Automa8e is an advanced, AI-driven platform reshaping how companies handle financial management, providing solutions that increase efficiency, accuracy, and productivity. In today’s business landscape, manual accounting processes are not only time-consuming but also prone to errors that impact the financial health of an organization. This blog delves into how Automa8e addresses common industry challenges, offers a revolutionary solution, and provides significant value for business owners, accountants, and finance teams.

In this blog, we’ll explore:

- Identify Industry Pain Points and Challenges

- Current Practices and Methods

- Automa8e: The Next-Generation Solution to Modern Accounting Challenges

- Features of Automa8e

- Why Automa8e? The Unique Value for Businesses

- Conclusion

Identify Industry Pain Points and Challenges

Financial management, especially in small to medium-sized businesses, faces numerous challenges that can hinder growth and operational efficiency:

- Data Entry Errors and Time-Consuming Processes: Most accounting tasks, such as transaction categorization, reconciliations, and financial reporting, are manually completed, leading to frequent errors. An industry report shows that 82% of accounting professionals believe automation can significantly reduce these errors.

- Cash Flow Delays: For businesses with limited cash flow, late payments and inefficient collections processes are among the most significant obstacles. Research indicates that over 65% of small businesses experience cash flow problems, with delayed receivables as a significant cause.

- Compliance and Reporting Gaps: Compliance with constantly changing financial regulations requires consistent updates, clear records, and accurate reporting. Inadequate reporting can lead to regulatory penalties and loss of investor confidence.

These are just a few challenges organizations face. Still, they underscore the need for a modernized, AI-enabled financial management solution that automates routine tasks, streamlines processes and provides real-time insights.

Current Practices and Methods

While accounting software has evolved over the years, many traditional practices persist in finance departments:

- Manual Bookkeeping and Data Entry: Traditional bookkeeping methods, such as using spreadsheets or basic accounting software, are still common but come with high error rates and lack scalability.

- Paper-Based Accounts Receivable and Payable Management: Many businesses still rely on paper-based or limited digital methods for managing invoicing and payments. This delays processing and increases the risk of misplaced documentation and inefficiency in collection efforts.

- Manual Bank Reconciliations: Bank reconciliation requires finance teams to match each bank transaction with internal records manually. This process is labour-intensive and often results in discrepancies.

- Outdated Reporting: Financial reporting practices often involve manual data gathering, leading to delayed insights and potential errors, making it difficult to react quickly to financial changes.

These outdated methods are slow, prone to inaccuracies, and unable to keep up with the demands of a fast-paced business environment. A solution like Automa8e, which automates these processes, is essential for maintaining accuracy, efficiency, and scalability.

Automa8e: The Next-Generation Solution to Modern Accounting Challenges

Automa8e is a comprehensive AI-powered platform tailored to address these challenges in financial management. It is designed to automate up to 85% of tasks traditionally done manually. Each module within Automa8e addresses specific pain points with innovative solutions.

1. Accounting & Bookkeeping

- Automated Entry & Classification: Automa8e automates data entry and transaction classification, significantly reducing manual input and the risk of errors. With AI-driven categorization, all records are accurate, organized, and instantly available.

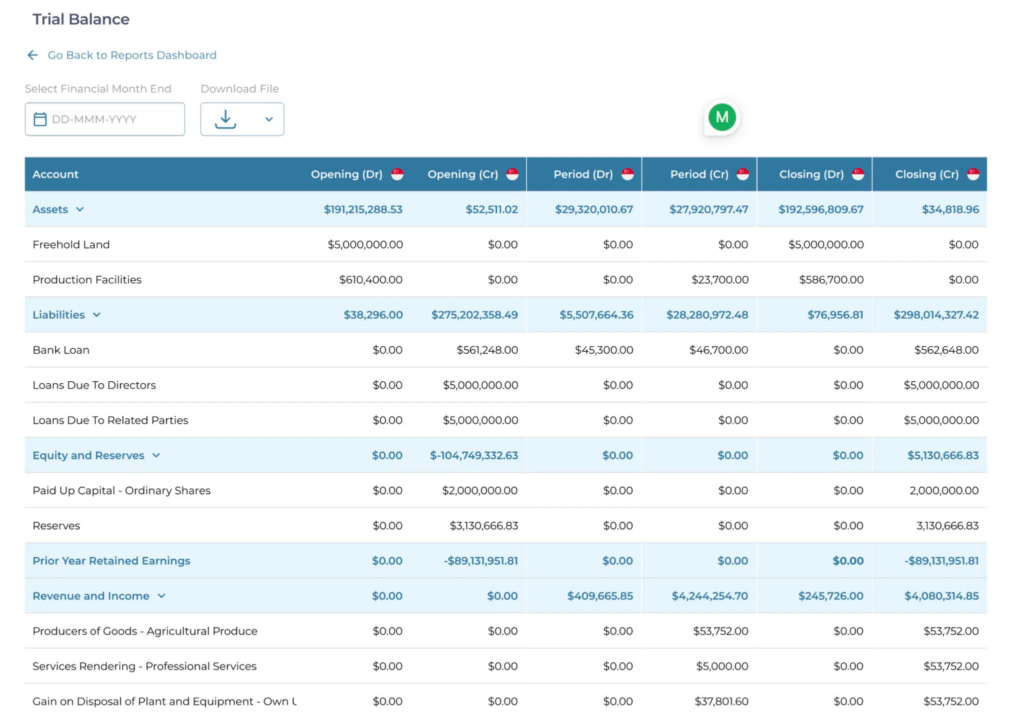

- End-to-End Visibility: The platform gives finance teams complete control over financial records, ensuring every transaction is recorded in real time. This level of visibility allows for quick audits, seamless month-end closing, and easy access to comprehensive financial reports.

- Customized Reports & Compliance: Automa8e generates tailored reports that adhere to international accounting standards and can be customized for different departments or stakeholders. With built-in compliance support, It helps organizations effortlessly maintain regulatory standards.

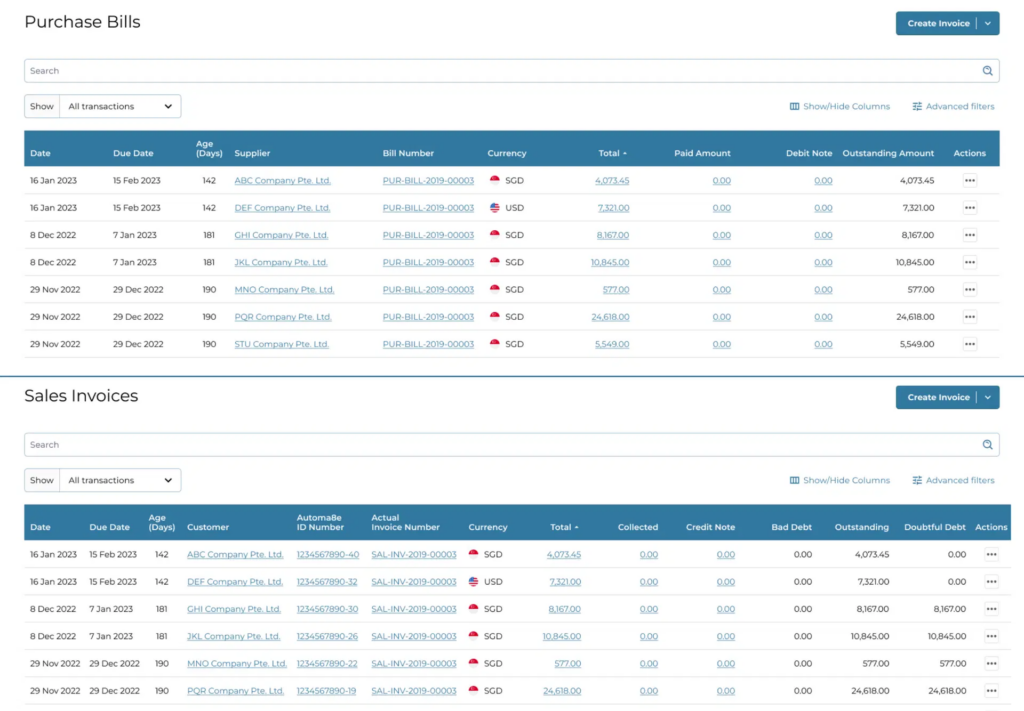

2. Invoices and Purchase Bills

- Quick Invoice Generation: Automa8e provides tools for creating, sending, and tracking invoices in just a few clicks. Businesses can customise templates, set recurring invoices, and send them directly to clients, improving payment timelines.

- Real-Time Tracking & Alerts: Track real-time invoice statuses and receive automated alerts for overdue accounts. This keeps cash flow steady by reducing payment delays.

- Purchase Bill Management: Automa8e makes organising and reconciling purchase bills easy, linking expenses directly to projects or cost centres. This clarity simplifies budget management and cost analysis.

3. Accounts Receivable and Collection Management

- Automated Collections Workflow: Managing outstanding invoices is streamlined through automated workflows. Automa8e sends reminders and escalations for overdue payments, saving time on follow-ups and reducing overdue accounts.

- Customizable Payment Terms: Set and enforce specific payment terms for different clients, helping to keep your accounts receivable in check and ensuring predictable cash flow.

- Centralized Receivables Dashboard: Track and monitor all outstanding invoices from a single dashboard, offering real-time insights into expected cash inflows, ageing receivables, and collection efficiency.

4. Accounts Payable and Payment Management

- Efficient Vendor Payments: Automa8e enables you to streamline accounts payable by scheduling vendor payments and automating bill payments, improving vendor relationships through timely payments and avoiding penalties.

- Dynamic Payment Scheduling: Customize payment schedules based on cash flow forecasts, allowing finance teams to manage outgoing payments strategically.

- Accounts Payable Dashboard: Get a complete view of payables, including due dates, pending payments, and vendor histories, all in one place, improving budget control and payment management.

5. Accruals and Deferments Calendar

- Automated Accruals & Deferrals: Track future revenues and expenses seamlessly, improving the accuracy of financial forecasts and year-end accruals.

- Customizable Calendar View: Use an intuitive calendar layout to view and manage anticipated financial obligations and revenues, making long-term planning more effective and aligned with business goals.

- Enhanced Compliance: Automa8e’s calendar ensures that all accruals and deferments meet accounting standards, providing a compliant revenue and expense recognition approach.

6. Provision for Doubtful Debt and Bad Debt Write-offs

- Risk-Based Collection Strategies: Automa8e identifies accounts at risk of default, categorizes them by risk level, and applies risk-based collection strategies to minimize potential write-offs.

- Automated Bad Debt Accounting: Write-offs are automated, ensuring accurate financial loss recording and realistic financial insights.

- Regular Review & Reporting: Finance teams can review doubtful debt provisions regularly with Automa8e’s analytics, enabling proactive debt management.

7. Bulk Classification of Bank Transactions

- Time-Saving Transaction Categorization: Automa8e enables bulk classification of bank transactions, allowing large volumes of data to be categorized efficiently and accurately.

- Custom Rules for Classification: Set rules based on transaction types or vendors, which Automa8e can automatically apply, increasing classification speed and accuracy.

- Reduced Manual Effort: This feature drastically reduces the time spent on data categorization, freeing up resources for more strategic tasks.

8. Bank Reconciliations

- Automated Matching Process: Automa8e matches bank statements with transactions, ensuring alignment between bank records and financial accounts.

- Real-Time Reconciliation: Real-time updates give finance teams instant clarity on discrepancies, enabling quicker resolution and increased accuracy.

- Improved Accuracy: The automation of reconciliation reduces human errors, ensuring that cash balances are accurate and reliable.

9. Bank Payment Integration

- Direct Payments from Automa8e: Initiate payments directly from the Automa8e interface, saving time and ensuring secure transactions.

- Multiple Bank Integrations: Automa8e integrates with multiple banks, enabling seamless transaction initiation and tracking.

- Security & Compliance: Automa8e’s integration meets regulatory security standards, ensuring data protection and transaction integrity.

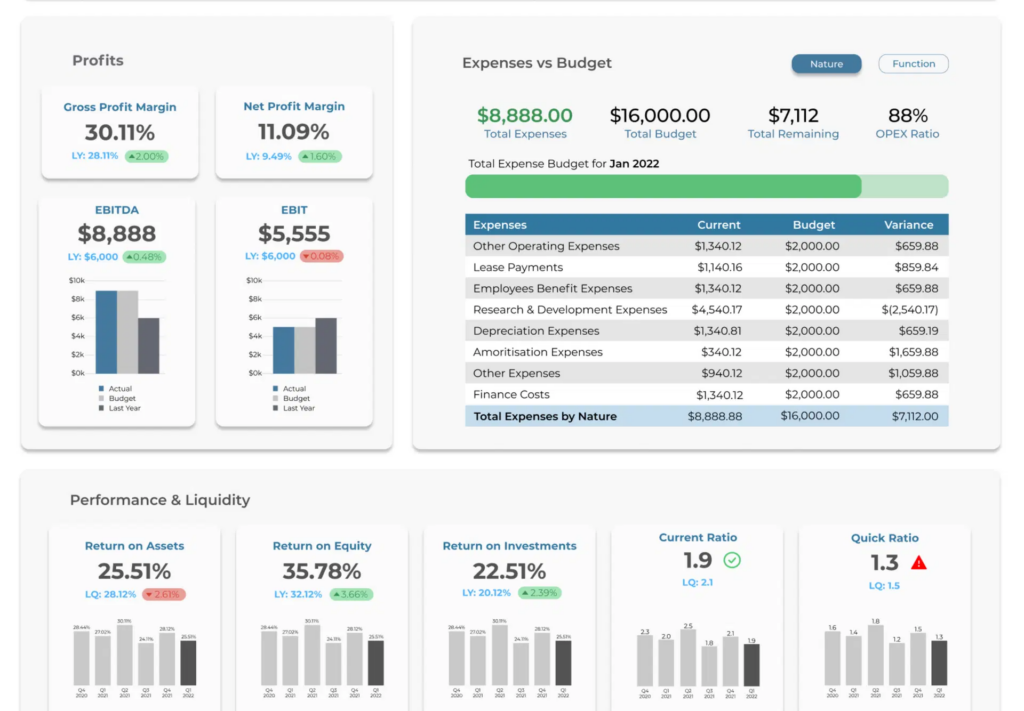

10. Dashboard with Sales Analytics

- Advanced Sales Filtering: View sales data filtered by period, client, or product, making it easy to analyze sales trends and key performance indicators (KPIs).

- Data Visualization: Real-time charts and graphs provide a clear picture of sales performance, aiding in decision-making.

11. Multi-Currency Support

- Multi-Currency Invoicing & Billing: Create invoices and process bills in multiple currencies, ensuring smooth international transactions.

- Automatic Currency Conversion: Automa8e handles currency revaluations automatically, adjusting values to the latest rates for accurate financial reporting.

- Global Compliance: Ensure international transactions comply with local regulations, simplifying audits and reporting for global operations.

12. Payment Gateway Integration

- Seamless Customer Payments: We accept and process payments through various payment gateways, simplifying transactions for customers and improving cash flow.

- Multiple Payment Options: Offer multiple payment methods, including credit cards and digital wallets, making it easier for clients to settle invoices.

- Real-Time Payment Tracking: Monitor payment status in real-time, enabling timely follow-ups and improving overall collection efficiency.

13. Peppol Ready E-Invoicing

- Compliant E-Invoicing: Automa8e’s Peppol-ready e-invoicing ensures invoices comply with international e-invoicing standards, such as InvoiceNow.

- Fast & Error-Free Processing: Invoices are sent directly to clients’ accounting systems, minimizing manual entry errors and shortening payment cycles.

- Reduced Processing Time: E-invoicing streamlines payment processing, accelerating payment timelines and supporting quicker cash flow realization.

14. Assets Management

- Comprehensive Asset Tracking: Manage property, plant, and equipment (PPE) across their lifecycle, from acquisition to depreciation and disposal.

- Improved Asset Utilization: Automa8e’s tools for tracking asset performance allow businesses to optimize usage, reduce maintenance costs, and enhance profitability.

- Automated Depreciation Calculation: Depreciation schedules are automated, ensuring compliance and accuracy in financial reporting.

15. PPE Assets – Acquisition and Depreciation

- Lifecycle Management: Track every stage of PPE assets, from acquisition to routine depreciation, helping ensure that assets are appropriately valued on the balance sheet.

- Automated Depreciation Schedules: Automa8e automates depreciation calculations, making compliance with GAAP or IFRS simple and reliable.

- Asset Insights: Gain insights into asset performance, helping finance teams make data-driven asset use and replacement decisions.

16. PPE Assets – Impairment and Disposals

- Simplified Impairment Testing: Automatically calculate and record impairment losses, ensuring that asset valuations are current and reflective of their actual value.

- Seamless Disposal Process: Manage asset disposals easily, ensuring that financial records are updated in real-time to reflect disposals.

- Compliance with Accounting Standards: Automa8e’s impairment and disposal features align with international accounting standards, simplifying audits and financial reporting.

17. Intangible Assets – Acquisition, Amortization, and Disposals

- Efficient Tracking of Intangible Assets: Manage acquisitions, track amortization, and handle disposals of intangible assets like patents and trademarks.

- Automated Amortization: Automa8e calculates amortization on a schedule, ensuring that expenses are recorded accurately.

- Visibility into Intangible Assets: Provides a clear view of intangibles’ value and remaining useful life, supporting better planning and reporting.

18. Investment Management

- Complete Investment Tracking: Automa8e manages various types of investments, such as properties, shares, and bonds, offering visibility into acquisition costs, valuations, and disposals.

- Real-Time Valuations: Investments are updated with current valuations, helping finance teams manage portfolios and make informed decisions.

- Performance Reporting: Generate detailed reports on investment performance, enabling better financial planning and strategy.

19. Funding Management

- Comprehensive Funding Oversight: Automa8e centralizes funding management, covering bank loans, finance leases, and right-of-use (ROU) leases, ensuring all financial obligations are tracked and managed in one place.

- Loan and Lease Tracking: It tracks loan schedules, repayments, interest accrual, and lease obligations with automatic updates, making it easy to stay on top of payment schedules and terms.

- Loan Payables and Receivables: Automa8e efficiently handles both loan payables and receivables, allowing finance teams to assess the complete impact of financing on cash flow, budgeting, and planning.

- Transparent Financial Obligations: Through a unified view, Automa8e ensures every loan, lease, and funding source is accurately reflected in financial records, helping companies manage obligations and stay prepared for audits.

20. Equity Management

- Easy Shareholder Tracking: Automa8e facilitates seamless equity management, covering share allotments, buybacks, treasury shares, and reductions to reflect changes in ownership accurately.

- Automated Equity Changes: As shares are issued, reduced, or repurchased, Automa8e updates records, providing real-time equity management and improving accuracy for financial planning.

- Treasury Shares and Equity Reductions: Finance teams can manage treasury shares, adjustments in ownership, and share reductions with precision, ensuring compliance and transparency.

- Enhanced Reporting for Stakeholders: Equity management reports offer insights into ownership and capital structure, supporting strategic decisions and maintaining investor relations.

Why Automa8e? The Unique Value for Businesses

Every feature within Automa8e works cohesively to automate complex accounting tasks and offer real-time financial visibility. This complete suite allows managing everything from daily transactions to high-level strategic financial tasks within one powerful platform. Adopting Automa8e helps businesses streamline operations, boost compliance, and stay proactive in financial management, paving the way for scalable growth and operational efficiency.

Simplify Your Financial Management with Automa8e

Automa8e is a powerful AI-driven accounting software that brings automation, accuracy, and clarity to financial management. By reducing manual tasks, offering real-time insights, and ensuring compliance across diverse financial functions, Automa8e allows businesses to focus on growth instead of day-to-day financial bottlenecks. Every feature is designed with modern businesses in mind, from automated invoicing to comprehensive asset tracking.

Ready to transform your accounting processes? Try Automa8e today with a free trial, or request a demo to see how it can simplify your financial operations. Take the next step toward streamlined, efficient financial management!