Bookkeeping is the backbone of financial management, ensuring accuracy, compliance, and financial health for any business. However, common bookkeeping mistakes can lead to cash flow problems, tax issues, and poor decision-making. Fortunately, automation tools Automa8e can help eliminate these challenges, ensuring a seamless and error-free bookkeeping process.

In this blog, we’ll discuss the most frequent bookkeeping mistakes, their impact on businesses, and how you can avoid them using best practices and automation.

In this blog, we’ll explore:

- Ignoring Regular Bookkeeping Updates

- Poor Invoice and Payment Management

- Misclassifying Expenses

- Failing to Reconcile Accounts

- Overlooking Tax Compliance

- Lack of Backup and Data Security

- Not Leveraging Automation

Not Keeping Business and Personal Finances Separate

One of the most common mistakes small business owners make is mixing personal and business finances. This can lead to inaccurate financial records, tax complications, and difficulty tracking expenses. Blurring these lines also makes it harder to assess the actual profitability of the business.

How to Avoid It:

- Open a dedicated business bank account and credit card.

- Use accounting software Automa8e to track all business-related transactions automatically and categorize them correctly.

- Set clear policies for expense reimbursements to maintain financial transparency.

- Maintain detailed records of each business transaction to prevent errors and misclassifications.

Ignoring Regular Bookkeeping Updates

Waiting until tax season or the end of the financial year to update books can result in missing transactions, reconciliation issues, and cash flow mismanagement. Irregular bookkeeping also makes it difficult to track profits, losses, and upcoming liabilities, which can affect decision-making.

How to Avoid It:

- Set a routine for updating records weekly or bi-weekly.

- Leverage AI-powered automation tools Automa8e to sync bank transactions, categorize expenses, and generate real-time financial reports.

- Assign bookkeeping tasks to a professional or delegate them to an automated system to ensure consistency.

- Utilize dashboards and alerts to keep track of outstanding transactions and pending reconciliations.

Poor Invoice and Payment Management

Delayed invoicing and payment follow-ups can cause cash flow problems and financial instability. Unpaid invoices can accumulate, leading to liquidity issues that disrupt operations and growth.

How to Avoid It:

- Automate invoice generation and email reminders using Automa8e to ensure timely payments.

- Set up recurring invoices for clients with long-term contracts to avoid manual follow-ups.

- Ensure accurate invoice details, including payment terms, due dates, and client information, to prevent disputes and payment delays.

- Monitor outstanding invoices and follow up consistently to minimize late payments.

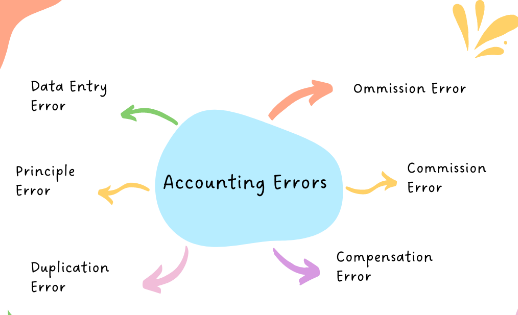

Misclassifying Expenses

Incorrectly categorizing expenses can lead to misreported financial statements, inaccurate tax deductions, and potential compliance issues.

How to Avoid It:

- Use AI-powered categorization features in Automa8e to automatically assign the right category to each transaction.

- Regularly review financial reports to spot inconsistencies and correct any misclassified transactions.

- Train staff on proper expense classification to avoid errors and maintain financial accuracy.

- Establish a standardized expense categorization system to streamline financial reporting and tax filing.

Failing to Reconcile Accounts

Neglecting bank reconciliation can cause discrepancies, making it difficult to detect errors, fraudulent transactions, or unauthorized withdrawals. Without reconciliation, businesses may also overlook duplicate transactions and missing deposits.

How to Avoid It:

- Automate reconciliation with Automa8e, which matches transactions against bank statements in real-time.

- Perform reconciliations at least once a month to ensure financial accuracy and detect discrepancies early.

- Keep track of outstanding checks and deposits to maintain up-to-date financial records.

- Utilize alerts and notifications for any mismatched transactions that require attention.

Overlooking Tax Compliance

Late or incorrect tax filings can result in penalties, audits, and legal consequences. Businesses that fail to keep accurate tax records may also miss out on potential deductions and exemptions.

How to Avoid It:

- Use Automa8e’s tax management features to automate GST calculations, generate tax reports, and ensure timely filings.

- Stay updated on tax deadlines, regulatory changes, and tax-saving opportunities.

- Consult with a tax expert to validate compliance and optimize tax obligations.

- Maintain digital records of tax filings, invoices, and receipts to support tax audits and regulatory checks.

Lack of Backup and Data Security

Losing financial data due to hardware failure, cyberattacks, or accidental deletion can be devastating for a business. Data breaches can also expose sensitive financial information, leading to compliance risks and financial loss.

How to Avoid It:

- Use cloud-based accounting software Automa8e to store data securely and enable real-time access.

- Enable automated backups and data encryption for financial protection against cyber threats.

- Implement access controls to restrict sensitive financial data to authorized personnel only.

- Regularly conduct security audits to ensure financial data integrity and prevent unauthorized access.

Not Leveraging Automation

Many businesses still rely on manual bookkeeping methods, leading to human errors, inefficiencies, and time-consuming processes. Manual data entry increases the risk of duplicate records, calculation mistakes, and compliance errors.

How to Avoid It:

- Adopt AI-driven automation tools Automa8e to streamline bookkeeping tasks and improve accuracy.

- Utilize smart analytics to gain insights into financial performance, profitability, and forecasting.

- Reduce manual data entry by integrating bank feeds, invoicing, and tax calculations within a single platform.

- Automate financial workflows, including approvals and reporting, to enhance efficiency and compliance.

FAQs

Common bookkeeping mistakes include mixing personal and business finances, missing regular updates, misclassifying expenses, and failing to reconcile accounts.

You can prevent bookkeeping errors by using automation tools like Automa8e, maintaining accurate records, reconciling accounts regularly, and keeping business and personal finances separate.

Automation reduces manual errors, saves time, improves accuracy, and ensures compliance with tax regulations by streamlining bookkeeping tasks.

It’s recommended to reconcile accounts at least once a month to detect discrepancies, prevent fraud, and maintain financial accuracy.

Poor invoice management can lead to cash flow issues, delayed payments, financial instability, and difficulties in tax reporting.

Using AI-powered bookkeeping software like Automa8e can help automate tax calculations, generate reports, and ensure timely tax filings.

Avoiding bookkeeping mistakes is crucial for maintaining financial stability, ensuring regulatory compliance, and making informed business decisions. By implementing best practices and leveraging AI-powered automation tools Automa8e, businesses can eliminate errors, save time, and improve their financial health.

Ready to simplify your bookkeeping? Try Automa8e today and experience seamless financial automation tailored for your business!