Setting financial goals is crucial for the success of any business, whether it’s a startup or a well-established company. As we move into 2024, the economic landscape continues to evolve, presenting both challenges and opportunities. This guide will help you navigate the process of setting financial goals that are realistic, actionable, and aligned with your overall business strategy.

Why Financial Goals Matter

Financial goals provide direction, motivation, and a clear framework for decision-making. They help businesses:

- Measure Progress: Financial goals serve as benchmarks for evaluating the success of your business.

- Attract Investors: Clear financial targets can make your business more attractive to potential investors and lenders.

- Improve Resource Allocation: With specific goals, you can allocate resources more efficiently and prioritize initiatives that drive growth.

- Mitigate Risks: Anticipating future financial needs and challenges allows you to plan accordingly and avoid potential pitfalls.

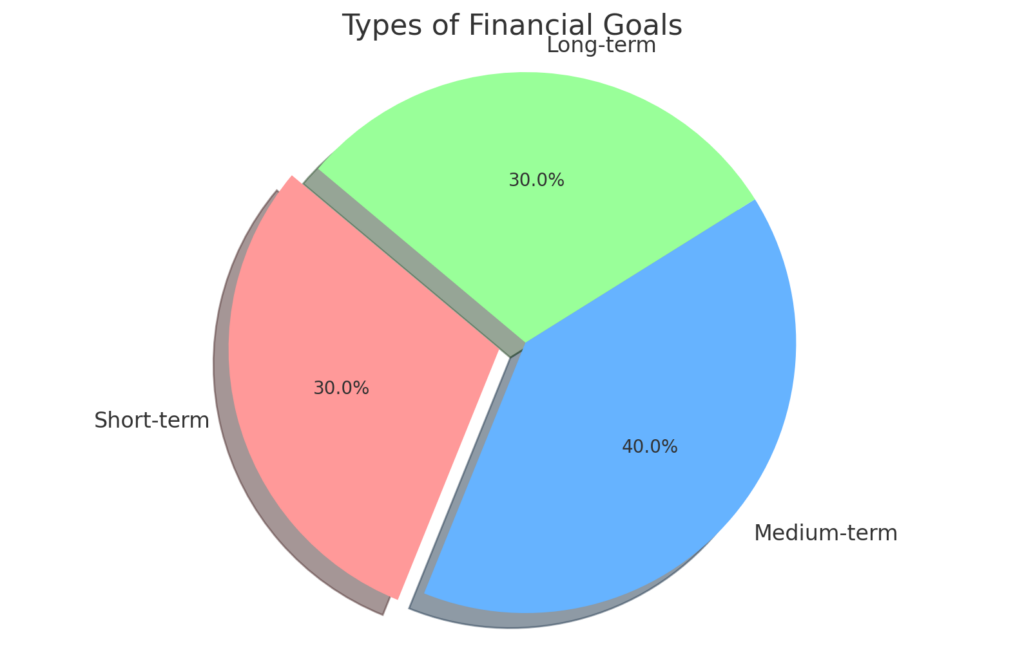

Types of Financial Goals

Short-term Goals (0-1 year)

Short-term goals focus on immediate needs and quick wins. These might include:

- Increasing monthly revenue

- Reducing operational costs

- Improving cash flow management

- Enhancing inventory turnover

Medium-term Goals (1-3 years)

Medium-term goals bridge the gap between immediate needs and long-term aspirations. Examples include:

- Expanding into new markets

- Launching new products or services

- Increasing customer retention rates

- Enhancing digital transformation efforts

Long-term Goals (3+ years)

Long-term goals are aligned with your business’s vision and mission. These goals often include:

- Achieving a significant market share

- Becoming an industry leader

- Reaching a specific revenue milestone

- Ensuring sustainable growth and profitability

Steps to Setting Financial Goals for 2024

1. Assess Your Current Financial Situation

Before setting new goals, understand where you currently stand. This involves:

- Reviewing Financial Statements: Analyze your income statement, balance sheet, and cash flow statement.

- Identifying Key Metrics: Focus on metrics such as revenue, profit margins, expenses, and debt levels.

- Conducting a SWOT Analysis: Identify your business’s strengths, weaknesses, opportunities, and threats.

2. Define Your Vision and Mission

Your financial goals should align with your business’s vision and mission. This ensures that your objectives support your long-term aspirations and values.

- Vision Statement: Where do you see your business in the next 5-10 years?

- Mission Statement: What is the purpose of your business, and how do you plan to achieve it?

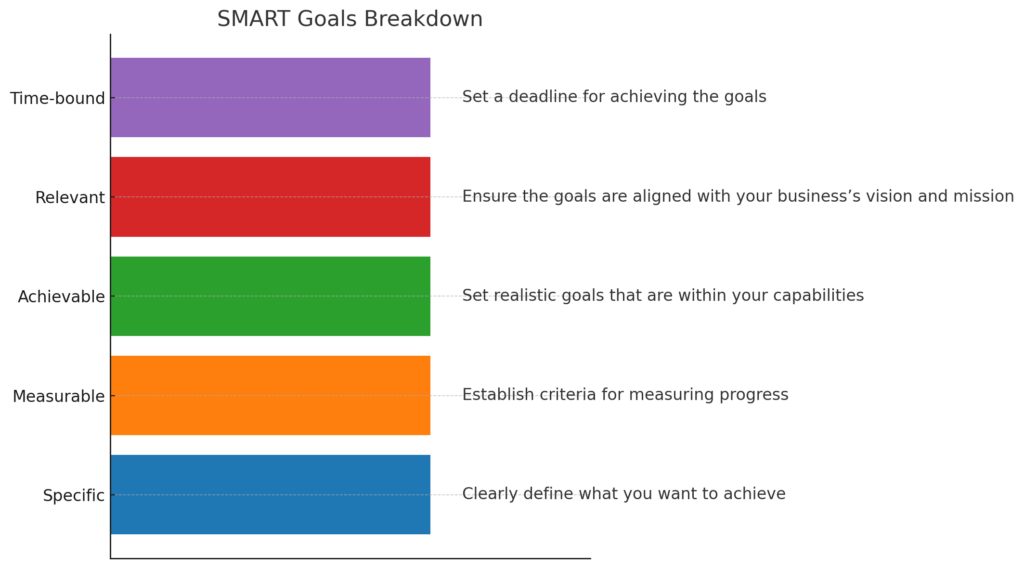

3. Set SMART Goals

Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework helps in creating clear and actionable objectives.

- Specific: Clearly define what you want to achieve.

- Measurable: Establish criteria for measuring progress.

- Achievable: Set realistic goals that are within your capabilities.

- Relevant: Ensure the goals are aligned with your business’s vision and mission.

- Time-bound: Set a deadline for achieving the goals.

4. Break Down Goals into Actionable Steps

Large goals can be overwhelming. Break them down into smaller, manageable tasks to create a clear roadmap.

- Milestones: Identify key milestones that indicate progress.

- Tasks: Define specific tasks required to achieve each milestone.

- Responsibilities: Assign tasks to team members and set deadlines.

5. Monitor and Adjust

Regularly review your progress and be prepared to make adjustments as needed. This involves:

- Monthly Reviews: Assess financial performance on a monthly basis.

- Quarterly Reviews: Conduct a more in-depth analysis every quarter.

- Annual Reviews: Evaluate overall progress at the end of the year and set new goals for the following year.

KPI Dashboards

KPI dashboards help you visualize key performance indicators and track progress in real-time. Tools like:

- Tableau: Advanced data visualization capabilities.

- Google Data Studio: Integrates with various data sources and is user-friendly.

- Microsoft Power BI: Offers powerful business analytics tools.

Financial Advisors and Consultants

Consider hiring financial advisors or consultants for expert guidance. They can provide valuable insights and help you develop realistic and achievable goals.

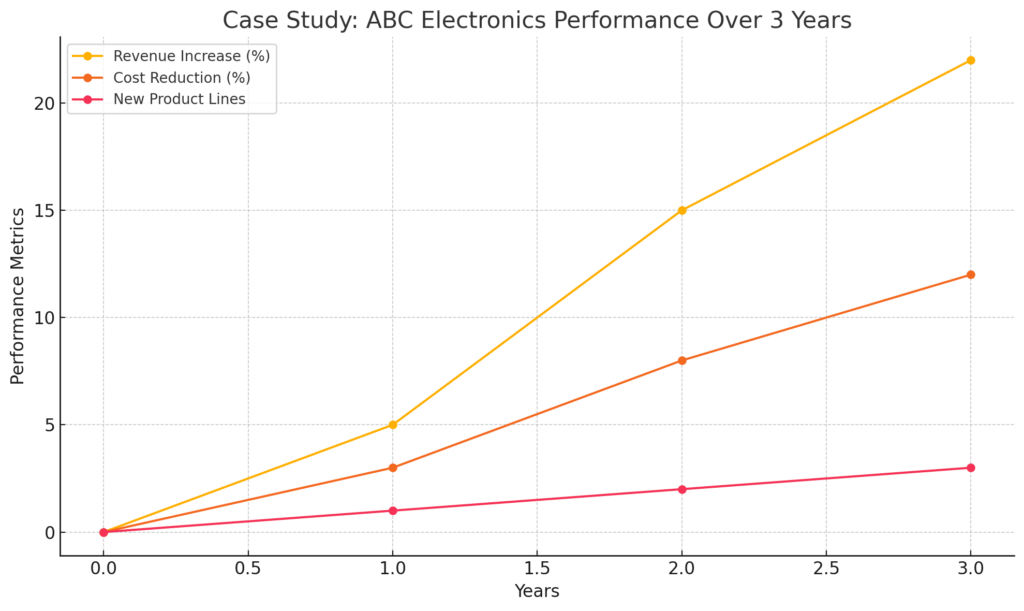

Case Study: A Real-world Example

Let’s look at a real-world example of a company that successfully set and achieved its financial goals.

Background

ABC Electronics, a mid-sized company specializing in consumer electronics, aimed to increase its market share and improve profitability over three years.

Goals

- Increase annual revenue by 20% within three years.

- Reduce operational costs by 10% within two years.

- Launch two new product lines within three years.

Steps Taken

- Assessing Current Situation: ABC Electronics conducted a thorough review of its financial statements and identified areas for improvement.

- Defining Vision and Mission: The company reaffirmed its mission to provide innovative and high-quality electronic products.

- Setting SMART Goals: Goals were clearly defined and broken down into specific tasks.

- Implementing Action Plans: The company launched marketing campaigns, improved supply chain efficiency, and invested in R&D for new products.

- Monitoring Progress: Regular reviews were conducted, and adjustments were made as needed.

Results

By the end of the three-year period, ABC Electronics successfully increased its annual revenue by 22%, reduced operational costs by 12%, and launched three new product lines, exceeding its original goals.

Tips for Success

1. Involve Your Team

Engage your team in the goal-setting process. Their insights and buy-in are crucial for success. Hold brainstorming sessions, seek their input, and ensure everyone understands their role in achieving the goals.

2. Stay Flexible

The business environment is dynamic, and unforeseen challenges can arise. Be prepared to adapt your goals and strategies as needed. Regularly review and adjust your goals based on current conditions.

3. Celebrate Milestones

Recognize and celebrate achievements along the way. This boosts morale and keeps the team motivated. Small rewards and public acknowledgments can go a long way in maintaining momentum.

4. Focus on Customer Needs

Align your financial goals with customer needs and preferences. A customer-centric approach can lead to increased sales, loyalty, and long-term success.

5. Continuously Improve

Embrace a culture of continuous improvement. Regularly seek feedback, analyze performance, and look for ways to enhance processes and strategies.

Conclusion

Setting financial goals for your business in 2024 is not just about numbers; it’s about creating a strategic roadmap that guides your business toward growth and success. By assessing your current situation, defining a clear vision, setting SMART goals, breaking them down into actionable steps, and regularly monitoring progress, you can achieve your financial objectives and build a sustainable and profitable business.

As you embark on this journey, remember to involve your team, stay flexible, celebrate milestones, focus on customer needs, and continuously seek improvement. With these strategies in place, your business will be well-equipped to navigate the challenges and opportunities that 2024 has to offer.