In today’s fast-paced business environment, financial data is no longer a static entity reviewed at the end of a quarter or fiscal year. The demand for real-time financial reporting is rapidly increasing, allowing businesses to make proactive decisions, improve financial planning, and maintain compliance effortlessly.

Financial leaders, CFOs, and business owners need instant access to critical financial data to maintain agility and efficiency. Whether managing cash flow, ensuring compliance, or making strategic investment decisions, having accurate and up-to-date financial insights is crucial. This blog explores the importance of real-time financial reporting, how it transforms financial management, and how automation-driven accounting software like Automa8e enables businesses to streamline financial processes effortlessly.

In this blog, we’ll explore:

- Real-Time Financial Reporting

- What is Real-Time Financial Reporting?

- Why is Real-Time Financial Reporting Essential for Businesses?

- How to Implement Real-Time Financial Reporting?

- Why Choose Automa8e for Real-Time Financial Reporting?

What is Real-Time Financial Reporting?

Real-time financial reporting refers to the ability to access, analyze, and interpret financial data instantaneously. Unlike traditional reporting, which often involves delays due to manual data entry, reconciliations, and consolidations, real-time reporting leverages automation and cloud technology to provide up-to-date financial insights.

This capability enables businesses to respond to financial changes as they happen, improving decision-making and reducing risks associated with outdated financial data.

Key Features of Real-Time Financial Reporting:

- Instant Data Updates: Live financial metrics eliminate waiting periods and outdated reports.

- Automated Reporting: Reduces manual errors and improves efficiency.

- Customizable Dashboards: Helps businesses tailor financial views based on specific KPIs.

- Integration with Accounting & Banking Systems: Ensures seamless financial data synchronization.

- Multi-Currency & Tax Compliance Support: Simplifies financial management across multiple jurisdictions.

- Predictive Analytics: Uses AI-driven insights to forecast trends and detect anomalies.

Why is Real-Time Financial Reporting Essential for Businesses?

1. Faster Decision-Making

In a competitive business landscape, waiting until the end of the quarter for financial reports is no longer practical. Instant access to financial data allows decision-makers to respond to changes quickly—whether adjusting budgets, reallocating resources, or identifying profit leaks. Businesses leveraging real-time reporting solutions like Automa8e gain a significant advantage in making data-driven decisions promptly.

2. Improved Financial Accuracy

Errors in traditional financial reporting can lead to misinterpretation of business performance. Automation-powered financial reporting tools ensure accuracy by eliminating manual data entry mistakes, reconciling data from various sources, and providing consistent reports.

Example: If a business tracks its revenue and expenses manually, errors in recording transactions can lead to incorrect profit margins. However, with Automa8e AI-powered automation, financial data is recorded and updated in real time, ensuring precise reporting.

3. Enhanced Cash Flow Management

Real-time reporting helps businesses monitor their cash flow in real time, allowing them to:

- Identify cash shortages before they become a problem.

- Ensure timely invoice payments.

- Optimize spending based on real-time data.

- Predict future cash flows based on current transactions.

Automa8e offers real-time cash flow tracking, integrating with banking and payment systems to provide accurate financial insights.

4. Regulatory Compliance & Transparency

Governments and tax authorities worldwide are enforcing stricter regulations on financial reporting. Real-time reporting ensures businesses stay compliant by providing:

- Accurate audit trails for tax submissions.

- Up-to-date financial statements that align with regulatory requirements.

- Error-free tax calculations and compliance tracking.

With Automa8e’s tax compliance automation, businesses can generate tax-ready reports, ensuring hassle-free audits and submissions.

5. Better Financial Forecasting & Budgeting

Access to real-time financial insights allows businesses to identify trends, predict financial outcomes, and adjust budgets dynamically rather than working with outdated projections. AI-powered analytics in Automa8e can provide financial trend predictions, helping businesses plan effectively for growth.

How to Implement Real-Time Financial Reporting?

1. Automate Financial Processes

Adopting cloud-based accounting solutions like Automa8e helps businesses automate repetitive tasks such as:

- Bank reconciliations

- Invoice generation

- Tax calculations

- Expense tracking

- Financial reporting

With built-in AI capabilities, Automa8e ensures data accuracy and provides instant access to financial insights.

2. Integrate Financial Data Sources

To ensure a single source of truth, businesses should integrate their accounting software with bank feeds, payroll systems, CRM, and ERP platforms for seamless financial management. Automa8e supports real-time integrations, allowing businesses to manage financial data effortlessly.

3. Use AI-Powered Analytics

Modern financial reporting tools, like those within Automa8e, leverage artificial intelligence (AI) and machine learning (ML) to:

- Identify patterns and trends in financial data.

- Detect anomalies and prevent fraud.

- Provide real-time financial insights for strategic planning.

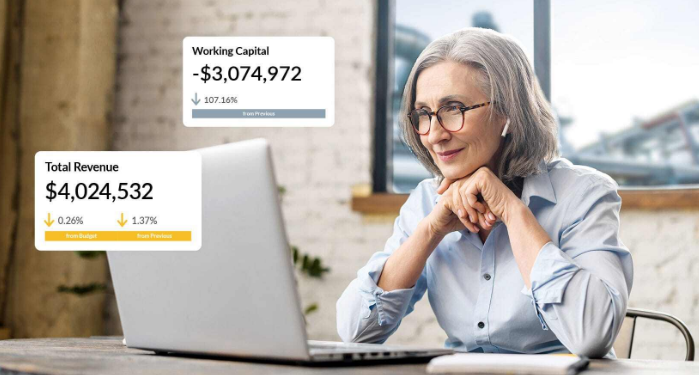

4. Set Up Customizable Dashboards

Real-time dashboards help CFOs and business owners track key financial indicators (KPIs) such as revenue, expenses, profit margins, and accounts receivables at a glance. Automa8e user-friendly dashboards allow businesses to customize financial reports based on their needs.

5. Ensure Data Security & Compliance

With real-time financial reporting, data security is paramount. Cloud-based platforms like Automa8e use encrypted servers and compliance-focused features to protect sensitive financial information and meet regulatory requirements.

Why Choose Automa8e for Real-Time Financial Reporting?

Automa8e is a next-generation accounting software designed to help businesses automate financial management, generate real-time reports, and optimize decision-making. Here’s how Automa8e stands out:

✅ AI-Powered Automation: Reduces manual effort and ensures accurate data processing.

✅ Customizable Financial Reports: Create tailored reports for audits, tax submissions, and financial analysis.

✅ Seamless Bank Integration: Syncs transactions in real time, eliminating reconciliation delays.

✅ Multi-Currency & Tax Compliance: Handles tax calculations, compliance, and currency conversions effortlessly.

✅ User-Friendly Dashboard: Provides clear financial insights to help businesses stay ahead of their financial goals.

With Automa8e, businesses can move beyond traditional reporting and embrace automation for smarter financial decision-making. Learn more about how Automa8e simplifies real-time financial reporting.

FAQs About Real-Time Financial Reporting

Real-time financial reporting refers to the continuous collection, analysis, and presentation of financial data, allowing businesses to access up-to-date financial insights instantly.

Key features include automated data collection, real-time analytics, AI-powered insights, customizable dashboards, multi-source data integration, and compliance tracking.

It enables faster decision-making, improves financial accuracy, enhances cash flow management, ensures regulatory compliance, and supports better financial forecasting.

With instant access to financial data, businesses can analyze trends, track performance, and make informed strategic decisions without delays.

It provides real-time visibility into cash inflows and outflows, helping businesses optimize spending, manage expenses, and ensure liquidity.

Automation eliminates manual data entry, reduces errors, speeds up financial processes, and ensures up-to-date reports with minimal human intervention.

Businesses can implement it by automating financial processes, integrating data sources, leveraging AI analytics, setting up dashboards, and ensuring compliance.

Challenges include data integration complexities, security concerns, the need for advanced analytics tools, and ensuring compliance with financial regulations.

Automa8e offers AI-driven financial automation, seamless data integration, secure processing, and customizable dashboards to enhance financial reporting efficiency.

Real-time financial reporting is no longer a luxury but a necessity for businesses aiming to stay competitive. By automating financial processes, integrating real-time data, and leveraging AI-driven analytics, companies can enhance financial visibility, improve cash flow management, and maintain compliance effortlessly.

Accounting solutions Automa8e empower businesses to take control of their finances with real-time insights and automation-driven efficiency. Start optimizing your financial reporting today and make data-backed decisions with confidence!

Leave a Reply

You must be logged in to post a comment.