Reconciliation is a vital financial process where you ensure your accounting records align with external data, such as bank statements, invoices, and receipts. It helps maintain accurate financial reporting, detect errors, and prevent fraud. Automa8e accounting software revolutionizes reconciliation by offering four versatile methods, enabling businesses to tailor the process to their needs.

In this blog, we’ll explore:

- What Is Reconciliation?

- Why Is Reconciliation Important for Businesses?

- 4 Types of Reconciliation in Automa8e

- Best Practices for Effective Reconciliation in Automa8e

- Common Challenges in Reconciliation and How Automa8e Solves Them

- FAQs About Reconciliation in Automa8e

What Is Reconciliation?

Reconciliation is the process of matching your internal financial records with external statements to ensure accuracy. It involves identifying discrepancies, such as missing transactions, duplicate entries, or errors. Regular reconciliation is critical for:

- Maintaining accurate financial records.

- Ensuring compliance with accounting standards.

- Detecting potential fraud or unauthorized transactions.

- Improving financial decision-making with reliable data.

With Automa8e, reconciliation is no longer a tedious process. Its four methods streamline and automate the task, saving time and ensuring precision.

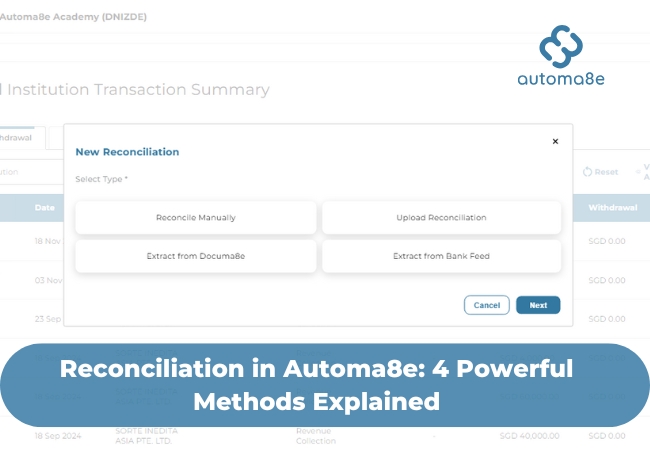

Reconciliation Methods in Automa8e

1. Reconcile Manually

Manual reconciliation provides users with direct control over the process. This method is ideal for businesses with low transaction volumes or for accounts that require a thorough review.

How It Works

- Select “Reconcile Manually” from the reconciliation options.

- Compare transactions in your Automa8e ledger with external records (e.g., bank statements or invoices).

- Mark transactions as reconciled when they match.

- Flag and investigate any discrepancies for correction.

Benefits

- High level of control and attention to detail.

- Suitable for accounts requiring granular oversight, such as payroll or tax-related transactions.

- Ideal for low-volume transaction accounts.

Pro Tip

Use manual reconciliation for sensitive accounts or during financial audits to ensure every detail is reviewed meticulously.

2. Upload Reconciliation

Upload Reconciliation simplifies the process for businesses handling high transaction volumes by automating much of the matching process.

How It Works

- Export external statements (e.g., bank or credit card statements) in supported formats like CSV or Excel.

- Upload the file to Automa8e.

- The system automatically matches the uploaded transactions with records in your ledger.

- Review and resolve any unmatched entries flagged by the system.

Benefits

- Saves time by automating the matching process.

- Reduces human errors associated with manual entry.

- Efficient for high-transaction accounts, such as accounts receivable or payable.

Pro Tip

Standardize file formats for uploads to minimize errors and ensure smooth processing.

3. Extract from Documa8e

Automa8e integrates seamlessly with Documa8e, its document processing feature, which uses advanced OCR (Optical Character Recognition) to extract data from uploaded documents. This method is perfect for reconciling receipts, invoices, and vendor statements.

How It Works

- Upload scanned documents or digital files, such as invoices or receipts, into Documa8e.

- Documa8e extracts relevant details like dates, amounts, and payees.

- The extracted data is matched with your Automa8e ledger.

- Review flagged discrepancies and make adjustments as needed.

Benefits

- Automates data extraction, saving significant time on manual entry.

- Ideal for businesses with extensive invoice or receipt-based transactions.

- Ensures accuracy with high-precision OCR technology.

Pro Tip

Ensure uploaded documents are clear and legible to maximize the accuracy of data extraction.

4. Extract from Bank Feed

Bank Feed integration allows Automa8e to sync directly with your bank accounts, enabling real-time reconciliation. This method is highly efficient for businesses with frequent or ongoing bank transactions.

How It Works

- Connect your bank account to Automa8e using the secure Bank Feed feature.

- The system fetches live transaction data from your bank.

- Automa8e automatically matches these transactions with your ledger.

- Any unmatched entries are flagged for review.

Benefits

- Provides real-time updates for reconciliation.

- Eliminates the need to manually upload bank statements.

- Perfect for cash flow management and monitoring daily transactions.

Pro Tip

Schedule regular synchronization to stay on top of transactions and identify discrepancies promptly.

Best Practices for Effective Reconciliation in Automa8e

- Reconcile Regularly

Avoid letting transactions pile up. Weekly or monthly reconciliation ensures discrepancies are caught early. - Utilize Automation Where Possible

Use Upload Reconciliation, Documa8e, and Bank Feed integration to automate repetitive tasks and save time. - Document Discrepancies

Maintain records of flagged transactions and their resolutions for audit and compliance purposes. - Train Your Team

Ensure your accounting team understands how to use Automa8e’s reconciliation features effectively. - Leverage Dashboards and Reports

Use Automa8e’s real-time reporting tools to monitor reconciliation progress and overall financial health.

Common Challenges in Reconciliation and How Automa8e Solves Them

1. Duplicate Transactions

- Challenge: Duplicate entries in the ledger can cause mismatches.

- Solution: Automa8e flags potential duplicates during reconciliation for quick review.

2. Missing Transactions

- Challenge: Transactions omitted from the ledger create discrepancies.

- Solution: Bank Feed and Documa8e ensure all transactions are accounted for, reducing the chance of omissions.

3. High Transaction Volumes

- Challenge: Manual reconciliation becomes unmanageable with large datasets.

- Solution: Upload Reconciliation and Bank Feed automate matching for high-volume accounts.

FAQs About Reconciliation in Automa8e

Yes, Automa8e allows you to use different reconciliation methods based on your requirements, offering flexibility and convenience.

Absolutely. Automa8e employs advanced encryption and secure connections to protect your financial data at all times.

Automa8e supports widely-used formats such as CSV, Excel, and PDF, ensuring compatibility with most external systems.

Documa8e’s OCR technology is highly accurate, provided the uploaded documents are clear and legible.

Yes, Automa8e supports multi-account reconciliation, making it easier to manage complex financial workflows.

Reconciliation is a fundamental part of financial management, and Automa8e makes it easier, faster, and more accurate. Whether you prefer the control of Manual Reconciliation, the efficiency of Upload Reconciliation, the automation of Documa8e, or the real-time updates from Bank Feed, Automa8e’s versatile features cater to businesses of all sizes and industries.

Start optimizing your reconciliation process today with Automa8e and experience the difference of advanced automation and precision!