In an era where time is money, efficient financial management is critical to business success. For organizations, handling complex financial workflows such as bill uploads, data extraction, approvals, and payments can be resource-intensive and prone to errors. To streamline these processes, Automa8e has teamed up with Aspire Bank to offer a seamless integration that simplifies financial operations from end to end.

This article explores this integration’s unique features and benefits, the modules involved, step-by-step guidance for setting it up, and its advantages across business functions. If you’re looking to streamline financial workflows and enhance productivity, the Aspire Bank and Automa8e integration may be just what your business needs.

Why Choose Aspire Bank Integration with Automa8e?

The integration between Aspire Bank and Automa8e is designed to automate and simplify the way businesses handle financial processes. This partnership enables businesses to streamline activities such as uploading and approving invoices, automating payments, and reconciling bank feeds. Through Automa8e’s cloud-based automation platform and Aspire Bank’s robust financial services, businesses gain a unified solution to manage accounting, data extraction, and payments efficiently.

Key benefits of the Aspire Bank integration with Automa8e include:

- Increased Efficiency: Streamline operations with tools for document upload, data extraction, and payment management all in one place.

- Enhanced Accuracy: Minimize human errors with AI-powered data extraction that ensures the correct information is captured and processed.

- Faster Approvals and Payments: With centralized workflows, finance teams can review, approve, and process payments quicker than ever.

- Data Security and Compliance: Aspire Bank and Automa8e are committed to safeguarding data with secure transactions and compliance measures, helping organizations stay compliant with financial regulations.

Key Modules in the Automa8e-Aspire Bank Integration

To maximize efficiency, Automa8e’s platform offers three key modules, each addressing a specific area of financial workflow:

- Automa8e for Accounting: This module centralizes financial tasks, enabling users to manage everything from invoice uploads to payment approvals in one interface.

- Documa8e for AI-Powered Data Extraction: Documa8e simplifies data extraction by leveraging AI to capture and organize key details from invoices, reducing manual entry and lowering error rates.

- Opera8e for Payments and Collections: Opera8e enables users to execute payments smoothly, helping finance teams manage payments, collections, and reconciliation with minimal friction.

These modules enable the Upload – Approve – Pay workflow, making it easy to manage everything from document upload to final payment processing.

Step-by-Step Guide: Setting Up Aspire Bank with Automa8e

Integrating Aspire Bank with Automa8e is simple, with a few specific steps that ensure a smooth setup. Below is a step-by-step guide to getting your Aspire Bank account linked with Automa8e.

Step 1: Set Up Aspire Bank in Automa8e

Access Automa8e Banking Section:

- Begin by logging into Automa8e. In the main dashboard, go to Banking and select Payment Integration.

Sign Up for Aspire Bank:

- In the Payment Integration section, click Sign Up next to Aspire Bank. Follow the instructions to create your Aspire account. Once registered, log in with your credentials.

- Enter the OTP (One-Time Password) sent to your registered mobile or email, and authenticate.

Generate an API Key in Aspire:

- After logging in, navigate to Settings → Aspire API.

- Select New API Key, provide a name for the API key, and enable all available features.

- Enter the OTP to verify, and then copy the generated API key.

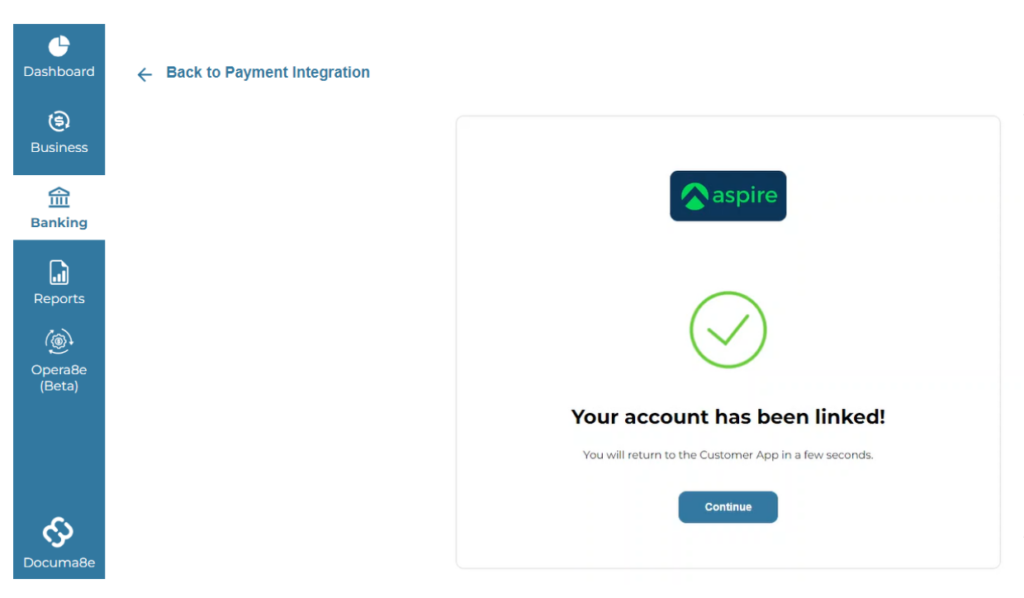

Step 2: Link Aspire Bank to Automa8e

Connect with Aspire Bank:

- Return to Automa8e, where you left off in the Payment Integration section, and select Link under Aspire Bank.

- Allow access when prompted, then paste your previously copied API key.

Enter the Client ID:

- After allowing access, enter your Aspire Client ID and select the Account Number associated with Aspire Bank.

- Confirm by clicking Continue. Your Aspire Bank account is now successfully linked to Automa8e.

Managing Bills with Documa8e and Automa8e: Upload and Approve

Once your Aspire Bank account is connected to Automa8e, you can begin uploading and managing bills. Documa8e and Automa8e streamline this process, ensuring smooth approvals and fast data extraction.

1. Data Extraction and Approval

- Upload Documents:

- In Documa8e, click on Upload Documents, then select Purchase Bill.

- Choose the document file to be uploaded. Once uploaded, click the three dots next to the document and select View Details.

- Approve and Sync to Automa8e:

- Click Approve to authorize the document for processing. After approval, select Sync to Automa8e to transfer the data to Automa8e’s accounting module.

2. Reviewing and Approving in Automa8e

- Approval in Automa8e:

- In Automa8e, go to Approval to review the document synced from Documa8e. Click Check Bill to verify the details, then confirm by clicking Approve Bill.

By reducing the need for repetitive manual entry, Documa8e and Automa8e help finance teams focus on strategic tasks rather than routine paperwork.

Processing Payments in Automa8e Using Opera8e

After uploading and approving your bills, you’re ready to make payments. Automa8e’s Opera8e module ensures that payment processing is efficient and hassle-free.

1. Initiate Payment

- Go to Opera8e:

- Within Automa8e, select Opera8e → Pending Payment. Locate the approved bill, click on the three dots next to it, then select Pay Now.

- Add Remarks and Proceed:

- Optionally, add remarks to provide context for the payment, then click Proceed to Payment.

- Confirm the transaction by selecting Pay Now. The payment is processed securely and instantly through Aspire Bank.

Bank Feed Reconciliation for Accounting Accuracy

The final step in maintaining streamlined financial workflows is reconciling bank feeds. This ensures that all transactions match up, eliminating discrepancies and maintaining accurate records.

1. Sync Bank Feed Data

- Access Reconciliation in Automa8e:

- In Automa8e, go to Banking – For Accountants. Click on the three dots next to your linked Aspire Bank account and select View Details.

- Sync and Link Transactions:

- Choose Sync Data, specify the date range, and sync transactions to retrieve Aspire Bank feeds.

- Select Linked Account Feed to connect transactions with Aspire Bank, ensuring a complete and accurate financial record.

This reconciliation process not only keeps financial records accurate but also prepares businesses for audits with organized and up-to-date financial data.

Why Businesses Should Consider the Aspire Bank and Automa8e Integration

In addition to operational advantages, the Aspire Bank and Automa8e integration offers key marketing benefits that can enhance brand reputation, customer trust, and employee satisfaction:

- Increased Productivity and Reduced Costs: With efficient financial workflows, businesses can reduce the time and costs associated with manual processes, allowing teams to focus on higher-value tasks.

- Stronger Financial Management: Centralized financial data gives finance teams the visibility they need to make informed decisions and monitor cash flow effectively.

- Compliance and Data Security: With Aspire Bank’s secure protocols and Automa8e’s privacy measures, businesses can be assured that their financial data remains confidential and compliant with industry standards.

- Enhanced Customer and Vendor Relationships: Timely payments and efficient approval workflows help maintain strong relationships with vendors and customers, boosting loyalty and reliability.

Aspire Bank and Automa8e Integration FAQ

The integration simplifies financial workflows, enabling businesses to manage invoices, payments, and reconciliation in one unified platform.

Yes, Chrome is recommended to ensure compatibility and the best user experience when accessing Automa8e’s functionalities.

The integration is highly secure, using encrypted connections and robust data protection measures, making it compliant with regulatory standards.

Yes, modules like Documa8e for data extraction or Opera8e for payments can be used independently, depending on your specific requirements.

API keys can be generated as needed, but it’s recommended to limit access to active users for enhanced security.

Data can be synced on demand, with flexible options to specify date ranges and ensure that your financial records are always accurate.

Empower Your Financial Workflows with Aspire Bank and Automa8e Integration

The integration between Aspire Bank and Automa8e is a game-changer for businesses aiming to optimize their financial workflows. This solution empowers finance teams to work smarter, not harder, by leveraging AI-powered data extraction, secure payment processing, and centralized financial management. With Automa8e’s modules—Documa8e for automated data handling, Opera8e for seamless payments, and Automa8e’s core accounting tools—businesses can streamline their end-to-end financial processes, reduce manual errors and gain real-time visibility into their finances.

Ready to transform your financial management and boost operational efficiency? Get started with Aspire Bank and Automa8e integration today to unlock the full potential of automated, accurate, and agile financial workflows.