.

- Decision-Making Confidence: Accurate records inspire confidence in your financial decisions, whether you are seeking investments, loans, or simply managing day-to-day operations.

In the world of finance, accuracy and integrity are non-negotiable. The Bulk Classification of Bank Transactions and Bank Reconciliations features ensure that your financial records are not just precise but also reflect your commitment to responsible monetary management.

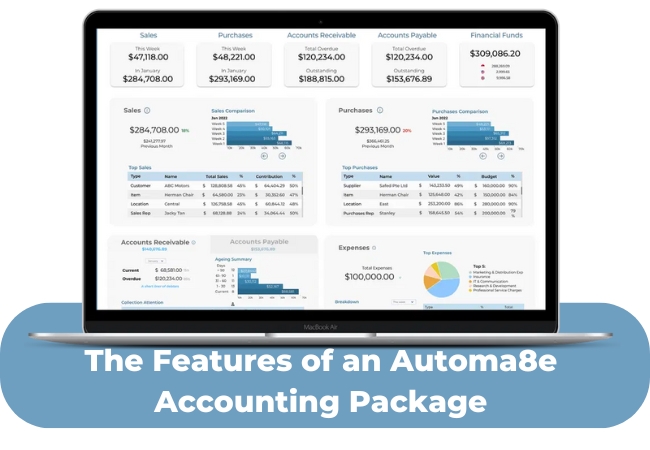

Navigating Your Financial World with the Interactive Dashboard

In the realm of business finance, knowledge is power. The Automa8e Accounting Package empowers you with an interactive dashboard, offering a comprehensive overview of your financial landscape.

An Overview of the Interactive Dashboard

Imagine having a cockpit view of your business’s financial health. The interactive dashboard provides just that:

- At-a-Glance Insights: Get a quick snapshot of your financial status, including cash flow, outstanding invoices, and expenses.

- Real-Time Data: Access real-time financial data, keeping you informed of your financial standing.

- Visual Representation: Information is presented graphically, making it easy to digest and understand.

Access to Real-Time Financial Data

In today’s fast-paced business environment, timely decisions are critical. The dashboard ensures you are always up to date:

- Instant Access: With real-time data at your fingertips, you can make informed decisions promptly.

- Profit and Loss: Monitor your profit and loss statements in real-time, allowing you to react swiftly to changes.

- Cash Flow: Keep a close eye on your cash flow, ensuring you have the liquidity you need for your day-to-day operations.

Customization Options for Personalized Insights

Your business is unique, and so are your financial needs. The dashboard caters to your individual preferences:

- Personalized Widgets: Customize the dashboard with widgets that matter most to you. Whether it is revenue trends, expense breakdowns, or client payment statuses, you can tailor the dashboard to suit your needs.

- Alerts and Notifications: Set up alerts for specific financial thresholds. Receive notifications when, for instance, your cash balance drops below a certain limit or when a client’s payment is overdue.

Customer Support via Automa8e System: Assistance at Your Fingertips

In the world of business, questions and challenges are part of the course. The Automa8e Accounting Package offers a seamless solution with its built-in customer support system.

Availability of Customer Support

Support is just a click away, thanks to the Automa8e System:

- Integrated Assistance: Access customer support directly from within the system, eliminating the need to search for contact information or wait in phone queues.

- Diverse Channels: Reach out via WhatsApp, WeChat, Zoom/Google video call, or even traditional phone calls. The support system offers a range of communication options to suit your preferences.

Benefits of Using the Automa8e System for Assistance

Why opt for the Automa8e System when seeking assistance? Here are some compelling reasons:

- Efficiency: The integrated system ensures quick and efficient assistance, reducing the time you spend navigating external support channels.

- Seamless Communication: Whether you prefer written communication or a face-to-face video call, the Automa8e System provides versatile channels for interaction.

- In-Context Assistance: Customer support within the system means that support agents have immediate access to your financial data, allowing for more context-aware and relevant assistance.

24-hour Email Support for Quick Responses

Email support is a valuable addition to the Automa8e System’s arsenal:

- Round-the-Clock Availability: With 24-hour email support, you can reach out whenever you encounter an issue or have a question, without being bound by business hours.

- Written Documentation: Email support often includes written responses, which can serve as valuable documentation for future reference.

- Response Time: Expect quick responses, ensuring that you can resolve your queries or issues promptly.

In the intricate world of finance, having a reliable compass and a lifeline for assistance is crucial. The interactive dashboard offers insights immediately, while the Automa8e System’s customer support ensures that you are never alone on your financial journey. With these tools at your disposal, you can navigate the complex terrain of business finance with confidence.

2. Advanced Accounting Package

Welcome to the pinnacle of financial control – the Advanced Accounting Package. In this segment, we delve into the enriched world of this package, tailored for businesses with intricate needs.

Exploring the Advanced Accounting Package

The Advanced Accounting Package is not just an upgrade; it is a transformation of your financial capabilities. Here is a glimpse of what it offers:

- Comprehensive Financial Arsenal: It comes equipped with an array of advanced tools designed to tackle the complexities of modern businesses.

- Advanced Reporting: Gain access to even more powerful reporting features, providing in-depth insights into your financial data.

- Multi-entity Support: For businesses with multiple entities or subsidiaries, this package offers seamless management and consolidation.

- Enhanced Customization: Tailor your financial workflows with even greater precision. The Advanced Accounting Package understands that every business is unique.

Enhanced Features for More Complex Businesses

Complexity does not faze this package; it thrives on it:

- Inventory Management: Keep meticulous track of your inventory, manage stock levels, and optimize your supply chain.

- Multi-Currency Support: If your business deals with international transactions, the Advanced Accounting Package simplifies multi-currency management.

- Budgeting and Forecasting: Take control of your financial future with advanced budgeting and forecasting tools, essential for strategic planning.

- Advanced Tax Management: Navigate the complexities of taxation effortlessly with features designed to streamline compliance.

Advance Accounting Package

Encouraging a Free Trial

We understand that committing to a new financial system is significant. That is why we encourage you to experience the power of the Advanced Accounting Package firsthand, risk-free, with our free trial.

During the trial, you can explore its features, assess its impact on your business, and determine if it fits your unique needs. It is an opportunity to witness the transformation that advanced financial management can bring to your business.

Do not hesitate; to embrace the future of financial control with the Advanced Accounting Package. Your journey to enhanced financial management begins with a click. Start your free trial today and elevate your business to new heights of financial excellence.

PPE Assets and Intangible Assets

In the intricate realm of monetary management, handling tangible and intangible assets efficiently is paramount. The Automa8e Accounting Package simplifies these complex processes, ensuring that your asset management is seamless and precise.

PPE Assets – Acquisition, Impairment, Depreciation, and Disposals

Managing tangible assets has never been easier with automation:

- Efficient Acquisition: Streamline the process of acquiring PPE (Property, Plant, and Equipment) assets. The package automates data entry and documentation, reducing manual errors.

- Impairment Recognition: Identify and account for impairments promptly. The package ensures that your financial statements accurately reflect the recoverable value of your assets.

- Depreciation Accuracy: Accurate depreciation calculations are essential. The package automates these calculations, considering various depreciation methods, ensuring compliance with accounting standards.

- Efficient Disposals: When it is time to dispose of assets, the package handles the process efficiently. It updates your records, calculates gains or losses, and ensures accurate financial reporting.

Intangible Assets – Acquisition, Impairment, Amortization, and Disposals

Managing intangible assets seamlessly is equally vital:

- Efficient Acquisition: The package automates the acquisition process for intangible assets. It streamlines documentation and data entry.

- Impairment Management: Recognize impairments promptly and accurately. The package ensures that your financial statements reflect the true value of your intangible assets.

- Amortization Precision: Amortization can be complex, but the package simplifies it. automates amortization calculations, ensuring accurate financial reporting.

- Efficient Disposals: When it is time to dispose of intangible assets, the packaging ensures a smooth process. It updates your records and calculates any gains or losses.

Mastery of Investment Management: Properties and Financial Instruments

In the intricate world of financial management, efficient handling of investment properties and financial instruments is essential. The Automa8e Accounting Package simplifies these complex processes, ensuring that your investment management is precise and hassle-free.

Investment Properties – Acquisition, Valuation, and Disposals

Efficiently managing investment properties has never been easier:

- Streamlined Acquisition: The package automates the acquisition process for investment properties. It simplifies documentation, data entry, and compliance checks, reducing the risk of errors.

- Accurate Valuation: Valuing investment properties accurately is crucial. The package ensures precise valuation methods are applied, reflecting the true value of your properties for financial statements.

- Efficient Disposals: When it is time to dispose of investment properties, the packaging simplifies the process. It updates your records, calculates gains or losses, and ensures accurate financial reporting.

Shares, Bonds, and Other Investments – Acquisition, Valuation, and Disposals

Managing financial instruments requires precision:

- Precision in Acquisition: The package automates the acquisition process for shares, bonds, and other investments. It simplifies documentation and ensures compliance with regulations.

- Accurate Valuation: Valuing these financial instruments accurately is essential for financial transparency. The package automates valuation processes, reflecting the true market value in your financial statements.

- Efficient Disposals: When it is time to sell or dispose of these financial assets, the package streamlines the process. It updates records, calculates gains or losses, and monitors your investment performance.

Mastering Funding Management: Loans, Leases, and Financial Obligations

In the intricate world of financial management, efficiently managing funding sources, loans, leases, and financial agreements is paramount. The Automa8e Accounting Package simplifies these complex processes, ensuring your financial obligations are tracked accurately and that compliance with financial agreements is maintained.

Funding – Bank Loans, Finance Leases, and ROU Leases

Efficiently managing funding sources and obligations is essential:

- Streamlined Tracking: The package automates the tracking of bank loans, finance leases, and ROU (Right-of-Use) leases. It simplifies documentation, automates interest calculations, and ensures that payment schedules are adhered to.

- Accurate Compliance: Staying compliant with financial agreements is crucial. The package includes compliance checks, ensuring that covenants and conditions are met.

- Reduced Risk: Automation reduces the risk of financial errors, ensuring that your financial records accurately reflect your funding sources and obligations.

Funding – Loans Payable and Loans Receivable

Efficiently managing loans payable and loans receivable is vital:

- Streamlined Loan Management: The package simplifies loan management through automation. It ensures that loans payable is tracked, payments are recorded accurately, and interest calculations are precise.

- Efficient Handling: Handling loans receivable becomes efficient with automated processes. It tracks incoming payments, ensures proper accounting for interest income, and reduces the risk of errors.

- Risk Reduction: Automation lowers the risk of financial discrepancies, helping you maintain a clean and accurate financial record.

Excellence in Equity Management: Share Operations and Customer Support

In the intricate world of economic management, efficiently managing equity and providing exceptional customer support is paramount. The Automa8e Accounting Package simplifies complex equity operations and ensures that clients have access to support when needed.

Equity – Share Allotments, Reductions, Treasury Shares, and Share Application Funds

Efficiently managing equity operations has never been easier:

- Streamlined Operations: The package automates equity management, including share allotments, reductions, treasury shares, and share application funds. It simplifies documentation and ensures precise accounting for these transactions.

- Accurate Equity Records: Maintaining accurate equity records is vital. The package automates record-keeping, reducing the risk of errors and ensuring that your equity data is reliable for financial reporting.

Customer Support in Pro Accounting

Exceptional customer support is the cornerstone of client satisfaction:

- Diversified Support Channels: The package offers diverse customer support channels, including WhatsApp, WeChat, Zoom/Google video call, and traditional phone support. Clients have the flexibility to choose the communication method that suits them best.

- Timely Assistance: Ensuring clients have access to support when needed is crucial. The package provides swift responses, addressing inquiries and concerns promptly.

3. Premium Accounting Package

Welcome to the pinnacle of financial excellence – the Premium Accounting Package. In this segment, we explore the comprehensive world of this package, tailored for businesses seeking top-tier financial management.

Comprehensive Financial Management with the Premium Package

The Premium Accounting Package is not just an upgrade; it is a transformation of your financial capabilities. Here is a glimpse of what it offers:

- All-Inclusive Features: Enjoy all the features of the Advanced Accounting Package and more. It is designed to meet the needs of businesses with the most intricate financial requirements.

- Enhanced Reporting: Gain access to advanced reporting features that provide unparalleled insights into your financial data, empowering you to make informed decisions.

- Priority Support: With the Premium Package, you receive priority customer support, ensuring that your inquiries and concerns are addressed promptly.

- Customization Beyond Limits: Tailor your financial workflows to the most intricate details. The Premium Accounting Package understands that every business is unique and offers customization options that leave no stone unturned.

Premium Accounting Package

Consider it an investment in the future of your business. For just a fraction of the value it brings, you gain access to a suite of advanced financial tools, unparalleled reporting capabilities, and priority support that ensures your financial journey is smooth and successful.

Encouraging a Free Trial

We understand that committing to a new financial system is significant. That is why we encourage you to experience the power of the Premium Accounting Package firsthand, risk-free, with our free trial.

During the trial period, you can explore its extensive features, assess its impact on your business, and determine if it fits your unique financial needs. It is an opportunity to witness the transformation that top-tier financial management can bring to your business.

Do not hesitate; to embrace the pinnacle of financial control with the Premium Accounting Package. Your journey to financial excellence begins with a click. Start your free trial today and elevate your business to new heights of financial mastery.

Mastering GST Compliance: Simplified Reporting with Automa8e Accounting

In the realm of financial management, Goods and Services Tax (GST) compliance is a crucial aspect that demands precision and efficiency. The Automa8e Accounting Package simplifies the complex world of GST reporting, ensuring that your business complies effortlessly while reducing the risk of errors and penalties.

Simplifying GST Compliance

Navigating the complexities of GST compliance can be challenging:

- Regulatory Framework: GST compliance involves adherence to a strict regulatory framework, and non-compliance can lead to costly penalties.

- Data Accuracy: Accurate reporting is essential to ensure that your GST returns align with your actual financial transactions.

Automating GST Form F5/F7 and F8 Preparation

The Automa8e Accounting Package simplifies GST compliance by automating the preparation of GST Form F5, F7, and F8:

- Effortless Data Integration: The package seamlessly integrates with your financial data, ensuring that your GST returns are generated based on accurate and up-to-date information.

- Automatic Calculations: It automates GST calculations, including input tax credits, ensuring that your returns reflect the correct GST amounts.

- Streamlined Reporting: With automation, generating GST Form F5, F7, and F8 becomes a streamlined process, reducing the time and effort required for compliance.

Reducing GST-Related Errors and Penalties

Errors in GST reporting can lead to financial repercussions:

- Risk Mitigation: Automa8e Accounting minimizes the risk of GST-related errors, reducing the chances of penalties and financial losses.

- Timely Filing: The package ensures that your GST returns are filed on time, eliminating late-filing penalties.

Mastering Corporate Tax Computation: Effortless ECI and Form C-S Handling

In the intricate world of fiscal management, efficient corporate tax computation is paramount. The Automa8e Accounting Package simplifies the complex processes of ECI (Estimated Chargeable Income) and Form C-S, ensuring that your corporate tax obligations are met seamlessly while ensuring compliance with tax regulations.

Efficient Corporate Tax Computation with Automation

Calculating corporate taxes can be a complex task:

- Compliance Complexity: Corporate tax computation involves adherence to intricate tax regulations, and non-compliance can result in legal consequences.

- Data Accuracy: Accurate computation is essential to ensure that your tax filings align with your actual financial activities.

Handling ECI and Form C-S Seamlessly

The Automa8e Accounting Package streamlines the process of corporate tax computation, making it effortless:

- Automated Data Integration: The package seamlessly integrates with your financial data, ensuring that your tax calculations are based on accurate and up-to-date information.

- Automatic Computations: It automates the calculations for ECI and Form C-S, ensuring that your tax returns accurately reflect your tax liabilities.

- Streamlined Reporting: With automation, handling ECI and Form C-S becomes a streamlined process, reducing the time and effort required for tax compliance.

Ensuring Compliance with Tax Regulations

Tax compliance is essential to avoid legal repercussions:

- Risk Mitigation: Automate Accounting minimizes the risk of tax-related errors, reducing the chances of penalties and legal consequences.

- Timely Filing: The package ensures that your ECI and Form C-S filings are submitted on time, eliminating late-filing penalties.

Mastering Corporate Tax Computation: Effortless ECI and Form C-S Handling

In the intricate world of monetary management, efficient corporate tax computation is paramount. The Automa8e Accounting Package simplifies the complex processes of ECI (Estimated Chargeable Income) and Form C-S, ensuring that your corporate tax obligations are met seamlessly while ensuring compliance with tax regulations.

Efficient Corporate Tax Computation with Automation

Calculating corporate taxes can be a complex task:

- Compliance Complexity: Corporate tax computation involves adherence to intricate tax regulations, and non-compliance can result in legal consequences.

- Data Accuracy: Accurate computation is essential to ensure that your tax filings align with your actual financial activities.

Handling ECI and Form C-S Seamlessly

The Automa8e Accounting Package streamlines the process of corporate tax computation, making it effortless:

- Automated Data Integration: The package seamlessly integrates with your financial data, ensuring that your tax calculations are based on accurate and up-to-date information.

- Automatic Computations: It automates the calculations for ECI and Form C-S, ensuring that your tax returns accurately reflect your tax liabilities.

- Streamlined Reporting: With automation, handling ECI and Form C-S becomes a streamlined process, reducing the time and effort required for tax compliance.

Ensuring Compliance with Tax Regulations

Tax compliance is essential to avoid legal repercussions:

- Risk Mitigation: Automa8e Accounting minimizes the risk of tax-related errors, reducing the chances of penalties and legal consequences.

- Timely Filing: The package ensures that your ECI and Form C-S filings are submitted on time, eliminating late-filing penalties.

Frequently Asked Questions (FAQs)

The Automa8e Accounting Package is a comprehensive fiscal management solution designed to simplify and streamline various financial processes for businesses.

We offer three packages:

Pro Accounting: Ideal for simplifying bookkeeping and fiscal management.

Advanced: Designed for businesses that need integrated accounting and business management.

Premium: The all-inclusive package for comprehensive fiscal management.

Choosing the right package depends on your business’s specific needs. Evaluate the complexity of your financial operations, the features required, and your budget to make an informed choice.

Starting a free trial is easy:

Visit our website and navigate to the package you are interested in.

Click on the “Start a free trial” button.

Follow the registration process, and you will gain access to the trial version of the selected package.

During the free trial, you will have access to all the features of the selected package, allowing you to explore its capabilities and assess how it aligns with your business needs.

During the free trial, you will have access to all the features of the selected package, allowing you to explore its capabilities and assess how it aligns with your business needs.

No, the free trial is entirely risk-free and does not require any commitment or obligation. It is an opportunity for you to evaluate the package and its suitability for your business.

Yes, customer support is available during the free trial. You can reach out to our support team for assistance or any questions you may have.

Yes, you can upgrade to a different package at any time if you find that your business needs more advanced features or capabilities.

If you decide to subscribe to a package after the free trial, you can do so through our website. Simply select the package you want and follow the subscription process.

Conclusion: Elevate Your Financial Management Today

In conclusion, the Automa8e Accounting Package is your key to unlocking unparalleled efficiency, precision, and compliance in your financial operations. Whether you are a small business looking to simplify bookkeeping or a complex enterprise seeking all-inclusive fiscal management, our packages have you covered.

With pricing options that fit various budgets and risk-free free trials available, there is no reason to delay your journey to financial excellence. Take that step today, choose the right package for your business, and experience the transformative power of automation in monetary management. Elevate your financial control, reduce errors, ensure compliance, and drive your business toward a future of success.

Automa8e is an AI-powered accounting Platform and document management solution that empowers businesses in Singapore by delivering invaluable information and practical guides for a wide range of business functions and day-to-day operations.

IRAS has verified that Automa8e has successfully integrated with IRAS’ tax filing APIs (Corporate Income Form C-S and GST Returns F5/F8 Submission), and is e-Invoicing ready. IRAS recognises that Automa8e has invested effort to align with IRAS’ vision to make tax filing experience seamless. IRAS strongly encourages businesses to consider the use of Automa8e if it meets the business’ needs

At Automa8e, our mission is to provide businesses with the knowledge and insights necessary to make intelligent decisions, enabling them to thrive and succeed. We are committed to sharing valuable information and aim to be the trusted partner that empowers businesses to achieve their goals through informed decision-making. With our comprehensive suite of tools and resources, we are dedicated to supporting businesses in Singapore on their path to success. Schedule a call now and discover how Automa8e can add value to your business.