Tax management can be a significant pain point for businesses, especially when it comes to managing complex and ever-changing tax regulations. Many businesses in Singapore face challenges such as inaccurate tax calculations, missed deadlines for filing GST and corporate tax returns, and difficulty in ensuring compliance with the Inland Revenue Authority of Singapore (IRAS) regulations.

In this blog, we’ll explore:

- Common issues include in tax Filling

- Current Practices and Methods

- Taxoma8e: Your Automated Tax Compliance Solution

- How Taxoma8e Works: Simplifying Your Tax Management Process

- Take Control of Your Tax Management with Taxoma8e

Common issues include:

- Miscalculations of Goods and Services Tax (GST) on sales and purchases, leading to overpayment or underpayment of taxes.

- Complexity in preparing and submitting the required GST forms (F5, F7, F8) and corporate tax filings (ECI and Form C-S).

- The time-consuming manual process of compiling data for tax returns, which often results in costly mistakes and inefficiencies.

- Risk of penalties due to non-compliance, errors, or missed filing deadlines.

According to a 2023 survey, nearly 40% of businesses reported experiencing challenges in managing their tax obligations, and 25% admitted to incurring fines or penalties due to late or incorrect filings. These issues not only drain valuable resources but also increase the operational burden on business owners.

Current Practices and Methods

Traditionally, businesses use manual methods or basic accounting software to manage their taxes. These methods typically involve tracking GST manually in spreadsheets, preparing tax returns one by one, and submitting them manually to IRAS. The problem is that these processes are slow, prone to human error, and require constant monitoring to stay up to date with changes in tax laws.

Key challenges of traditional tax management methods:

- Manual processes: Businesses spend hours gathering financial data, calculating GST, and preparing corporate tax submissions, leaving room for errors.

- Outdated software: Many businesses rely on outdated systems that don’t integrate well with other financial management tools, making it harder to consolidate data.

- Compliance issues: Keeping up with IRAS requirements is difficult when businesses have to manually track deadlines, updates, and changes in tax codes.

These traditional approaches are not scalable for growing businesses and can lead to costly compliance issues.

Taxoma8e: Your Automated Tax Compliance Solution

Taxoma8e is designed to address these pain points by offering a fully integrated, automated tax management solution that simplifies the tax compliance process for businesses. As part of the Automa8e accounting software suite, Taxoma8e seamlessly integrates tax management into the overall financial operations of your business.

How Taxoma8e Works: Simplifying Your Tax Management Process

1. Tax Settings Configuration

Before automating your tax calculations, Taxoma8e requires some initial configuration:

- GST Registration: Start by entering your GST registration number and configuring the applicable GST rates in the system’s tax settings.

- Tax Codes Setup: Establish tax codes for different types of transactions to ensure accurate tax calculations across your sales and purchases.

2. Automated Tax Calculation

Once your tax settings are in place, Taxoma8e handles the tax calculation automatically:

- GST Calculation: Automatically calculate the GST for all your transactions. This includes GST collected on sales and GST paid on purchases, ensuring accurate real-time tax data.

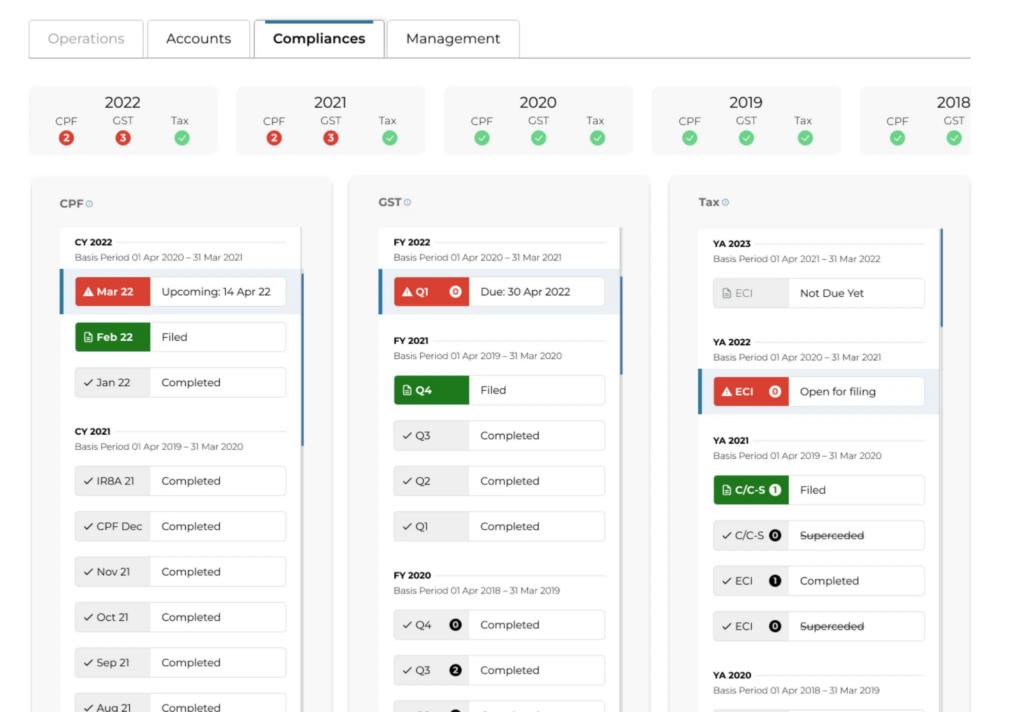

- Corporate Tax Computation: Taxoma8e also computes corporate taxes, managing both Estimated Chargeable Income (ECI) and preparing necessary submissions like Form C-S/C.

3. GST Return Filing

Taxoma8e streamlines the entire GST filing process:

- Prepare GST Form F5: Auto-populate and submit GST Form F5 to IRAS, detailing the GST you’ve collected and paid.

- Prepare GST Form F7: File GST Form F7 to claim refunds on GST paid in cases of excess input tax.

- Prepare GST Form F8: Use Form F8 for voluntary disclosures of errors or omissions in previous GST returns, ensuring compliance and transparency.

4. Corporate Tax Filing

Handling corporate tax returns has never been easier:

- Prepare ECI Form: Compute your Estimated Chargeable Income (ECI) and file it directly with IRAS using Taxoma8e.

- File Form C-S/C: Complete and file Form C-S (a simplified income tax return for small companies) or Form C (standard income tax return) for larger businesses.

5. Data Integration and Syncing

Taxoma8e seamlessly integrates with other Automa8e modules, ensuring that all relevant financial data is synced and incorporated into your tax computations and filings:

- Automatic Data Sync: Keep your financial and tax data consistent across all modules to avoid discrepancies.

6. Reporting and Compliance

Taxoma8e offers powerful reporting and compliance features:

- Tax Summary Reports: Generate detailed reports summarizing GST collected, GST paid, and other tax-related data to give you a comprehensive overview.

- Compliance Monitoring: Stay on top of your compliance obligations by ensuring that all filings align with IRAS regulations and guidelines.

Taxoma8e goes beyond just automation – it helps businesses stay compliant with Singapore’s tax regulations, ensuring peace of mind and a smoother tax management process.

Why Taxoma8e is Essential for Your Business

Using Taxoma8e offers a range of benefits that directly impact your business:

- Efficiency: By automating your tax calculations and filings, you can eliminate time-consuming manual processes. This frees up your team to focus on strategic tasks rather than administrative burdens.

- Accuracy: Taxoma8e’s automated calculations minimize the risk of human error, ensuring that all GST and corporate tax computations are accurate and up-to-date. This reduces the risk of costly mistakes or penalties.

- Compliance: Staying compliant with IRAS regulations is a breeze with Taxoma8e’s built-in monitoring features. It helps you meet all filing deadlines and stay on top of tax code changes, so you never miss a beat.

- Seamless Integration: Taxoma8e integrates smoothly with other Automa8e modules, meaning all your financial data is in one place. No more scrambling to gather data from different sources; everything is synced and ready for filing.

- Security: With data encryption and robust security measures, your sensitive tax data is always protected. Taxoma8e ensures that your financial records are safe from breaches or unauthorized access.

- Detailed Reporting: Taxoma8e generates comprehensive tax summary reports, giving you a clear view of your GST collected, GST paid, corporate taxes, and overall tax position. These reports are essential for audit readiness and better financial decision-making.

Whether you’re managing GST returns, corporate tax filings, or compliance monitoring, Taxoma8e makes tax management easy, efficient, and secure.

Take Control of Your Tax Management with Taxoma8e

Don’t let tax management become a bottleneck for your business. With Taxoma8e, you can automate your tax processes, ensure compliance with IRAS regulations, and focus on what really matters – growing your business.

Ready to transform the way you manage taxes? Start using Taxoma8e today and experience a seamless, efficient, and secure tax management solution.

Contact our team for a free demo or explore our website to learn more about how Taxoma8e can streamline your tax compliance and improve your business operations.

Take the next step towards smarter tax management. With Taxoma8e, tax compliance is no longer a headache but an opportunity for efficiency and growth.